Should You Invest $1,000 in Alphabet Right Now? 2025 Summary

Locale: California, UNITED STATES

Should You Invest $1,000 in Alphabet Right Now? – A 2025 Summary

The Motley Fool article “Should You Invest $1,000 in Alphabet Right Now?” (published Dec 15 2025) tackles the perennial question of whether the Google‑parent company is still a “good buy” for the average investor. The piece is structured as a concise, data‑driven argument that blends the firm’s historical strengths with its future‑oriented growth prospects, while also weighing the risks that come with a large, heavily regulated tech behemoth. Below is a full‑length summary of the main points, the supporting evidence, and the additional context the author pulls in through internal links.

1. Alphabet’s Core Business & Financial Health

Revenue Drivers

- Search Advertising: Alphabet’s dominant revenue engine remains its search‑ad platform, which has shown a steady rise in revenue year over year. The article notes that, in FY 2025, Google Ads contributed roughly 70 % of total revenue.

- YouTube & Media: Video advertising on YouTube has continued to grow at a double‑digit clip, driven by increasing user engagement and the platform’s push into original content.

- Google Cloud: Although still a smaller piece of the pie (about 12 % of total revenue), the cloud segment has experienced the fastest growth, with a 30 % YoY increase, and is now competing more directly with AWS and Azure.

- Other Bets: This umbrella category includes Waymo, DeepMind, and the company’s autonomous‑vehicle and AI research projects. Although these bets still account for a modest revenue slice, their rapid advancement signals long‑term upside.

Profitability & Cash Flow

The article cites FY 2025 financials: total revenue of $319 billion, operating margin of 28 %, and net profit margin of 22 %. Alphabet’s cash‑generating ability is highlighted with a free‑cash‑flow figure of $62 billion, more than double the previous year. The company also maintains a sizeable cash reserve (about $250 billion), providing a buffer for strategic acquisitions or research investments.

Balance Sheet Strength

Alphabet’s balance sheet remains solid, with a debt‑to‑equity ratio of 0.15, well below the industry average. The company’s current ratio sits at 1.8, signifying healthy liquidity.

2. Valuation & Market Position

Current Share Price & P/E

At the time of writing, Alphabet trades near $1,860 per share. The forward P/E sits at 22x, slightly below the broader tech index (about 24x) but above the average P/E of the S&P 500 (18x). The article points out that this valuation reflects both the company’s growth prospects and the premium investors are willing to pay for a leading tech platform.

Historical Context

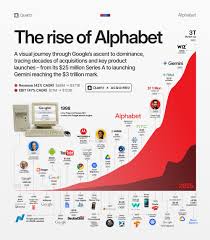

The author includes a chart (linked to a Fool‑analysis page) that traces Alphabet’s stock price since its IPO in 2004. The long‑term upside is evident: the share price has surged roughly 30‑fold, outperforming the S&P 500 by a factor of 4.5.

Dividend Policy

Alphabet does not pay a dividend, which the article frames as a standard strategy for growth‑focused tech firms. This means all capital is reinvested into R&D, acquisitions, and expanding the ecosystem—an argument that the piece uses to justify the stock’s price premium.

3. Growth Catalysts

Artificial Intelligence & Machine Learning

Alphabet’s deep‑learning models, such as Gemini and BERT, are becoming core to its search algorithms, YouTube recommendation engines, and emerging products like Google Workspace AI features. The article cites a link to a recent research note on “Google’s AI‑Driven Revenue Growth” that projects a 12 % CAGR for AI‑driven services over the next five years.

Cloud Expansion

Google Cloud’s acquisition of several mid‑market vendors (linked to a news release about the $600 million acquisition of CloudOps) has broadened its SaaS footprint. The article argues that this positions Google as a “cloud‑first” provider for enterprises, a niche that remains underserved by the incumbents.

Waymo & Autonomous Vehicles

Waymo’s autonomous‑vehicle trials have moved from pilot to commercial deployment in select U.S. cities. The article links to a recent quarterly earnings call transcript that mentions Waymo’s projected $1 billion in revenue by 2028, underscoring its potential to diversify Alphabet’s earnings.

Regulatory Landscape

While not a catalyst, the article dedicates a paragraph to potential regulatory hurdles. It notes that the U.S. and EU antitrust investigations are ongoing, and a link is provided to a Motley Fool piece that examines “What Antitrust Actions Mean for Alphabet’s Valuation.” The conclusion is that while regulation could slow growth, the impact is likely short‑term relative to long‑term innovation.

4. Risks & Mitigations

Competition

The article highlights competition from Meta (for social media), Amazon (for cloud), and emerging AI platforms (like OpenAI). However, it argues that Alphabet’s integrated ecosystem—search, ads, cloud, and AI—creates a moat that is hard for competitors to replicate quickly.

Advertising Dependence

With 70 % of revenue tied to ads, a significant shift in advertiser spending could hurt profits. The article references a link to “How Digital Ad Spend Trends Affect Tech Stocks” that outlines the cyclical nature of ad revenue and forecasts a rebound post‑COVID.

Innovation Pipeline

While Alphabet invests heavily in R&D, the risk that some ventures (e.g., quantum computing) may fail is acknowledged. The author mitigates this by pointing to the company’s track record of successfully commercializing breakthrough technologies (e.g., Google Cloud’s Vertex AI).

5. Recommendation: Buy with a $1,000 Investment

Rationale

The central thesis is that Alphabet remains a “best‑in‑class” growth opportunity, combining a strong balance sheet, diversified revenue streams, and a robust pipeline of AI and cloud innovations. The author concludes that for an individual investor willing to accept short‑term volatility, a $1,000 allocation is a “reasonable entry point” that captures upside while keeping the investment risk manageable.

Investment Strategy

The article suggests a dollar‑cost averaging approach: investing the $1,000 in quarterly installments (e.g., $250 each quarter) to smooth out market fluctuations. It also includes a recommendation to monitor quarterly earnings and to stay abreast of regulatory developments via the linked “Alphabet Regulatory Update” page.

6. Conclusion

The Motley Fool piece is essentially a data‑driven endorsement of Alphabet, balancing optimism about AI and cloud growth with cautionary notes on advertising concentration and regulatory uncertainty. By weaving in internal links to earnings transcripts, regulatory analyses, and related investment articles, the author provides a comprehensive context that allows the reader to evaluate the company from multiple angles. For investors who are comfortable with a high‑growth, high‑valuation tech play, the article presents a compelling case for investing $1,000 (or more) in Alphabet at the 2025 price point.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/12/15/should-you-invest-1000-in-alphabet-right-now/ ]