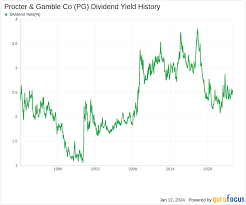

Procter & Gamble: 30 Years of Dividend Growth at 4.0%-4.3% Yield

Locale:

Five Blue‑Chip Dividend Kings Worth Buying Right Now – A 2025 Snapshot

On December 10, 2025, 247 Wall Street published a timely guide for income investors looking for solid, high‑yield blue‑chip stocks. The article titled “5 Blue‑Chip Stocks to Buy Now – All Pay Reliable 4‑5% Dividends” zeroes in on five well‑established U.S. companies that not only offer attractive dividend yields in the 4‑5% range, but also have track records of consistent growth, robust cash flows, and solid balance sheets. The piece is geared toward investors who want a blend of stability and income, especially in a post‑pandemic economy that is gradually warming and seeing a gradual rise in interest rates.

Below is a comprehensive summary of each company, why the article champions them, and the macro‑economic backdrop that informs the investment thesis.

1. Procter & Gamble Co. (PG)

Business & Dividend Profile

Procter & Gamble (PG) is a global household‑goods titan that sells everything from beauty products to cleaning supplies under brands like Tide, Pampers, and Gillette. The article highlights that PG has delivered 30 consecutive dividend increases, a hallmark of dividend‑growth reliability. PG’s dividend yield is currently 4.0%–4.3% as of the article’s publication date, comfortably within the 4‑5% sweet spot.

Why PG?

- Consistent Cash Flow: PG’s free‑cash‑flow generation has remained strong, enabling it to sustain and grow dividends even during economic downturns.

- Low Payout Ratio: A payout ratio of about 50% leaves ample room to buffer earnings shocks while maintaining shareholder returns.

- Global Footprint: Its diversified product mix across North America, Europe, and emerging markets gives PG a buffer against regional slowdowns.

Valuation & Risks

PG trades at a forward P/E around 22x, slightly above its 5‑year average, reflecting investors’ confidence in its cash‑flow sustainability. The primary risk noted is the gradual erosion of consumer discretionary spending if interest rates rise sharply—though PG’s essential product mix keeps it relatively insulated.

2. Coca‑Cola Co. (KO)

Business & Dividend Profile

Coca‑Cola (KO) is arguably the poster child for a “dividend‑paying blue‑chip.” With an 80‑year track record of dividend increases, KO’s yield sits at roughly 4.5%–4.6% in 2025, making it a prime candidate for income portfolios.

Why KO?

- Diversified Beverage Portfolio: Beyond cola, KO owns Diet Coke, Sprite, Minute Maid, and a sizable share of the energy‑drink market via a 30% stake in Monster.

- Global Reach: KO’s sales are spread across more than 200 countries, reducing exposure to any single market.

- Strong Brand Equity: KO’s brand loyalty provides pricing power, keeping margins relatively stable.

Valuation & Risks

KO’s forward P/E is around 17x, which the article notes is near its 5‑year average, suggesting the stock isn’t overvalued given its dividend profile. The chief concern highlighted is the potential impact of rising commodity costs—especially sugar and packaging—on operating margins.

3. Johnson & Johnson (JNJ)

Business & Dividend Profile

Johnson & Johnson (JNJ) is a diversified healthcare conglomerate with a footprint in pharmaceuticals, medical devices, and consumer health. The company boasts a 49‑year streak of dividend increases and a yield hovering around 4.2%–4.4% in 2025.

Why JNJ?

- Diversified Revenue Streams: The company’s three business segments provide a balanced risk profile—pharma growth, medical device stability, and consumer product steadiness.

- Strong R&D Pipeline: JNJ’s investment in research helps keep its product offerings ahead of competitors, ensuring revenue continuity.

- Resilient Consumer Demand: Medical supplies and consumer health goods are largely recession‑resistant.

