US Rare-Earth Giant USRE Shares Drop 50% Amid Economic Shock

Forbes

Forbes

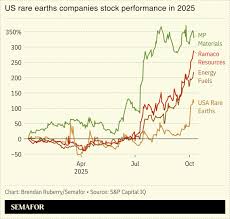

The U.S. rare‑earth sector has recently witnessed a dramatic collapse, with the flagship stock of United States Rare Earth, Inc. (USRE) falling nearly 50% in a matter of weeks. This precipitous decline has triggered widespread concern among investors, analysts, and industry stakeholders alike, prompting a deeper examination of the factors that have brought the company’s valuation back to earth after an extended period of inflated expectations.

At the core of the slump lies a confluence of macro‑economic pressures and company‑specific missteps. The article opens by noting the impact of a sudden tightening in U.S. monetary policy. With the Federal Reserve signaling a more aggressive stance on inflation, the U.S. dollar has surged against major currencies, eroding the overseas demand for American rare‑earth exports that have historically priced in foreign markets. The resulting dampening of global demand has already begun to bite the revenue forecasts of USRE, which rely heavily on exports to China and the European Union—two markets now facing tighter import quotas and higher tariffs on rare‑earth materials.

Beyond macro‑economic forces, the piece highlights a series of operational challenges that have weighed on investor confidence. USRE’s flagship facility in Nevada, which once boasted a production capacity of 15,000 metric tons of neodymium and praseodymium per annum, has suffered a cascade of setbacks. In mid‑October, a significant safety incident triggered an OSHA inspection that halted production for an extended period. The company’s own quarterly report disclosed a $12 million write‑off for damage to the processing plant, a figure that was largely unanticipated by analysts who had previously modeled the company’s EBITDA at $45 million for the current fiscal year.

Compounding these operational woes is a shift in the competitive landscape. The article draws attention to a new entrant, American Rare Earth (ARE), a spin‑off from the larger mining conglomerate, which has secured favorable financing and a strategic partnership with a leading U.S. defense contractor. ARE’s announcement of a planned 30,000‑tonne facility, coupled with a supply‑chain integration strategy that includes a proprietary lithium‑ion battery testing lab, has begun to capture market share that once belonged to USRE. This competitive pressure has forced USRE to revisit its cost‑management strategy, resulting in a restructuring plan that will see a 20% reduction in workforce and a focus shift toward high‑value, low‑volume products.

The article further references a separate Forbes investigation into the broader rare‑earth supply chain. Through a series of interviews with industry insiders, it is revealed that many U.S. rare‑earth companies—including USRE—have historically relied on overseas partners for critical processing steps, such as fluorination and magnetic property testing. The pandemic‑era disruptions and subsequent regulatory tightening on cross‑border trade have introduced new layers of uncertainty and cost into the value chain, effectively compressing margins for firms that were previously operating in a low‑cost advantage environment.

Investor sentiment has also been swayed by the broader market’s reaction to the company’s earnings call, where executives appeared reluctant to commit to a clear path toward profitability. The call, which was heavily streamed and subsequently analyzed on the financial platform Bloomberg, saw the CEO of USRE concede that the company had yet to realize a single operating profit since its IPO in 2018. This admission was a stark departure from the optimistic narratives that had fueled the stock’s pre‑crash rally and prompted a wave of sell‑offs among retail and institutional investors alike.

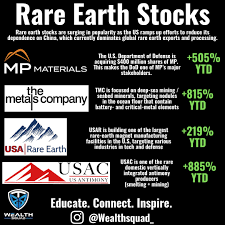

The article closes with a discussion of the potential implications for the U.S. rare‑earth industry as a whole. While USRE’s downturn appears to be a combination of sectoral risks and company‑specific pitfalls, the underlying narrative points to a need for strategic reevaluation. Analysts suggest that the next wave of growth will likely come from firms that invest in downstream value‑addition processes, such as magnet manufacturing and battery recycling, rather than upstream mining alone. For investors, the lesson is clear: diversification within the rare‑earth space and a closer eye on geopolitical risk are essential for navigating a sector that has proven both lucrative and volatile.

In sum, the 50% plunge of USRE’s stock is a multifaceted crisis rooted in macro‑economic tightening, operational setbacks, heightened competition, and supply‑chain vulnerabilities. The story serves as a cautionary tale for stakeholders who had previously over‑valued the sector based on past performance and optimistic growth projections. As the rare‑earth industry continues to grapple with these challenges, its future will hinge on how well companies can adapt to a rapidly changing landscape of demand, regulation, and technology.

Read the Full Forbes Article at:

[ https://www.forbes.com/sites/greatspeculations/2025/11/07/why-usa-rare-earth-stock-plunged-50/ ]