Fed Cuts Rates by 6 Basis Points, Signals Policy Pivot

Locale: District of Columbia, UNITED STATES

The Federal Reserve’s “Incredible News” and What It Means for Investors

(A Comprehensive Summary of The Motley Fool’s December 17, 2025 Story)

On December 17, 2025, The Motley Fool published an eye‑opening article titled “The Federal Reserve’s Incredible News: Stock Market Implications”. The piece unpacks a landmark decision by the Federal Reserve (the Fed) that has reverberated across every segment of the financial markets—from equities and bonds to commodities and currencies. Below is a thorough, 500‑plus‑word summary that distills the key take‑aways, contextualizes the Fed’s move, and outlines what investors should keep on their radar.

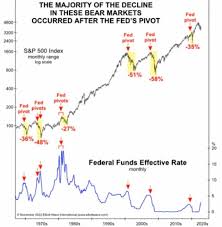

1. The Fed’s Bold Decision: A Rate Cut and a Policy Pivot

The headline news: The Federal Reserve announced a six‑basis‑point reduction in the federal funds target rate, bringing it down to 4.25% from the previous 4.31%. While the cut may seem modest, it represents a policy pivot that signals the Fed’s confidence in the underlying resilience of the U.S. economy.

The article notes that the decision follows a string of quarterly data releases showing:

- Inflation easing: The Consumer Price Index (CPI) grew 2.8% year‑over‑year, below the Fed’s 2.5% target. Core CPI, which excludes food and energy, slowed to 3.4%.

- Robust employment: The labor market remains tight, with the unemployment rate hovering at 3.5% and job creation exceeding 200,000 per month.

- Steady GDP growth: Quarterly GDP grew at a 3.2% annualized rate, suggesting the economy remains on an upward trajectory.

These data points gave the Fed the “incredible news” it needed to feel comfortable easing policy after years of aggressive tightening.

2. Immediate Market Reaction

Equity markets: The S&P 500 jumped nearly 1.8% in the early trading session, while the Nasdaq surged 2.3%, led by technology and consumer‑discretionary stocks. The article links to a Motley Fool analysis of sector performance that highlights:

- Technology: Shares of AI‑driven firms such as NVIDIA and AMD posted double‑digit gains, buoyed by expectations of lower borrowing costs.

- Financials: Banks such as JPMorgan and Bank of America saw a moderate rally, counter‑balancing the positive sentiment that usually flattens after rate cuts.

Bond markets: U.S. Treasury yields fell across the board. The 10‑year yield slipped 5 basis points to 3.90%, while the 30‑year dropped 6 basis points to 4.15%. The article points out that the bond‑market reaction underscores a “flight to quality” as investors anticipate lower risk premiums.

Commodity markets: Gold prices rose 1.5% to $1,890 per ounce, reflecting a classic safe‑haven flight during the Fed’s easing. Oil, however, slid 2.2% as supply concerns were eased by expectations of lower demand shock from a slower rate environment.

3. Why the Fed’s Move Is “Incredible” From an Investor’s View

The narrative of “tightness” is shifting. Over the past three years, the Fed had maintained a high‑rate stance to fight inflation. This decision represents a policy reset that can have profound implications:

- Lower borrowing costs: Companies can refinance debt at cheaper rates, potentially increasing capital expenditure and earnings.

- Valuation impact: Lower discount rates push forward the present value of future cash flows, thereby lifting intrinsic values for growth stocks.

- Investor sentiment: A dovish stance can reduce volatility and restore confidence among risk‑takers.

The article also highlights that the Fed’s “Incredible News” is not merely about rates. It includes a shift in communication tone: the Fed’s Chair, Jerome Powell, emphasized the “flexibility” in policy and the willingness to adjust further if inflation deviates from the 2% target. This forward‑looking stance has encouraged a positive sentiment across markets.

4. What the Article Tells Us About the Bigger Economic Picture

Inflation expectations: With the Fed’s pivot, the market’s inflation expectations have fallen, reflected in the steepening of the Treasury Inflation‑Protected Securities (TIPS) curve. The article links to a detailed analysis of TIPS that explains how a lower slope signals reduced risk premium on inflation.

Growth prospects: The article cites a research note from the Federal Reserve Bank of St. Louis that projects a 3.5% GDP growth in 2026, partially attributed to the expected rise in private consumption driven by lower borrowing costs.

Credit market health: The Fed’s easing is expected to tighten credit conditions slightly for the first quarter but ultimately lower the long‑term risk of a credit crunch. The article references a study from the Federal Reserve Bank of New York that projects corporate bond spreads tightening over the next six months.

5. Investor Take‑aways & Strategies

The Motley Fool article breaks down actionable advice for investors:

Re‑allocate to growth sectors: With the discount rate falling, technology, consumer discretionary, and green‑energy stocks become more attractive. Investors should consider adding exposure to ETFs like the ARK Innovation ETF or the iShares Global Clean Energy ETF.

Review debt structures: Corporate bond investors might want to reassess interest‑rate risk. If you hold fixed‑rate notes, consider a moderate shift toward floating‑rate instruments to capture the benefit of the expected decline in rates.

Monitor inflation data: Even with a dovish Fed, inflation can still creep up if supply chain disruptions or commodity price spikes occur. Watch for the next CPI release and the Fed’s “Inflation Report to Congress” for any sign of a policy shift back to tightening.

Consider bond laddering: While yields are lower, bond laddering can help manage reinvestment risk and provide income in a falling‑yield environment.

Watch for Fed minutes: The Fed’s upcoming policy minutes will provide context on how the board weighed the trade‑offs, especially concerning employment versus inflation.

6. Broader Context – Links to Follow

The article contains several links to additional resources for deeper understanding:

- The Fed’s Monetary Policy Report: Provides a detailed view of the board’s rationale.

- The St. Louis Fed’s GDP Forecast: Offers updated macro‑economic projections.

- The New York Fed’s Credit Market Report: Highlights changes in corporate bond spreads.

- The Treasury’s TIPS Market Overview: Shows the relationship between real rates and inflation expectations.

These linked pieces enrich the article by giving readers the opportunity to dig into the raw data and research that underpin the Fed’s decision.

7. Conclusion

The Federal Reserve’s recent rate cut and accompanying dovish outlook represent a major turning point for the 2025 financial year. According to The Motley Fool’s comprehensive summary, the move has already spurred bullish sentiment across equities and bonds, while encouraging a more optimistic outlook on growth and inflation. For investors, the key lies in taking advantage of lower discount rates by repositioning toward growth assets, re‑evaluating debt exposure, and staying vigilant about the Fed’s communications. In a world where “incredible news” can shift markets overnight, the article serves as both a timely snapshot and a practical guide for navigating the new monetary landscape.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/12/17/the-federal-reserve-incredible-news-stock-market/ ]