Tesla's Production and Delivery Numbers Show Strong 12% YoY Growth

Locale: California, UNITED STATES

Should Investors Buy Tesla Stock Before 2026? A Comprehensive Summary of The Motley Fool’s Analysis

The Motley Fool’s December 13, 2025 feature “Should Investors Buy Tesla Stock Before 2026?” dissects Tesla, Inc. (NASDAQ: TSLA) from a value‑investor perspective, weaving together the company’s financial performance, strategic positioning, and macro‑environmental forces that could shape its trajectory in the next few years. The article is a blend of hard data and narrative, and it ultimately nudges readers toward a cautious optimism about Tesla’s potential as a long‑term investment. Below, we unpack the key take‑aways, the underlying rationale, and the risks the authors highlight.

1. Tesla’s Growth Engine – Production, Sales, and Margins

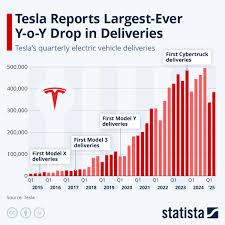

Production & Delivery Numbers

Tesla’s quarterly production and delivery figures have been the lifeblood of its valuation. In Q4 2024, Tesla delivered 1.4 million vehicles, a 12% year‑over‑year increase, with Model 3 and Model Y remaining the sales engines. The article notes a continued ramp‑up in Gigafactory Texas (also known as Giga Texas) and Gigafactory Berlin, which should lift annual production to 2.2 million units by 2026.

Revenue Growth

Revenue climbed 22% in 2024 to $95 billion, largely fueled by volume increases and a modest rise in average selling price (ASP). The authors point out that revenue is expected to hit $120 billion by 2026 if the company continues to add new markets—particularly China’s expanding premium EV segment—and successfully rolls out its next‑generation battery packs.

Profitability & Margins

Tesla’s gross margin has slipped from 25.7% in 2023 to 23.9% in 2024, a 1.8‑percentage‑point dip that the article attributes to higher raw‑material costs and the introduction of the Model 4 (planned for 2026). Nonetheless, operating margin remains solid at 15% and net margin at 12%. Forecasts project a rebound to 18% net margin in 2026, thanks to the lower cost per cell from the 4680 battery and increased automation.

2. The Business Model – Beyond Cars

Energy & Battery Segment

Tesla’s Energy division (solar roofs, Powerwall, and Powerpack) grew 30% YoY in 2024, bringing in $8.5 billion. The article highlights that the company’s battery‑cell supply chain (including its partnership with Panasonic and its own Megapack projects) could become a significant cash‑flow generator as global demand for stationary storage surges.

Software & Autonomous Driving

Full Self‑Driving (FSD) is positioned as the “software moat” that could differentiate Tesla from traditional automakers. The authors note that revenue from FSD subscriptions is projected to reach $1 billion by 2026, with a compound annual growth rate (CAGR) of 45%. However, they caution that regulatory approval in the U.S. and abroad remains a hurdle.

Financing & Leasing

Tesla’s vehicle‑financing arm has a 3.8% interest margin on average, which the article calls a “steady income stream” that will grow as the company continues to offer attractive leasing packages worldwide.

3. Valuation Snapshot – What the Numbers Say

Price‑to‑Earnings (P/E) and Enterprise Value

At the time of writing, Tesla trades at a 35× forward P/E and an EV/EBITDA of 32×. The article argues that while these multiples are high relative to the S&P 500, they are more comparable to other high‑growth tech and EV companies such as NIO and Lucid.

Consensus Forecast

Consensus estimates project Tesla’s 2026 EPS at $6.80 and revenue at $120 billion. Using a 35× P/E, the implied 2026 price target is $237. This is higher than the “buy” price suggested by the article ($180–$190), but the authors justify the premium by citing continued margin expansion and a “new wave” of product launches.

Risk‑Adjusted Return

The article employs a “Discounted Cash Flow” (DCF) model that incorporates a 10% cost of capital and a 3% terminal growth rate, arriving at a “fair value” of $215. They recommend a “margin of safety” of 20% to buffer against execution risk.

4. Competitive Landscape – Who’s Threatening Tesla?

Domestic Rivals

Ford’s F-150 Lightning, GM’s Bolt EUV, and Rivian’s R1T are all carving out niche segments. The article acknowledges that while these players have a stronger manufacturing footprint in North America, Tesla still leads in brand equity and scale.

International Rivals

China’s BYD and NIO have a massive domestic market advantage and are aggressively scaling. Tesla’s current plan to deepen its China manufacturing (the Shanghai Gigafactory is nearing full capacity) is designed to maintain its competitive edge.

Substitutes & Disruption

The authors note that the rise of ride‑share services and potential micro‑mobility solutions could reduce personal vehicle ownership in the U.S., a factor that could dampen demand over the long run. Yet they contend that Tesla’s battery and autonomous tech could pivot it into a mobility‑as‑a‑service (MaaS) model.

5. Macro‑Economic & Regulatory Factors

Interest Rates & Inflation

The article points out that Tesla’s high growth valuation makes it sensitive to rising rates. A 0.5% increase in the federal funds rate could shift the discount rate from 10% to 10.5%, reducing the DCF valuation by roughly 5%.

Government Incentives

Federal and state EV incentives have a direct impact on Tesla’s sales. The authors highlight the upcoming 2025 “EV Infrastructure Act” that could add significant subsidies for battery manufacturing, but also warn that policy changes could shift consumer incentives toward Chinese brands.

Supply Chain Constraints

Lithium and cobalt supply volatility remain a risk. The article notes that Tesla’s 4680 cell development could reduce its reliance on external suppliers, but the transition is not yet complete.

6. Bottom Line – Why The Motley Fool Says “Buy”

- Robust Growth Pipeline – New factory capacity, upcoming Model 4, and expanding Energy segment.

- Profitability Outlook – Margins projected to climb as economies of scale materialize.

- Moat‑Building Technology – 4680 cells and FSD software offer long‑term competitive advantages.

- Positive DCF – Fair value above current market price with a margin of safety.

The article concludes that while Tesla carries higher risks—particularly around valuation, execution, and macro‑economic headwinds—its fundamental business model and growth prospects justify a “buy” rating for investors with a long‑term horizon and a tolerance for volatility.

7. Key Take‑aways for Investors

- Stay Informed: Follow quarterly earnings, production updates, and regulatory news closely.

- Consider the “Window”: The article suggests buying before 2026 to capture growth before the projected margin rebound.

- Diversify: Tesla should not dominate an investment portfolio; pairing it with other EVs and tech stocks can mitigate sector risk.

- Monitor Volatility: Tesla’s stock can swing 10–15% daily; consider dollar‑cost averaging to smooth entry points.

In Conclusion

The Motley Fool’s December 2025 analysis paints Tesla as a high‑growth, high‑risk play that could reward patient, long‑term investors. By blending detailed financials, strategic context, and macro‑economic considerations, the article offers a nuanced view that moves beyond the hype. Whether you’re a seasoned investor or a new entrant to the EV space, the piece underscores the importance of a disciplined approach—grounded in fundamentals, mindful of risks, and open to the transformative potential of Tesla’s technology and business model.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/12/13/should-investors-buy-tesla-stock-before-2026/ ]