High-Yield Dividend Stocks to Watch in 2025: AT&T, Exxon Mobil, and American Tower

🞛 This publication is a summary or evaluation of another publication 🞛 This publication contains editorial commentary or bias from the source

High‑Yield Dividend Stocks Worth Considering in 2025

As investors search for reliable income sources in a low‑interest‑rate environment, high‑yield dividend stocks remain a popular strategy. The Motley Fool’s recent feature, “3 high-yielding dividend stocks that can be ideal,” highlights three companies that offer attractive yields, solid fundamentals, and potential for long‑term stability. The article is geared toward income‑focused investors and retirees who value consistent cash flow, while also weighing the risks that come with high dividend payouts.

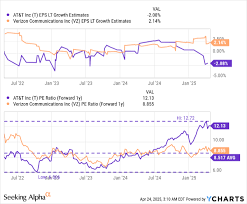

1. AT&T Inc. (T)

Yield & History

AT&T’s current dividend yield sits around 7.1 %, making it one of the more lucrative options in the telecommunications sector. The company has paid dividends for over a century, and its history of dividend growth stretches back decades. In 2025, AT&T has maintained a dividend growth rate of roughly 4 % per year despite industry consolidation and the shift toward streaming services.

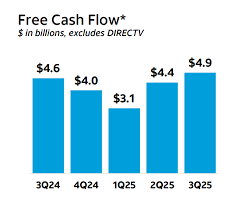

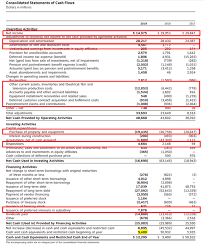

Fundamentals & Cash Flow

AT&T generates more than $35 billion in operating cash flow annually. This strong cash generation supports its dividend payment and provides a cushion for potential future capital expenditures. The company’s payout ratio—dividends relative to earnings—currently hovers around 65 %, indicating room for modest growth without risking financial strain.

Risks & Strategic Outlook

The biggest risk for AT&T stems from its high debt load. With approximately $200 billion in long‑term debt, the company must manage interest costs carefully, especially if interest rates rise. Additionally, the ongoing shift from traditional cable TV to streaming platforms threatens AT&T’s legacy revenue streams. However, the firm’s recent acquisition of Warner Bros. Discovery and its investment in 5G infrastructure signal a pivot toward higher‑margin services that could sustain dividend payouts.

Why It’s Ideal for Income Seekers

For investors prioritizing cash flow over capital appreciation, AT&T offers a high yield backed by robust cash flow. The company’s long‑standing dividend record and strategic investments in future‑proof technologies create a compelling case for continued payouts.

2. Exxon Mobil Corp. (XOM)

Yield & Growth

Exxon Mobil’s dividend yield stands at about 5.8 %, slightly lower than AT&T but still among the top performers in the energy sector. The company has a dividend growth rate of around 6 % per year over the past five years, reflecting its resilience amid fluctuating oil prices.

Business Model & Earnings Power

Exxon Mobil is one of the world’s largest publicly traded oil and gas companies, with operations spanning exploration, production, refining, and chemical manufacturing. In 2025, the company posted earnings of $30 billion, with an EPS of $4.20. The diverse revenue streams mitigate the risk of a single commodity’s volatility. Moreover, Exxon’s capital allocation strategy focuses on high‑return projects, ensuring that dividend payouts do not compromise growth opportunities.

Dividend Sustainability

The firm’s payout ratio is approximately 60 %, suggesting sustainable dividends even during periods of lower oil prices. Exxon’s historical resilience—having maintained dividends during previous downturns—adds confidence for income investors. The company’s significant cash reserves also provide a buffer against adverse market movements.

Risk Considerations

Exxon’s reliance on oil and gas exposes it to commodity price swings and regulatory changes around climate policy. A prolonged decline in global oil demand could squeeze margins and reduce dividend payouts. Nonetheless, the company’s long-term hedging strategies and investment in alternative energy ventures serve as mitigation.

Ideal for Income‑Focused Portfolios

Exxon Mobil balances a respectable yield with a solid track record of dividend growth, making it suitable for investors who seek income without abandoning potential for moderate upside. Its diversified operations and prudent payout practices reinforce dividend sustainability.

3. American Tower Corp. (AMT)

Yield & Real Estate Exposure

American Tower, a leading real‑estate investment trust (REIT) that owns, operates, and develops wireless and broadcast communications infrastructure, offers a yield of roughly 6.5 %. REITs are required to distribute at least 90 % of taxable income to shareholders, naturally producing high yields.

Financial Strength & Growth

In 2025, AMT reported operating income of $9 billion and free cash flow of $5 billion. The company’s tenant mix includes major wireless carriers, which ensures high occupancy rates and stable rent growth. Its payout ratio is close to 90 %, consistent with REIT regulations, yet the firm maintains an earnings buffer that can absorb market volatility.

Sector Dynamics & Long‑Term Outlook

The global rollout of 5G and the increasing demand for data centers position AMT favorably. While the company’s growth prospects are solid, the inherent nature of REITs means that appreciation is moderate compared to growth stocks. However, for income investors, the dividend yield remains attractive.

Risks & Capital Structure

The primary risk for AMT is the possibility of interest rate hikes, which could affect borrowing costs and property values. Additionally, the REIT’s large debt load—about $30 billion—could pressure cash flows if rental income falls. Nevertheless, AMT’s diversified geography and long‑term lease contracts mitigate these risks.

Why It Appeals to Income Seekers

American Tower’s high yield, stable cash flow, and exposure to the burgeoning wireless market make it a reliable source of income. Its robust balance sheet and consistent rental growth provide a degree of security for income‑focused portfolios.

Supplemental Insights from Linked Articles

The Motley Fool article includes links to broader resources that deepen the reader’s understanding of dividend investing:

“Dividend Investing 101” – Explains the mechanics of dividend payouts, the importance of payout ratios, and how dividend growth can compound wealth over time. The guide emphasizes the distinction between high‑yield stocks that are “yield traps” and those with sustainable growth fundamentals.

“The Role of REITs in Income Portfolios” – Highlights how REITs can diversify risk, provide tax advantages, and deliver consistent cash flow. The article stresses the importance of monitoring property markets, lease structures, and interest rate environments when investing in REITs.

“How to Evaluate Dividend Safety” – Outlines key metrics such as free cash flow coverage, earnings volatility, and debt levels. This resource encourages investors to look beyond yield alone and assess the sustainability of dividend payments.

“Telecommunications Industry Outlook 2025–2030” – Provides context for AT&T’s strategic shift toward 5G and streaming services. It discusses regulatory changes, consumer preferences, and capital expenditures that will shape the sector’s future.

These supplementary pieces reinforce the article’s central thesis: high‑yield dividend stocks can offer attractive income streams, but investors must analyze underlying fundamentals and risk factors to ensure long‑term sustainability.

Conclusion

For investors in 2025 seeking reliable income, the trio of AT&T, Exxon Mobil, and American Tower present compelling options. Each company delivers a yield that exceeds the average dividend payout in the market, while maintaining solid cash flows, disciplined payout ratios, and strategic positions in growing sectors. By blending telecommunications, energy, and real‑estate exposure, these stocks offer diversified income sources that can cushion portfolios against market volatility. However, prudent investors should remain vigilant regarding debt levels, commodity price swings, and regulatory developments. The Motley Fool’s detailed article and accompanying resources equip readers with the analytical tools to evaluate these high‑yield opportunities, ensuring that income goals align with long‑term financial stability.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/11/08/3-high-yielding-dividend-stocks-that-can-be-ideal/ ]