Door County Embraces Accessible Tourism for All

Fox 11 News

Fox 11 NewsLocales: Wisconsin, UNITED STATES

Door County, Wisconsin, a picturesque peninsula nestled between Green Bay and Lake Michigan, is undergoing a significant transformation, actively working to establish itself as a leading accessible tourism destination. Beyond simply meeting the requirements of the Americans with Disabilities Act (ADA), Door County is embracing a proactive approach to inclusivity, aiming to welcome all travelers and enrich the experience for everyone. This isn't just a matter of legal compliance; it's a strategic investment in broadening the appeal of the region and ensuring its long-term economic vitality.

For years, the stunning natural beauty of Door County - its cherry orchards, lighthouses, state parks, and charming towns - has drawn visitors from across the Midwest and beyond. However, for individuals with disabilities, navigating the peninsula's often uneven terrain and older infrastructure presented significant challenges. Recognizing this gap, local organizations and the county government have begun a concerted effort to remove barriers and create a truly welcoming environment.

The Driving Force: Peninsula Wheel the World

At the heart of this movement is Peninsula Wheel the World, a grassroots organization founded by Emily Liebau. Liebau, a passionate advocate for accessible travel, identified a critical need for dedicated effort in Door County. "We're trying to make it so that anyone can enjoy Door County," she explains, a simple statement that encapsulates a powerful vision. Peninsula Wheel the World doesn't just point out problems; it actively collaborates with local businesses, parks departments, and the county government to develop practical solutions.

Their work includes comprehensive accessibility audits of local establishments, trails, and public spaces. These audits go beyond basic ADA checklist compliance, delving into the user experience for individuals with a range of disabilities - from wheelchair users and those with visual or auditory impairments, to individuals with cognitive or sensory processing differences. The organization then provides actionable recommendations for improvement, offering guidance on everything from ramp construction and accessible restroom facilities to clear signage and staff training.

Concrete Improvements Across the Peninsula

The impact of Peninsula Wheel the World's efforts is becoming increasingly visible. A key focus is on trail improvements. Previously rugged and often impassable for wheelchair users or those with mobility limitations, several popular trails are now being upgraded to meet ADA standards. This includes smoothing surfaces, reducing slopes, and installing accessible resting areas. The goal isn't just to allow access, but to create trails that are genuinely enjoyable for everyone, regardless of their physical abilities. Projects are underway at Peninsula State Park, Potawatomi State Park, and numerous county parks, demonstrating a commitment to accessible outdoor recreation.

Beyond trails, accessible accommodations are expanding. While progress is ongoing, a growing number of hotels, bed and breakfasts, and vacation rentals are adapting their properties to accommodate guests with disabilities. This includes features like roll-in showers, accessible parking, and visual/auditory alerts. The Door County Visitors Bureau is actively working with lodging providers to promote these options and create a comprehensive database of accessible accommodations.

The Power of Information

Perhaps one of the most crucial aspects of this initiative is the improvement of accessible travel information. Previously, finding reliable details about the accessibility of specific locations was often difficult. Peninsula Wheel the World, in partnership with the Visitors Bureau, is compiling detailed information - including photographs and specific accessibility features - and making it readily available online via a dedicated website and through accessible digital maps. Visitor centers are also being equipped with this information, ensuring that travelers can plan their trips with confidence.

A Broader Trend in Tourism

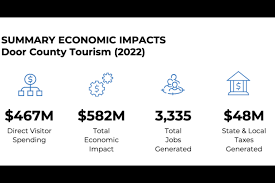

Door County's commitment to accessibility isn't an isolated event. It reflects a growing global trend in tourism, recognizing that inclusivity is not only the right thing to do but also a smart business strategy. The disabled population represents a significant and often overlooked market segment. By catering to their needs, Door County is expanding its potential customer base and positioning itself as a forward-thinking destination.

Challenges and Future Outlook

While substantial progress has been made, challenges remain. Many older buildings require extensive (and expensive) renovations to fully comply with ADA standards. Funding for these projects is often limited, requiring ongoing fundraising efforts and creative partnerships. Furthermore, maintaining accessibility requires continuous monitoring and upkeep.

However, the momentum is strong. The collaborative spirit between Peninsula Wheel the World, local businesses, and the county government provides a solid foundation for continued progress. Door County is not just becoming more accessible; it's becoming a model for inclusive tourism, demonstrating that everyone deserves the opportunity to experience the beauty and charm of this remarkable peninsula.

Read the Full Fox 11 News Article at:

[ https://fox11online.com/newsletter-daily/door-county-wisconsin-accessibility-travel-tourism-peninsula-wheel-the-world-americans-with-disabilities-act ]