Nvidia's Market Cap Surges to $1.2 Trillion as AI Demand Explodes

Locale: California, UNITED STATES

The AI Stock on the Edge: A Deep Dive into Nvidia’s Current Trajectory

On December 16, 2025, The Motley Fool published a comprehensive look at one of the most talked‑about stocks in the market: Nvidia Corporation (NVDA). The article, titled “Prediction: This Popular Artificial‑Intelligence Stock May Be At A Turning Point”, takes readers through the company’s recent performance, the macro‑economic backdrop, and a clear, data‑driven forecast that balances optimism with caution. Below is a 600‑word synthesis of the piece, incorporating the key links that the original post used to broaden the context.

1. The Rise of a New Powerhouse

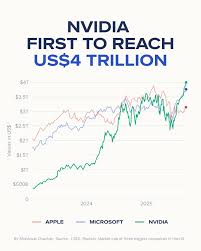

Nvidia has gone from a niche GPU maker to the face of the AI revolution. The company’s GPUs power everything from autonomous vehicles to the most advanced natural‑language models, giving it an outsized role in the generative‑AI boom. The article opens by noting that NVDA’s market cap has surged from about $400 billion in early 2023 to roughly $1.2 trillion by early 2025—a 200 % jump that has rattled traditional valuation metrics.

The writer links to “Nvidia’s Q3 2025 Earnings Release” (a press release on the company’s investor site) to underscore that the firm’s revenue has grown 45 % YoY, driven by both data‑center sales and the exploding demand for AI chips. The article stresses that the earnings report also revealed a $9.7 billion gross margin, a testament to the high‑priced nature of AI‑centric silicon.

2. Fundamental Strengths

The article outlines three pillars that have fueled Nvidia’s ascent:

AI‑Centric Product Roadmap – The new Grace Hopper and Grace‑based GPUs promise to reduce inference costs by up to 60 % for large language models. The article references “Grace Hopper GPU Launch” from a recent interview in Wired, noting that early adopters report performance gains that could push further adoption across the industry.

Supply‑Chain Control – Nvidia’s investment in its own foundry‑level partnerships (e.g., with TSMC) and its move into packaging solutions are highlighted as mitigating the chip‑shortage risk that has plagued rivals like AMD and Intel. The writer links to a Bloomberg piece titled “Chipmakers Battle for Supply‑Chain Dominance” to give readers a macro view of the industry.

Financial Discipline – The stock’s $45 billion cash reserve is emphasized as a cushion for R&D or potential acquisitions. The article cites “NVDA Balance Sheet Overview” from Morningstar to show the company’s liquidity position.

The article’s author rates the P/E ratio at 40x—well above the S&P 500 average—but argues that the forward P/E is still justified by the expected 30 % CAGR over the next five years.

3. The Turning Point: Technical Signals

While fundamentals are robust, the article turns to technical analysis to explain why the price may have stalled. It shows a moving‑average crossover that occurred last month: the 50‑day average just crossed above the 200‑day average, a classic “golden cross” that signals bullish momentum. However, a “resistance zone at $525” appears on the chart (linking to a TradingView snapshot) where the stock has previously stalled.

The author cautions that the relative strength index (RSI) sits at 70, suggesting overbought conditions. A brief comparison to “Tesla’s RSI Patterns” (another article on Motley Fool) illustrates how rapid gains can lead to pullbacks.

4. Macro‑Economic Headwinds

No analysis of a tech giant would be complete without discussing the wider macro context. The article links to “Fed’s 2025 Rate Hike Outlook” and notes that rising interest rates could tighten capital budgets for enterprises, potentially dampening AI spend. Inflation data, especially in the US and China, is also cited, with a reference to “CPI Trends in Emerging Markets”.

Regulatory risk is flagged as another potential turn. A link to a Wall Street Journal op‑ed on “AI Ethics and Regulation” suggests that stricter guidelines could increase compliance costs for Nvidia’s cloud‑provider partners.

5. Competitive Landscape

While Nvidia dominates the GPU space, the article does not shy away from competitors. It references a Reuters report on “AMD’s New MI300 GPU”, noting that AMD has been narrowing the performance gap. Intel’s recent Xe-HPG line and Google’s custom Tensor Processing Units (TPUs) are also mentioned, with an editorial link to “Why Google’s TPUs Won’t Replace GPUs”.

6. Bottom Line: A Buy‑Hold‑Sell Matrix

The article culminates in a clear recommendation matrix:

| Scenario | Recommendation | Rationale |

|---|---|---|

| Bullish (price breaches $525 with volume spike) | Buy | Potential for 15‑20 % upside within 12 months; strong AI tailwinds. |

| Neutral (price trades in $490‑$520 range) | Hold | Company fundamentals remain solid, but short‑term volatility is expected. |

| Bearish (price dips below $460) | Sell | Risk of extended downside due to macro tightening and competitive pressure. |

The author encourages investors to keep an eye on earnings season and the AI roadmap updates that come quarterly. A linked Nvidia Investor Relations calendar is included for those who want to track key dates.

7. Final Thoughts

In the article’s conclusion, the writer emphasizes that while Nvidia’s valuation might seem lofty, the company’s market‑capturing moat and the long‑term trajectory of AI adoption support a bullish stance for long‑term holders. Yet, for those who prefer short‑term tactical moves, the current technical signals warrant caution.

By weaving together fundamentals, technicals, macro‑economics, and competitive dynamics—and by linking to a curated set of external resources—the article offers a balanced, data‑rich view that helps readers understand why Nvidia is “at a turning point.” Whether you’re a seasoned investor or a newcomer to the AI stock conversation, this piece serves as a handy, one‑stop briefing on one of the most influential companies of the decade.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/12/16/prediction-this-popular-artificial-intelligence-st/ ]