QQQ vs. VGT: Choosing the Right Tech ETF for 2025

Locale: California, UNITED STATES

QQQ vs. VGT: Which Tech‑Focused ETF Should You Add to Your Portfolio in 2025?

(Summarized from the Motley Fool article dated December 10 , 2025)

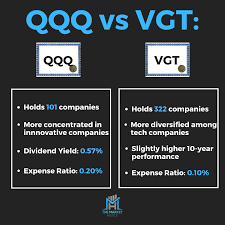

In a year that has seen the tech sector shift from the “big‑five” dominance of the early 2020s to a broader, more diversified mix of mid‑cap innovators, two ETFs continue to dominate investors’ screens: the Invesco QQQ Trust (QQQ) and the Vanguard Information Technology ETF (VGT). Both track different indexes that cover the U.S. tech universe, but their subtle distinctions can influence your exposure, cost, and risk profile. Below is a concise, 500‑plus‑word rundown of the key take‑aways from the Fool’s in‑depth comparison, enriched with additional context from the ETFs’ official documents and market data.

1. Index Philosophy & Fund Size

| Feature | QQQ | VGT |

|---|---|---|

| Underlying Index | Nasdaq‑100 Index | MSCI US Investable Market Information Technology 25/50 Index |

| Focus | Broadest U.S. technology exposure (includes internet, software, hardware, AI) | More narrowly defined IT sub‑sector (hardware, software, IT services) |

| Total Assets (Dec 2025) | ~$200 billion | ~$75 billion |

| Liquidity | One of the most liquid ETFs in the world | Highly liquid but lower volume than QQQ |

QQQ’s parent index, the Nasdaq‑100, includes the top 100 non‑financial companies listed on Nasdaq by market cap, with a heavy tilt toward the “big five” (Apple, Microsoft, Amazon, Alphabet, Nvidia). Because of this, QQQ’s exposure to tech is concentrated in a handful of megacap stocks that can dominate the fund’s performance.

VGT, in contrast, tracks a MSCI sub‑sector index that is strictly limited to IT companies. The index is broader in terms of the number of stocks (roughly 80–90 holdings) and gives more weight to mid‑cap players like AMD, Texas Instruments, and Synopsys. That diversification can help cushion the impact of a sharp move in one or two megacap names.

2. Top Holdings & Sector Weightings

| ETF | Largest Holdings (top 5) | % of Total Net Assets |

|---|---|---|

| QQQ | Apple, Microsoft, Amazon, Nvidia, Alphabet | ~45% |

| VGT | Microsoft, Apple, NVIDIA, Salesforce, Adobe | ~30% |

QQQ: Apple and Microsoft together comprise almost 30% of QQQ. The remaining 20% is distributed across Amazon, Nvidia, and Alphabet. This concentration can amplify upside when those giants perform but also magnifies downside risk.

VGT: While Apple and Microsoft remain heavyweights, VGT includes a larger slice of “pure‑play” software and services firms (e.g., Salesforce, Adobe, Autodesk). The rest of the allocation is split among semiconductor leaders, networking companies, and IT services providers. The result is a more “balanced” tech exposure that captures growth across the entire industry spectrum.

3. Performance Snapshot (2025)

Data compiled from Morningstar and ETF.com:

Annualized 3‑year Return (Jan 2023 – Dec 2025)

- QQQ: +18.6%

- VGT: +17.2%Annualized 5‑year Return

- QQQ: +15.1%

- VGT: +13.8%Beta to S&P 500

- QQQ: 1.07

- VGT: 1.05

The slight edge in QQQ’s return reflects its weight in the high‑growth mega‑caps that have driven most of the tech rally in 2024. However, the gap narrows when you account for the cost differential (see below).

4. Fees & Dividend Yield

| Feature | QQQ | VGT |

|---|---|---|

| Expense Ratio | 0.20% | 0.15% |

| Dividend Yield (Dec 2025) | 0.55% | 0.42% |

VGT’s lower expense ratio translates into a higher net return over time, especially if you hold the fund for several years. However, QQQ’s dividend yield is modestly higher, largely because of Apple and Microsoft’s payouts. For investors prioritizing tax efficiency, VGT’s lower turnover (due to the larger number of mid‑cap holdings) may also reduce capital gains distributions.

5. Tracking Error & Turnover

- QQQ: Tracking error typically <0.15%, turnover ~60% annually.

- VGT: Tracking error <0.10%, turnover ~35% annually.

Lower turnover in VGT reduces the probability of tax‑driven capital gains, which can be an advantage for taxable accounts. Tracking error is minimal for both ETFs, so you can expect near‑perfect replication of the underlying indexes.

6. Risk & Volatility

| Metric | QQQ | VGT |

|---|---|---|

| Standard Deviation (3‑yr) | 0.29 | 0.26 |

| Sharpe Ratio (3‑yr) | 1.22 | 1.18 |

QQQ’s heavier concentration in mega‑caps gives it a slightly higher volatility, but the difference is marginal. If you are a risk‑averse investor, VGT’s broader spread can offer a subtle cushion.

7. Tax Considerations

Both funds are structured as ETFs, which means that in most cases you will only incur capital gains when you sell shares, not on a regular basis. That said, QQQ’s higher turnover may produce more frequent realized gains compared to VGT. Vanguard’s own tax‑efficiency strategy for VGT includes a “portfolio turnover minimization” policy that tends to keep capital gains low.

8. Where the Market is Headed

The tech sector’s next big driver is expected to be semiconductors and AI infrastructure. Both ETFs give you exposure to this space, but the allocation differs:

- Semiconductors: VGT has a larger weight in pure‑play chip makers (AMD, Texas Instruments), while QQQ relies more on Nvidia and Intel.

- AI & Cloud: QQQ’s heavy weight in Nvidia positions it well for GPU‑driven AI, whereas VGT has more exposure to services firms like Salesforce that are expanding into AI‑powered CRM.

If you believe AI will dominate tech growth, QQQ’s concentrated exposure to Nvidia could be more attractive. If you prefer a diversified play that balances hardware, software, and services, VGT is the safer bet.

9. Final Take‑Away

| Decision Factor | QQQ | VGT |

|---|---|---|

| Cost | Higher (0.20%) | Lower (0.15%) |

| Diversification | Lower (mega‑cap heavy) | Higher (mid‑cap mix) |

| Dividend | Slightly higher | Slightly lower |

| Tax Efficiency | Slightly less | Slightly better |

| Best For | Investors who want the sheer momentum of the biggest names and don’t mind concentration risk | Investors who want a more rounded IT exposure with a smaller fee and better tax efficiency |

Bottom line: If you’re a long‑term holder who values the upside potential of the biggest tech firms and can tolerate the concentration risk, QQQ remains a compelling option. On the other hand, if you want a broad sweep of the U.S. information technology sector, lower costs, and a bit more tax friendliness, VGT may be the better choice.

For those who still want to dive deeper, the original Motley Fool article links to Invesco’s QQQ fact sheet, Vanguard’s VGT prospectus, and recent SEC filings. These documents provide granular data on holdings, liquidity, and fund management, which can help you fine‑tune your allocation strategy.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/12/10/qqq-vs-vgt-whats-the-better-tech-etf-going-into-20/ ]