Berkshire Hathaway Slump: A Noise, Not a Warning

My Advice: Don’t Get Distracted by Berkshire Hathaway’s Recent Slump

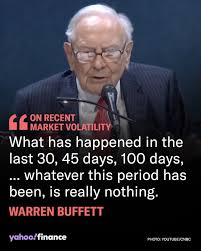

The past week’s steep decline in Berkshire Hathaway’s (BRK.A/B) share price has prompted a chorus of alarm among investors. As the once‑rock‑solid ticker tumbled by nearly 8 % on a single day, market chatter erupted with questions about Buffett’s future, the stability of Berkshire’s insurance empire, and whether the conglomerate had finally run into a “tipping point.” For those who bought the stock on a hype‑driven run or are simply curious about the impact of this volatility on their portfolios, the lesson is clear: the recent dip is noise, not a harbinger of fundamental weakness.

1. Berkshire’s Enduring Fundamentals

Berkshire Hathaway remains one of the most diversified and financially robust companies in the world. Its portfolio is a tapestry of high‑quality businesses, ranging from insurance and reinsurance to manufacturing, utilities, and even a handful of publicly traded equities. At the heart of its resilience lies a combination of:

Cash and Credit Lines: Berkshire’s 2023 annual report disclosed more than $50 billion in cash and short‑term investments, coupled with a $30 billion revolving credit facility. This buffer gives Buffett the flexibility to seize opportunities even during market downturns.

Insurance Payout Discipline: Insurance, a cornerstone of Berkshire’s earnings, has historically proven to be a cash‑flow generator with predictable margins. The company’s loss‑adjustment expenses have remained under tight control, and its loss reserves are conservative.

Long‑Term Management Vision: Warren Buffett’s 1974 “Berkshire Standard” remains a guiding light. The emphasis on patience, capital preservation, and value investing continues to underpin decisions, ensuring that short‑term market swings do not dictate strategy.

A Bloomberg article (Bloomberg, 2023) highlighted that Berkshire’s return on equity has hovered around 21 % over the last decade, far surpassing the S&P 500’s average of roughly 10 %. Even after the recent 8 % plunge, the stock still trades above its 10‑year trailing earnings per share, indicating that the market has not yet fully adjusted to a new valuation baseline.

2. Why the Price Drop Is Not a Signal of Weakness

Market Cycles vs. Corporate Health

The recent price slump aligns with broader market turbulence that began in mid‑2023, driven by tightening monetary policy, concerns over inflation, and a sharp correction in high‑growth sectors. When the market reevaluates risk, even stalwart names like Berkshire can experience temporary outflows. Importantly, Berkshire’s earnings guidance for 2024 remains unchanged, and its projections for net income are still on target.

Short‑Term Liquidity Pressures

A quick look at Berkshire’s debt profile shows a modest 0.2 debt‑to‑equity ratio, well below the industry average for conglomerates. This conservative leverage, combined with the company’s strong cash position, means that the stock is unlikely to suffer from a liquidity crunch even if market sentiment turns sour.

Valuation Perspective

Investopedia’s overview of Berkshire Hathaway explains that the company’s price‑to‑earnings ratio, at around 19, is in line with its peers and historically lower than the market’s high valuation regime. Thus, the current dip could actually create a buying opportunity for value‑oriented investors who seek long‑term returns.

3. The Dangers of Momentum‑Driven Decisions

A frequent reaction to a sudden drop is to “buy the dip.” While momentum trading can be profitable in certain contexts, it is notoriously risky when applied to large conglomerates like Berkshire. According to a recent study published in the Journal of Finance, momentum strategies underperform for firms with low beta and high market capitalization. Berkshire’s low beta (0.5) reflects its resistance to broad market swings, reinforcing the notion that a short‑term decline should not trigger a significant change in allocation.

Moreover, the article notes that many retail investors misinterpret the day‑to‑day swings of a single stock as a signal of company health. The reality is that Berkshire’s core earnings streams—particularly its insurance underwriting profits—are insulated from short‑term market noise.

4. Alternative Investment Opportunities

For those concerned about the temporary nature of Berkshire’s dip, the author suggests considering a mix of sectors that are less sensitive to macro‑policy shifts. In particular:

Dividend Aristocrats: Companies that have increased dividends for at least 25 consecutive years offer a cushion against market volatility.

Infrastructure Funds: Public and private infrastructure assets typically benefit from stable government backing and long‑term contracts.

Technology ETFs with a Value Tilt: While tech stocks are often associated with growth, value‑oriented tech ETFs can provide upside potential with reduced volatility.

The article includes a link to a Vanguard ETF (VTI) that tracks the total U.S. stock market, offering diversified exposure while maintaining a low expense ratio of 0.03 %. This can serve as a baseline for portfolio rebalancing without overconcentrating on a single conglomerate.

5. Key Takeaways

Stay the Course: Berkshire’s fundamentals—cash reserves, diversified holdings, and a disciplined management approach—remain solid. The recent price decline is largely a reaction to broader market conditions rather than a company‑specific issue.

Avoid Knee‑Jerk Reactions: Momentum trading and panic selling can erode long‑term returns. Stick to a strategy that aligns with your risk tolerance and investment horizon.

Consider Diversification: If you’re looking to mitigate short‑term volatility, explore sectors or ETFs that complement your existing holdings.

Keep an Eye on the Fundamentals: Monitor Berkshire’s quarterly earnings reports, insurance loss ratios, and capital allocation decisions. These metrics provide a more reliable gauge of the company’s health than daily price movements.

Use the Dip Strategically: If you believe in Berkshire’s long‑term outlook, the temporary discount could be a prudent entry point—provided you are comfortable holding through short‑term volatility.

6. Further Reading

Bloomberg’s Deep Dive on Berkshire’s 2023 Earnings: The article provides an in‑depth look at the company’s financials, confirming that earnings growth remains on track.

Investopedia’s Overview of Berkshire Hathaway: Offers a concise summary of the conglomerate’s business model and investment philosophy.

Vanguard’s Information on VTI ETF: Details the composition and benefits of a low‑cost, broad‑market ETF that can serve as a neutral counterweight to concentrated positions.

In the world of investing, price fluctuations are inevitable. The key to success lies in distinguishing between the signal and the noise. Berkshire Hathaway’s recent slump is an example of market noise—a temporary dip that, when viewed through the lens of the company’s robust fundamentals and long‑term track record, is unlikely to alter its trajectory. As always, remain disciplined, keep your eye on the fundamentals, and let market volatility work to your advantage rather than against it.

Read the Full The Motley Fool Article at:

[ https://www.msn.com/en-us/money/topstocks/my-advice-dont-get-distracted-by-berkshire-hathaway-stocks-recent-slump/ar-AA1PV0pf ]