REE Demand Expanding Beyond EVs and Defense

Locales: Wyoming, Colorado, Texas, UNITED STATES

The Expanding REE Ecosystem: More Than Just Magnets

The initial article correctly identifies electric vehicles (EVs), defense applications, and renewable energy as primary drivers of REE demand. However, the scope is expanding. Modern technologies - from smartphones and laptops to medical imaging and advanced robotics - all rely heavily on these often-overlooked elements. Neodymium and praseodymium, essential for high-strength permanent magnets used in EV motors and wind turbines, remain crucial. Dysprosium, enhancing high-temperature performance, is also critical. But the REE suite includes 17 elements, each with unique properties and applications. Cerium, for example, is vital in polishing compounds, while lanthanum is used in camera lenses and hybrid vehicle batteries.

MP Materials and the US Onshoring Push

MP Materials' control of the Mountain Pass mine is indeed a strategic asset. The US government's commitment to reducing dependence on China for REEs is a substantial tailwind, extending beyond mere rhetoric to include funding initiatives and streamlined permitting processes. The recent Infrastructure Renewal Act of 2025 included significant allocations for domestic REE processing and refining capabilities, and further legislation is anticipated this year. However, mining and initial processing are only parts of the puzzle. The US still lacks a fully integrated supply chain for refining REEs into finished materials needed by manufacturers. Several companies are now racing to establish this mid-stream processing capacity, creating both opportunities and potential competition for MP Materials.

Global Competition: China's Dominance and Emerging Players

The article rightly points to China's dominance. It controls a vast majority of the REE supply chain, from mining and processing to magnet manufacturing. While China has been tightening environmental regulations on its REE industry, increasing costs and potentially limiting supply, it maintains considerable leverage. However, the narrative of unchallenged dominance is shifting. Australia has emerged as a significant REE producer, particularly through companies like Lynas Rare Earths. Vietnam also holds considerable REE reserves and is attracting foreign investment. Brazil and India are also actively exploring and developing their REE resources. This diversification, while positive for supply chain security, also increases competition.

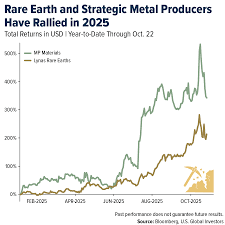

Financial Volatility and Demand Fluctuations

The recent downward pressure on MP Materials' stock price, linked to slowing demand and macroeconomic conditions, serves as a cautionary tale. The EV market, while still growing, has experienced periods of slower-than-expected growth, impacting demand for REE-powered motors. Furthermore, geopolitical instability and fluctuating commodity prices add layers of complexity. Investors need to consider not just the long-term demand outlook but also short-term market fluctuations. The price of REEs themselves can be volatile, impacting the profitability of mining companies.

Beyond Mining: The Circular Economy and Material Science

An often-overlooked aspect is the potential for REE recycling and material substitution. The circular economy, emphasizing resource recovery and reuse, is gaining traction. Technologies for extracting REEs from end-of-life products like magnets and electronics are improving, potentially reducing reliance on primary mining. Furthermore, ongoing research into alternative materials and magnet designs that reduce or eliminate the need for critical REEs could disrupt the market. While these alternatives aren't yet commercially viable at scale, they represent a long-term threat to the traditional REE supply chain.

Investment Strategy: A Nuanced Approach

The author's "hold" recommendation for MP Materials appears reasonable. The company's strengths remain valid, but the valuation requires careful consideration. However, investors interested in the REE sector shouldn't limit their focus to a single company. A diversified approach, including exposure to companies involved in mining, processing, recycling, and materials science, may be more prudent. Exchange-Traded Funds (ETFs) focused on critical minerals provide another avenue for gaining exposure to the sector. Ultimately, understanding the complex interplay of geopolitical factors, technological advancements, and market dynamics is crucial for making informed investment decisions.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2026/02/17/usa-rare-earth-stock-buy-sell-or-hold/ ]