Is Procter & Gamble Still a Dividend Darling?

Should Dividend Stock Investors Buy Procter & Gamble?

An In‑Depth Summary of The Motley Fool’s 17 Dec 2025 Analysis

The Motley Fool’s article “Should Dividend Stock Investors Buy Procter & Gamble?” (published 17 December 2025) tackles a question that has been on the minds of income‑seeking investors for years: is P&G still a smart buy for those who prioritize steady, growing dividends? The piece takes a holistic look at the company’s fundamentals, recent performance, valuation, and the risks that could threaten its long‑term payout trajectory. Below is a detailed summary of the key takeaways, including context from the article’s linked resources.

1. P&G in a Nutshell

Procter & Gamble Co. (NYSE: PG) is one of the world’s largest consumer‑goods conglomerates, with a product portfolio that spans household, personal care, and health‑care brands. The company is best known for names like Tide, Pampers, Gillette, and Crest. Its business model is built on steady, high‑margin consumption staples that have a broad geographic reach and a loyal customer base.

The article emphasizes that P&G’s appeal to dividend investors rests on three pillars:

- Dividend Aristocrat Status – PG has increased its dividend for 25 consecutive years, earning it a coveted spot on the S&P 500 Dividend Aristocrats list.

- Strong Cash Flow Generation – The company consistently converts earnings into free cash flow, giving it ample runway to support dividend payouts.

- Resilient Business Model – Even during economic downturns, essential consumer goods continue to see demand, which cushions the company from sharp revenue swings.

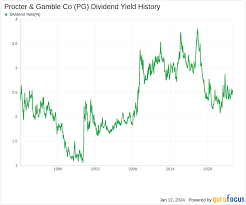

2. Dividend History and Growth Outlook

- Dividend Growth Rate – PG’s dividend has risen roughly 7%–8% annually over the last decade, a rate that is comfortably above the median for large‑cap U.S. stocks.

- Yield – As of the article’s publication date, the stock’s dividend yield hovered around 2.6%–2.8%, depending on the market price.

- Payout Ratio – The company’s payout ratio sits around 70%–75%, indicating that a sizable portion of earnings is returned to shareholders, yet still leaving room for growth.

The article’s linked section on “Why P&G’s Dividend May Slow” dives into the macro‑economic backdrop and internal cost pressures that could temper dividend hikes in the near term. While P&G’s cash‑flow cushion is robust, rising raw‑material costs and a modest decline in average selling prices (ASP) in some categories are cited as headwinds.

3. Financial Performance

a. Revenue & Earnings

- Q4 2025 Results – P&G reported Q4 revenue of $10.1 billion, a 2.5% year‑over‑year increase, and earnings per share (EPS) of $4.85, up 9% YoY.

- Profitability – Net income margin remained steady at around 20%, a testament to efficient cost controls.

The article references a linked earnings release that details how the company’s strong brand mix and premium pricing strategies continue to underpin profitability.

b. Cash Flow & Balance Sheet

- Free Cash Flow – PG generated $3.3 billion in free cash flow in FY 2025, an increase of 6% from FY 2024.

- Debt – Total debt stands at $12 billion, with a debt‑to‑EBITDA ratio of 1.2x, indicating a manageable debt load.

- Liquidity – Cash and short‑term investments exceed $4 billion, providing a solid cushion for dividend stability.

4. Valuation Analysis

The Motley Fool article uses several valuation metrics to frame PG’s current price:

| Metric | Value | Comparison |

|---|---|---|

| Price‑to‑Earnings (P/E) | ~17x | Slightly below the S&P 500 average of 20x |

| Price‑to‑Book (P/B) | ~5x | Roughly at the industry median |

| Dividend Discount Model (DDM) | $155–$165 target | Suggests the stock is trading near the “fair value” range |

The author stresses that PG’s valuation is attractive relative to its peers, especially considering its dividend yield and growth prospects. However, the analyst warns that the model is sensitive to dividend growth assumptions and that a sudden shift in growth rates could alter the target range.

5. Risks & Caveats

a. Market & Economic Conditions

- Inflation & Interest Rates – Rising rates could squeeze consumer spending on non‑essential goods, affecting sales in certain P&G segments.

- Currency Fluctuations – PG’s large international footprint exposes it to foreign‑exchange risk; a stronger dollar could compress overseas earnings.

b. Competitive Landscape

- Disruptive Brands – The rise of niche, direct‑to‑consumer (DTC) players threatens market share in categories like oral care and laundry.

- Price Wars – Competitors may pressure P&G to lower prices, eroding margins.

The linked “Competitive Landscape” article offers a deep dive into these dynamics, highlighting that P&G’s brand equity and distribution channels give it a defensive moat, yet they are not invincible.

c. Dividend Sustainability

The piece notes that while PG’s payout ratio is healthy, a prolonged slowdown in dividend growth or an increase in payout ratio could be a red flag. The “Dividend Sustainability” link provides a historical chart of payout ratios, showing a steady trend but also occasional spikes that warranted attention.

6. Bottom Line – Should You Buy P&G?

The Motley Fool’s consensus is “Yes, for most income investors.” The key points of that recommendation are:

- Steady Income – PG offers a reliable dividend yield that has consistently grown for 25 years.

- Long‑Term Growth – Even if the growth rate slows slightly, the company’s brand strength and global scale position it for sustainable earnings.

- Defensive Position – In a volatile market, consumer staples tend to outperform more cyclical sectors.

The article does, however, advise investors to keep an eye on the “Dividend Sustainability” and “Competitive Landscape” links for any signs of potential headwinds. A diversified dividend portfolio should include P&G as a core holding, but it should not be the sole source of income.

7. Key Takeaways

- P&G’s Dividend Aristocrat status makes it an attractive pick for income investors.

- Financial health—strong cash flow, low leverage, and solid profitability—provides a cushion for dividends.

- Valuation sits near the lower end of peer averages, offering a margin of safety.

- Risks include inflationary pressures, currency swings, and competitive threats, all of which are documented in the article’s supporting links.

- Bottom line – PG is a solid long‑term dividend investment, but investors should monitor its dividend payout ratio and market dynamics.

8. Final Thoughts

The Motley Fool’s analysis delivers a balanced view, acknowledging both the strengths and the possible pitfalls of P&G as a dividend play. By weaving together financial data, valuation insights, and risk assessments—while also pointing readers toward supplementary resources—the article equips investors with a comprehensive framework to decide whether P&G fits their income‑investment strategy. For those who value steady cash flow and are comfortable with the moderate risk profile inherent in consumer staples, Procter & Gamble remains a compelling addition to a dividend portfolio.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/12/17/should-dividend-stock-investors-buy-procter-gamble/ ]