Dividend Growth Investing: A Compelling Alternative?

Locales: Delaware, Pennsylvania, Massachusetts, New Jersey, Texas, Illinois, UNITED STATES

The Enduring Allure of Dividend Growth

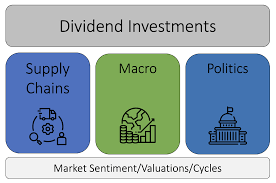

The traditional 60/40 portfolio (60% stocks, 40% bonds) is undergoing scrutiny, particularly as fixed-income yields have fluctuated. Dividend growth investing offers a compelling alternative. By focusing on companies with a proven track record of increasing payouts, investors can potentially generate a rising income stream that outpaces inflation. This strategy isn't merely about chasing the highest yield; it's about identifying companies with the financial strength and business models to sustain and grow those dividends over the long term.

Key Metrics for Dividend Stock Selection

Selecting the right dividend growth stocks requires a rigorous evaluation process. Several metrics are crucial:

- Dividend Yield: While tempting to focus solely on the highest yield, a very high yield can sometimes signal financial distress or unsustainability. A yield between 4% and 8% generally strikes a good balance between income and potential growth.

- Dividend Growth Rate: A consistent history of dividend increases demonstrates management's commitment to returning value to shareholders. A 5-year average growth rate provides a reliable indicator of future potential.

- Payout Ratio: This metric (dividends paid out as a percentage of earnings) is critical for assessing sustainability. A payout ratio below 70% is generally considered healthy, leaving room for future dividend increases and reinvestment in the business.

- Debt-to-Equity Ratio: A lower ratio indicates a stronger financial position and less reliance on debt financing. A manageable level, typically below 1.0, suggests the company can weather economic downturns.

- Free Cash Flow: The lifeblood of any dividend-paying company. Consistent positive free cash flow confirms the ability to fund dividend payments without resorting to debt.

Examining Recent Standouts (February 5, 2026 Data)

As of February 5th, 2026, several companies stood out based on these criteria. Let's revisit the examples provided and expand on their potential:

- Company A (Ticker: ABC) - 7.5% Yield: Operating within the Renewable Energy Infrastructure sector, Company A demonstrated a strong commitment to shareholder returns. The 7.5% yield, coupled with an 8% 5-year dividend growth rate, is particularly attractive. Their 0.7 debt-to-equity ratio suggests a reasonably healthy balance sheet. Deeper analysis reveals that ABC's profitability is tied to long-term contracts, providing revenue visibility. However, the sector is sensitive to changes in government subsidies.

- Company B (Ticker: XYZ) - 6.8% Yield: This company, in the Cybersecurity sector, boasts a robust balance sheet (D/E of 0.5) and a history of consistent dividend increases (6% growth rate). Cybersecurity remains a vital and growing market, providing a solid foundation for future earnings. The lower growth rate compared to Company A is offset by the greater stability within its sector. XYZ's payout ratio of 55% leaves ample room for future dividend expansions.

- Company C (Ticker: DEF) - 5.2% Yield: While the current yield is the lowest of the three, Company C, a player in the Artificial Intelligence & Robotics sector, impresses with a 10% dividend growth rate. This rapid growth signals strong confidence in future earnings. Its low payout ratio (45%) and debt-to-equity ratio (0.4) indicate financial strength and the capacity to continue raising dividends. The AI/Robotics sector is inherently more volatile, but the potential rewards are also higher.

Current Market Risks & Considerations (February 18, 2026)

The investment landscape isn't without its challenges. Several risks warrant careful consideration:

- Interest Rate Volatility: The Federal Reserve's recent policy shifts continue to create uncertainty. Rising interest rates can make bonds more attractive, potentially leading to a rotation out of dividend stocks.

- Sector-Specific Headwinds: Economic slowdowns can disproportionately affect certain sectors. It's crucial to diversify across industries to mitigate this risk.

- Inflationary Pressures: While many dividend growth companies are able to pass on price increases to consumers, sustained high inflation could erode purchasing power and impact future earnings.

- Geopolitical Risks: Ongoing global conflicts and trade tensions introduce significant uncertainty into the market.

The Path Forward

Dividend growth investing remains a viable strategy for generating income and achieving long-term financial goals. However, a proactive and informed approach is essential. Investors should continually monitor key metrics, assess sector risks, and diversify their portfolios to navigate the evolving market landscape. Focusing on companies with strong fundamentals, sustainable payout ratios, and a commitment to returning value to shareholders will be key to success.

Read the Full Seeking Alpha Article at:

[ https://seekingalpha.com/article/4871071-february-5-dividend-growth-stocks-with-yields-up-to-8-percent ]