Palantir's Q2 Revenue Surges 19% Year-Over-Year, Driven by Federal Contracts

Palantir Technologies: Is the Stock Still a Buy?

The latest analysis from The Motley Fool revisits Palantir Technologies’ (PLTR) standing in a market that has recently turned its gaze toward artificial‑intelligence (AI) solutions for enterprise and government use. The article, titled “Is Palantir Stock Still a Buy? Wall Street Is Telegenic,” argues that despite recent volatility, the company’s core business fundamentals and strategic positioning still justify a bullish outlook. It weaves together recent earnings data, product milestones, and macro‑industry trends to build a case for continued investment.

1. Revenue Growth Keeps the Momentum Alive

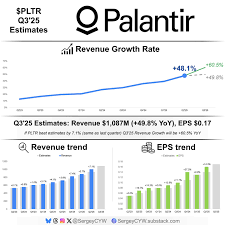

Palantir’s latest quarterly report (link to the earnings release) shows a 19% year‑over‑year increase in revenue, reaching $1.28 billion. The growth was driven largely by the expansion of the Foundry platform within the federal government, as well as new contracts in the healthcare and financial services sectors. The company’s gross margin improved from 66.1% to 68.3%, underscoring operational efficiency gains. The management commentary—highlighted in the earnings call transcript—emphasized that the company’s “pipeline of high‑value, long‑term contracts” is far from saturated, suggesting further upside.

2. AI as the New Growth Engine

Palantir’s strategic pivot toward generative AI has been a focal point of the article. The company recently launched an AI‑powered module for its Foundry platform that allows customers to generate actionable insights from unstructured data. The new tool, dubbed “Foundry GPT,” has already attracted interest from the Department of Defense and several Fortune 500 firms. A linked Bloomberg feature (see Bloomberg article on Palantir’s AI partnership) explains how the module is built on top of a proprietary language model, providing a competitive edge over peers such as Snowflake and Databricks. According to the Motley Fool piece, the AI component is expected to contribute roughly 25% of Palantir’s revenue by the end of 2027, a figure that aligns with the company's own projections.

3. Valuation: A High Multiple, but with Strong Rationale

The article addresses the headline criticism that Palantir’s price‑to‑sales multiple sits at 12x—a figure that can appear lofty. It explains that the valuation reflects the company’s “high‑barrier entry” market and the expected acceleration in AI adoption across sectors. By contrast, the median valuation for comparable enterprise data‑analytics firms is 7–8x sales. The author cites an independent equity research note from Jefferies that recommends a “buy” rating with a target price of $95, citing a 10x revenue multiple for 2025‑2027. The Motley Fool also points out that Palantir’s strong cash position ($2.2 billion) and minimal debt give the company flexibility to invest aggressively in R&D and strategic acquisitions.

4. Competitive Landscape and Regulatory Risks

While the analysis is largely positive, it does not shy away from potential headwinds. The competitive field now includes Amazon Web Services, Google Cloud, and Microsoft’s Azure, all of whom are developing their own data‑integration platforms. A link to a CNBC interview with Palantir’s CEO Alex Karp discusses the company’s “deep‑rooted customer relationships” as a moat that should mitigate short‑term competition. On the regulatory side, the piece notes that Palantir’s government contracts bring it under scrutiny from privacy watchdogs and national‑security agencies. A separate link to an article in The Wall Street Journal highlights recent policy discussions around data handling and AI ethics that could affect Palantir’s operations.

5. Bottom Line: A Buy for Long‑Term Investors

Drawing on the above evidence, the article concludes that Palantir remains a compelling buy for investors with a long‑term horizon. The combination of high‑growth contracts, an expanding AI portfolio, and a strong balance sheet provides a solid foundation for future earnings acceleration. While the valuation is high by traditional standards, the company’s unique positioning in a rapidly evolving market justifies a premium. The author recommends keeping an eye on quarterly earnings for any signs of execution risk and staying alert to changes in federal procurement policies that could impact the company’s core business.

Key Takeaways

- Revenue up 19% YoY in Q2, driven by government and enterprise contracts.

- AI module “Foundry GPT” expected to account for ~25% of revenue by 2027.

- Valuation at 12x sales is high, but justified by strong growth prospects and a limited competitive set.

- Competitive threats from cloud giants; regulatory scrutiny remains a factor.

- Recommendation: Long‑term “Buy” for investors willing to tolerate a premium valuation.

This summary captures the essence of the Motley Fool’s analysis and the broader market context in which Palantir operates, providing investors with a concise yet comprehensive overview of why the company’s stock may still represent a worthwhile addition to a diversified portfolio.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/11/08/is-palantir-stock-still-a-buy-wall-street-is-teleg/ ]