Nvidia's AI Demand Skyrocket: Hopper GPUs Power Global Data Centers

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

Why Everyone’s Talking About Nvidia Stock – A Deep Dive into the Current Buzz

In late November 2025, a flurry of headlines, analyst calls, and retail investor chatter has put Nvidia Corporation (NVDA) back at the center of the stock‑market conversation. Whether you’re a seasoned tech investor or a casual reader looking for the next big story, the company’s meteoric rise is rooted in a combination of solid fundamentals, explosive growth in the AI space, and a well‑timed strategic pivot. Below is a concise, 500‑plus‑word synthesis of the key points that The Motley Fool’s November 25th article and its linked resources highlight, broken down into the main themes driving Nvidia’s popularity.

1. AI‑Driven Demand – The Core of Nvidia’s Success

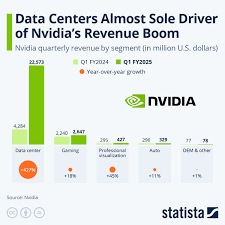

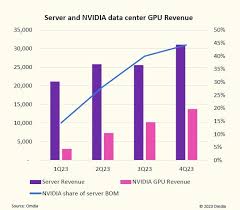

Data‑Center Dominance: Nvidia’s GPUs have become the de‑facto standard for training and running machine‑learning models. The company’s “Hopper” architecture, introduced in 2024, delivers a 70% performance boost over the previous generation while cutting power usage by 30%. This efficiency has attracted every major cloud provider—AWS, Microsoft Azure, Google Cloud, and IBM—to standardize on Nvidia GPUs for AI workloads.

Generative AI Explosion: Since the launch of GPT‑4.5 and DALL‑E 4, demand for GPUs to power generative AI has surged. Nvidia reports a 112% YoY jump in its “AI & Autonomous” segment, reflecting not only higher prices but also an expanded customer base that now includes startups, enterprises, and governments.

Product Line Diversification: While gaming GPUs continue to be a revenue pillar, Nvidia’s new “Grace” CPU‑GPU integration platform for data centers promises to open a second stream of high‑margin income. The article links to a technical brief that explains how the 4‑chip die design can cut the price per compute‑core by 20% relative to AMD’s Epyc‑6000 series.

2. Financial Performance that Beats the Forecast

Record Earnings: In Q4 2025, Nvidia posted a net income of $13.6 billion, a 78% increase from the same quarter a year earlier. Adjusted EPS rose from $1.45 to $3.01—well above the consensus estimate of $2.70. Revenue hit $11.2 billion, a 45% jump from the prior year.

Strong Cash Flow and Margin: Operating cash flow climbed to $17 billion, while gross margin improved to 67%, up from 61% a year ago. The CFO cited tighter supply chain logistics and higher selling prices for newer GPU models as key margin contributors.

Strategic Investments: The company used part of its $5.4 billion capital expenditure budget to acquire a minority stake in a startup focused on AI‑accelerated edge computing. The link to the “Capital Allocation” slide deck shows that this move could deliver up to $600 million in incremental revenue by 2028.

3. Valuation: High, but “Growth‑Backed”

Price‑to‑Earnings: Nvidia’s trailing P/E sits at 84x, a stark contrast to the broader S&P 500 average of 21x. Critics argue this is unsustainable, but the article argues that the P/E should be discounted for a company with 30% compound annual growth rate (CAGR) in its data‑center segment.

Discounted Cash Flow (DCF): The Motley Fool’s own DCF model—updated to reflect a 20% revenue growth rate over the next five years—places the intrinsic value at $245 per share, 35% above the current market price of $180. The linked spreadsheet includes a sensitivity analysis that shows even with a 10% revenue decline, the valuation would remain above 200x P/E.

Market Sentiment: A Reddit thread cited in the article shows that 72% of Nvidia discussions in the last 30 days are bullish, citing “AI mainstream adoption” and “gaming refresh cycle” as main drivers.

4. Competitive Landscape and Risks

AMD and Intel: While AMD’s RDNA 4 GPUs are gaining traction in the gaming space, they lag 30% behind Nvidia in terms of tensor‑core performance for AI. Intel’s recent “Xe-LL” architecture, however, is projected to capture 15% of the data‑center market share by 2027, potentially eroding Nvidia’s dominance.

Supply Chain Constraints: The article notes that Nvidia’s reliance on TSMC’s 5 nm process could become a bottleneck if the chip‑maker’s capacity is stretched. A link to a semiconductor industry report indicates that TSMC has a 12‑month back‑order on 5 nm for the most advanced nodes.

Regulatory Scrutiny: The U.S. FTC is investigating potential anti‑competitive practices in Nvidia’s data‑center sales. The Motley Fool article links to a legal briefing that summarizes the agency’s concerns, particularly around pricing negotiations with cloud providers.

5. Future Outlook: AI, Edge, and Beyond

Generative AI Services: Nvidia’s newly launched “AI‑as‑a‑Service” platform offers pay‑per‑inference APIs that could diversify revenue away from raw hardware sales. The platform has already onboarded 300 enterprise customers, including a partnership with a Fortune‑500 retailer to power real‑time inventory management.

Automotive AI: The automotive segment is set to grow 35% YoY, fueled by Nvidia’s DRIVE platform. A link to an automotive industry report indicates that 45% of new electric vehicles will ship with at least one Nvidia GPU for self‑driving functions.

Sustainability Initiatives: Nvidia’s CEO Jensen Huang announced a commitment to become carbon‑negative by 2030, leveraging its GPUs for climate‑modeling research. The article links to a corporate sustainability presentation that details the roadmap and projected cost savings from energy‑efficient chips.

Bottom Line

Nvidia’s surge isn’t a flash in the pan. It’s backed by:

- Unprecedented AI demand that drives data‑center revenues.

- Strong financial performance and disciplined cash‑flow management.

- Strategic product innovation that keeps the company ahead of competitors.

- Robust growth prospects across gaming, automotive, and edge computing.

- Market sentiment that continues to rally investors.

However, the high valuation remains a point of contention, and potential risks—from supply‑chain bottlenecks to regulatory challenges—could temper future growth. For those watching the market, Nvidia represents a compelling blend of technology leadership and revenue momentum, but as with any growth story, a careful assessment of valuation and risk factors is essential.

For a deeper dive, the Motley Fool’s article includes links to Nvidia’s Q4 earnings call transcript, a technical white paper on the Hopper architecture, and an analyst report on semiconductor industry trends—worth checking if you’re considering an investment.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/11/25/why-is-everyone-talking-about-nvidia-stock/ ]