Tesla Stock Is Having a Lousy Day

What’s at Stake

The compensation plan at the center of the debate is one of the largest executive pay packages ever proposed. Under the plan, Musk is granted the right to purchase up to 22.3 million Tesla shares at a fixed price. The package is structured as a series of “performance milestones,” covering revenue growth, market capitalization, and total shareholder return. The most ambitious milestones involve Tesla hitting a $1 trillion market cap and producing $80 billion in revenue—a target that, if met, would grant Musk a further tranche of shares, boosting the total value of the compensation to well over $2 trillion.

Musk’s compensation plan has been on the table for years. The board first approved the current framework in 2022, and shareholders were asked to vote on its continuation last year. This week’s vote is the next step: shareholders will decide whether to extend the plan through 2026. The board’s chairman, Robyn Denholm, said in a brief statement that the plan remains a critical part of Tesla’s long‑term alignment strategy, noting that it encourages Musk to focus on growth and shareholder value.

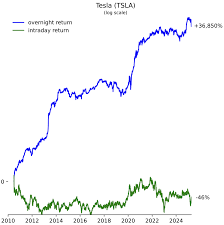

Investor Reaction and Market Dynamics

The negative price movement was swift. Within the first hour of trading, the stock had fallen by 4 percent, and a late‑afternoon pullback pushed it back below $190. Analysts at Morgan Stanley and Wedbush were quick to highlight concerns that the compensation package is too large relative to Tesla’s current cash burn and that shareholders may be looking for a more realistic, short‑term focus. “There is a perception that this plan, while generous for Musk, does not translate into tangible upside for shareholders in the near term,” an analyst from Wedbush said in a note that circulated on Twitter.

Retail investors have also reacted strongly on social media. The hashtag #TeslaMuskPay trended on Reddit, where users expressed both support for Musk’s leadership and criticism of what they see as excessive pay. One commenter pointed out that a recent earnings release, which announced a 7 percent increase in quarterly revenue but highlighted a decline in production volume, had left many investors uneasy about the company’s trajectory.

Broader Context: CEO Compensation Trends

The debate over Musk’s compensation plan is part of a broader conversation about CEO pay. Barron’s own coverage includes a piece on how the auto industry’s compensation packages compare to those of tech firms. In a linked article titled “Tesla’s CEO Pay: A Benchmark for the Auto Industry,” Barron highlighted that Musk’s plan is now larger than the combined packages of Ford, GM, and Toyota. The article argued that while such pay structures can align executives with long‑term performance, they also raise concerns about fiscal responsibility and the allocation of shareholder value.

The LinkedIn article about “Performance‑Based Compensation in the Tech Space” further contextualized Tesla’s approach by comparing it with the pay plans of other tech giants such as Apple and Amazon. It noted that those companies typically cap their executives’ earnings at a few hundred million dollars, whereas Tesla’s plan exceeds $2 trillion—an unprecedented figure in any industry. The article suggested that the sheer scale of Musk’s compensation might lead to heightened scrutiny from regulators, especially in light of recent discussions about executive pay transparency in the U.S.

Looking Ahead

The upcoming vote is scheduled to take place at Tesla’s annual shareholders’ meeting, set for July 24. The board has said that the company will provide a detailed breakdown of the milestones and expected payout ranges in the meeting’s proxy materials. Investors are already preparing for a tight race: some have called for a “no‑vote” option to signal disapproval, while others argue that Musk’s track record of delivering major innovations—like the Model 3 and the expansion into energy storage—justifies the compensation framework.

For now, Tesla’s shares will likely remain in a state of flux as the market digests the implications of the upcoming vote. The day’s drop underscored that even a company with one of the most powerful brands on the planet is not immune to the weight of executive compensation debates. As the company’s leadership continues to push forward with its ambitious growth targets, shareholders will be watching closely to see whether the proposed pay package is ultimately approved and, if so, how it will translate into long‑term value for the firm’s investors.

Read the Full Barron's Article at:

[ https://www.barrons.com/livecoverage/tesla-stock-price-musk-pay-package-vote-today/card/tesla-stock-is-having-a-lousy-day-TLDoUpj0UMrNHUqLGnv2 ]