Investor Sentiment Hits All-Time Highs Amid Low Volatility

Investopedia

InvestopediaLocale: New York, UNITED STATES

Investors Feel Good About Stocks These Days – That Might Not Be a Good Thing

The stock market has been on a steady up‑trend, with the S&P 500 and Nasdaq composite posting gains that have buoyed investor sentiment in the last few weeks. Many retail and institutional investors are feeling optimistic—thanks in part to strong quarterly earnings, a surge in technology and consumer‑tech stocks, and a backdrop of low interest rates and robust corporate cash flow. However, a close look at sentiment indicators and the broader macro backdrop suggests that this optimism could be premature. Below is a summary of the key points raised in Investopedia’s analysis of why “feeling good” about the market may be a warning sign rather than a green light.

1. Investor Sentiment Has Reached All‑Time Highs

The article opens by citing the most recent American Association of Individual Investors (AAII) Investor Sentiment Survey. In the most recent cycle, the survey reported a 71% bullish sentiment—higher than any point in the last decade. At the same time, the CBOE Volatility Index (VIX), often called the “fear gauge,” has dipped to a one‑month low of 12.4, which is well below the 20‑level that usually signals a nervous market.

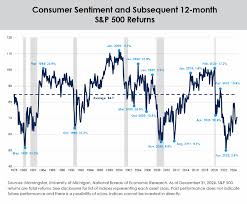

Why It Matters – Historically, the confluence of high bullish sentiment and low VIX often precedes a market correction or a brief pullback. Think of the late‑2000s and the dot‑com boom: exuberant sentiment, followed by a sharp reversal.

Investopedia reminds readers that sentiment is a lagging indicator. While the market is currently strong, the sentiment data suggests that many investors have “already priced in” upside, leaving little room for further gains without a corresponding shift in fundamentals.

2. Overvaluation of Key Sectors

A large portion of the rally has been driven by technology, biotechnology, and renewable‑energy stocks. These sectors have seen price‑to‑earnings (P/E) ratios climb to the mid‑30s, with the S&P 500’s technology sector averaging a P/E of 32.7—well above the 20‑plus average of the past decade.

Example – Companies like Tesla, Nvidia, and Advanced Micro Devices have all enjoyed multi‑digit year‑over‑year earnings growth. Yet their valuations have outpaced the fundamental drivers of revenue and profit growth.

Investopedia notes that while high P/E ratios can be justified by rapid growth, they become problematic when growth prospects plateau or when macro conditions tighten. A sudden uptick in interest rates, for example, could force investors to re‑price those stocks, leading to a sharp decline.

3. Low Volatility May Signal a Complacent Market

Low volatility typically signals confidence, but it can also indicate complacency. With the VIX hovering below 15 for several months, investors may be underestimating risk.

The article cites a CBOE research study that found markets with low volatility are more likely to experience “stop‑loss” events, where traders who use technical stop‑orders trigger a cascade of selling that can drive prices down. This is especially relevant in the technology sector, where many investors rely on technical indicators to time entries and exits.

4. Macro Data Suggests Underlying Weakness

Interest Rates – The Federal Reserve has hinted at a rate hike cycle in the coming months, targeting rates above 5%. Rising rates increase borrowing costs for companies, especially those with high leverage, and shrink the present value of future earnings.

Inflation – While headline inflation has eased slightly, core inflation remains stubborn at 4.1%. Persistent inflation erodes purchasing power and can squeeze corporate margins, especially in commodity‑heavy industries.

Consumer Spending – Retail sales growth slowed in the most recent quarter, raising concerns that consumer confidence could waver if interest rates rise.

Investopedia argues that while the market’s bullish stance is understandable given the recent economic data, these macro fundamentals suggest a potential slowdown that could dampen earnings growth.

5. Psychological Pitfalls: Overconfidence and Herd Behavior

The article discusses the psychological dimension of market optimism. When a majority of investors are bullish, it creates a herd mentality that can push prices beyond their intrinsic values. It also erodes risk appetite, as investors become less willing to diversify or to consider downside scenarios.

Key Insight – Overconfidence can lead to “portfolio drift,” where investors shift heavily into high‑growth, high‑valuation stocks and away from defensive or dividend‑yielding equities. The result is a portfolio that is more exposed to volatility and downside risk.

6. Practical Advice for Investors

Investopedia proposes several strategies to protect portfolios amid high optimism:

Re‑balance Toward Defensive Sectors – Allocate a portion of the portfolio to utilities, consumer staples, and healthcare—sectors that tend to perform well during economic slowdowns.

Use Dollar‑Cost Averaging – Instead of lump‑sum investing at market highs, spread purchases over time to reduce entry‑price risk.

Set Stop‑Losses and Trailing Stops – Protect gains by automatically selling if a stock falls below a set threshold or by using trailing stops that lock in profits.

Monitor Valuation Ratios – Keep an eye on P/E, PEG, and price‑to‑sales ratios. If they rise beyond historically acceptable ranges, it may be time to consider a partial exit.

Diversify Geographically – Global equity exposure can offset domestic overvaluation, especially if emerging markets are trading at lower multiples.

Stay Informed on Macro Trends – Pay close attention to Federal Reserve policy statements, inflation reports, and consumer confidence data.

The article also recommends reading complementary Investopedia pieces, such as “What Is Investor Sentiment?” and “Bull Market vs Bear Market: What’s the Difference?” to deepen understanding of how sentiment and market structure interact.

7. Bottom Line

While the current market trajectory seems encouraging, the article warns that excessive optimism may be a harbinger of a correction. High bullish sentiment, low volatility, sector overvaluation, and a tightening macro environment collectively suggest that the market is potentially overextended.

Investors should adopt a cautious stance, focus on risk management, and remain prepared for a market pullback. As the article concludes, “feeling good about stocks” should be tempered with a realistic assessment of fundamental and macroeconomic realities. Doing so can help investors preserve capital and position for long‑term gains—even if the market does experience a brief slowdown.

Read the Full Investopedia Article at:

[ https://www.investopedia.com/investing-pros-feel-good-about-stocks-these-days-that-might-not-be-a-good-thing-11870361 ]