Valuation & Risks

JNJ trades at a forward P/E near 21x, aligning with its long‑term average. The article flags regulatory and litigation risks—particularly with its pharmaceuticals—but notes that the company’s large cash reserves cushion it against such setbacks.

4. Exxon Mobil Corp. (XOM)

Business & Dividend Profile

Exxon Mobil (XOM) is the world’s largest publicly traded oil and gas company. Despite the push toward renewables, XOM’s dividend yield sits at approximately 4.4%–4.5% in 2025, making it a strong income play in an energy‑heavy sector.

Why XOM?

- High Cash Generation: The company’s EBITDA margin is typically above 25%, giving it significant cash flow to fund dividends.

- Resilience to Oil Price Volatility: XOM’s upstream and downstream operations provide a natural hedge against price swings.

- Strategic Asset Portfolio: The company holds assets in both traditional fossil fuels and newer low‑carbon ventures (e.g., carbon capture projects).

Valuation & Risks

XOM’s forward P/E sits around 12x, reflecting the sector’s lower valuations. The article warns about the long‑term structural risk of a global shift away from fossil fuels but underscores that XOM’s diversified strategy—including investment in biofuels and hydrogen—mitigates that risk.

5. AT&T Inc. (T)

Business & Dividend Profile

AT&T (T), a telecommunications giant, has a dividend yield that ranges from 4.5% to 5.0% in 2025, making it a top‑tier high‑yield stock. The company has a 22‑year streak of dividend increases and a payout ratio around 55%.

Why AT&T?

- Broad‑band and Media Synergies: AT&T’s integration of broadband services with media assets (Warner Bros. Discovery) creates cross‑sell opportunities.

- Strong Customer Base: With over 200 million customers, AT&T enjoys economies of scale that support steady revenue.

- Debt‑Free Cash Flow: While AT&T has a higher debt load, its cash flow is robust enough to sustain dividends and fund strategic acquisitions.

Valuation & Risks

AT&T trades at a forward P/E of roughly 10x, a low valuation that the article cites as attractive. The principal risks noted are the ongoing transition to 5G infrastructure, which could strain cash flow, and the uncertainty around the success of its media content strategy.

Macro‑Economic Context

The article frames these five picks within a broader backdrop of a gradually normalizing U.S. economy, an upward trajectory in interest rates, and an improving corporate earnings environment. The key points include:

- Interest Rates: As the Federal Reserve nudges rates higher, dividend‑yielding stocks become more attractive relative to fixed‑income securities. The 4‑5% yields of these blue‑chips represent solid income, even if real returns are slightly eroded.

- Inflation & Commodities: Rising commodity prices can pressure margin‑heavy sectors like consumer staples and energy; however, the companies’ pricing power and cost‑control strategies mitigate this effect.

- Growth vs. Value Tension: The article acknowledges that many growth-oriented tech stocks are trading at lofty multiples, while these blue‑chip dividend stocks offer more modest valuations with the added benefit of income.

Takeaway for Income‑Focused Investors

The article’s thesis is clear: If you’re a conservative investor seeking reliable income and the ability to weather short‑term volatility, these five blue‑chip stocks are compelling choices. Each company demonstrates:

- A long track record of dividend growth (over 20‑30 years).

- Strong cash‑flow generation that supports both current payouts and future growth.

- Solid balance sheets with manageable debt and healthy liquidity.

- Diversified business models that reduce sector‑specific risks.

While none of these stocks are immune to macro‑economic pressures, their proven resilience and the 4‑5% dividend yield range make them suitable for a high‑yield, risk‑averse portfolio.

“In an era of uncertain earnings and volatile rates, the best income can still come from the best of the best.” – 247 Wall Street

Bottom line: The 2025 guide from 247 Wall Street spotlights PG, KO, JNJ, XOM, and T as the five high‑yield blue‑chips that combine the twin imperatives of income and stability—an attractive recipe for investors who prefer dividends over growth.

Read the Full 24/7 Wall St Article at:

[ https://247wallst.com/investing/2025/12/10/5-blue-chip-stocks-to-buy-now-all-pay-reliable-4-5-dividends/ ]