AI Reshapes Software: Opportunities for Dividend Investors

Forbes

ForbesLocales: New York, California, UNITED STATES

Tuesday, February 17th, 2026 - The software sector is currently experiencing a period of significant readjustment, largely driven by the rapid advancement and integration of generative Artificial Intelligence (AI). Recent weeks have witnessed considerable pressure on software stock valuations, as investors grapple with understanding the long-term implications of this technological shift. While some perceive this downturn as a temporary correction, a deeper examination suggests a fundamental recalibration of expectations is underway.

The core question haunting investors is whether the explosive growth previously enjoyed by software companies is sustainable in an AI-driven world. Will AI fundamentally alter the industry landscape, rendering existing business models obsolete, or will software remain an essential component of the future technological ecosystem? The most likely scenario lies in a nuanced middle ground. AI will undoubtedly reshape the software industry, automating processes, fostering innovation, and creating entirely new market opportunities. However, it's highly improbable that AI will entirely supplant the need for software itself. In many ways, AI requires robust software infrastructure to function and scale effectively.

This presents a unique opportunity for dividend investors. The current market volatility has created pockets of value within the software space, offering attractive entry points for those seeking long-term income and capital appreciation. The key is to identify companies that possess the resilience and adaptability to thrive in this evolving environment. But what characteristics should dividend investors prioritize when assessing software companies in the age of AI?

Key Criteria for AI-Era Dividend Stocks:

- Demonstrated Business Strength: A proven track record of consistent revenue growth and profitability is paramount. Look for companies with established market positions and a history of delivering value to customers.

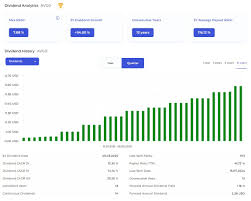

- Reliable Dividend History: A consistent dividend payment history, ideally with a pattern of increases, signals financial discipline and a commitment to returning capital to shareholders. This demonstrates a company's ability to generate sustainable cash flow even during periods of economic uncertainty.

- Sustainable Competitive Advantage (Moat): The most crucial factor. Companies must possess a durable competitive advantage that shields them from disruption. This could take the form of proprietary technology, strong network effects, high switching costs for customers, or a powerful brand reputation.

- AI Integration Strategy: How is the company actively integrating AI into its existing products and services? Are they leveraging AI to enhance efficiency, improve customer experience, or develop entirely new revenue streams? A proactive approach to AI adoption is a strong indicator of future success.

Spotlight on Potential Dividend Plays:

Let's examine a few prominent software companies that currently exhibit these characteristics:

- Microsoft (MSFT): As a dominant force in the software industry, Microsoft's scale and diversification provide a significant buffer against disruption. The company's substantial investments in generative AI, particularly through its partnership with OpenAI, position it to capitalize on this emerging technology. While its current dividend yield (approximately 1.0% as of early 2026) is modest, its consistent dividend growth and overall financial strength make it a compelling option. Furthermore, Microsoft's Azure cloud platform is becoming increasingly vital for AI model training and deployment, strengthening its long-term outlook.

- Adobe (ADBE): Adobe's leadership in creative software (Photoshop, Illustrator, Premiere Pro) is underpinned by a powerful subscription-based business model that generates predictable recurring revenue. The company is actively integrating AI-powered features into its creative suite, enhancing user productivity and unlocking new creative possibilities. The modest dividend yield (around 0.8%) is offset by Adobe's consistent revenue growth and strong brand loyalty. The shift towards AI-assisted design and content creation further reinforces Adobe's value proposition.

- Oracle (ORCL): Oracle's transformation from a traditional software vendor to a cloud-based service provider has been a multi-year effort, but it's gaining traction. Its database software remains critical for many organizations, and its cloud offerings are expanding rapidly. With a relatively healthy dividend yield of 2.4%, Oracle offers a combination of income and growth potential. The company is leveraging AI to improve its cloud services and automate database management, enhancing its competitiveness.

Beyond the Big Three:

Investors should also consider other potential dividend contenders, such as ServiceNow (NOW), which is leveraging AI to automate IT workflows, and Salesforce (CRM), a leading provider of customer relationship management (CRM) software that's integrating AI into its sales and marketing tools.

A Cautious Outlook:

It's crucial to acknowledge that these companies are not immune to market volatility. Economic headwinds and unforeseen technological developments could impact their performance. However, by focusing on companies with strong fundamentals, consistent dividend histories, and proactive AI strategies, dividend investors can navigate the current disruption and position themselves for long-term success. Diversification is also key - spreading investments across multiple companies reduces risk.

Disclaimer: I am not a financial advisor. This is not financial advice. Please consult with a qualified professional before making any investment decisions.

Read the Full Forbes Article at:

[ https://www.forbes.com/sites/michaelfoster/2026/02/17/ai-took-a-bite-out-of-software-stocks-heres-our-dividend-play/ ]