South Korea's Pension Fund Cuts Foreign Stocks to Bolster Won

Locale:

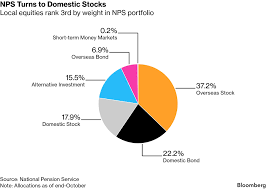

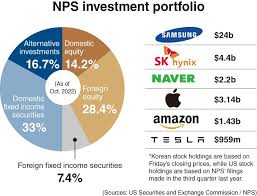

Seoul, South Korea - February 17th, 2026 - South Korea's National Pension Service (NPS), a global financial heavyweight managing over $850 billion in assets, today announced a significant recalibration of its investment strategy. The fund will reduce its target allocation to foreign stocks by approximately 3 percentage points - equivalent to roughly $3 billion - in a deliberate move to bolster the South Korean won and address growing concerns about currency instability.

The announcement, made today, underscores a growing trend amongst national pension funds to balance investment returns with national economic priorities. While traditionally focused on maximizing returns for its beneficiaries, the NPS is now actively working to stabilize the domestic financial landscape, particularly the weakening won. This marks a notable shift, acknowledging the interconnectedness of pension fund investment strategies and national currency health.

The won has been under sustained pressure in recent months, reaching near two-year lows against the US dollar. Several factors contribute to this decline, including a widening current account deficit - reflecting increased imports relative to exports - and the ongoing series of interest rate hikes in the United States. The latter, in particular, draws capital away from emerging markets like South Korea towards higher-yielding US assets. These combined pressures create a challenging environment for the won and raise fears of a potential currency crisis.

The NPS's decision isn't occurring in isolation. The South Korean finance ministry has also been actively intervening in the foreign exchange market, utilizing its reserves to buy won and prop up its value. The NPS's move is therefore seen as a complementary effort to the government's broader stabilization strategy.

A Balancing Act: Returns vs. Stability

Analysts are divided on the long-term implications of this strategic adjustment. Proponents argue that preventing a significant currency devaluation is crucial for maintaining macroeconomic stability and protecting the purchasing power of South Korean citizens. A sharply depreciating won would increase import costs, fueling inflation and potentially leading to broader economic hardship.

However, critics caution that reducing exposure to foreign equities may dampen the NPS's overall investment returns. Global stock markets, particularly in the United States, have consistently outperformed domestic markets in recent years. Lowering foreign holdings could translate to lower pension payouts for future retirees.

"The NPS is walking a tightrope," explains Park Hee-jae, an economist at Kyobo Securities. "Stabilizing the won is undoubtedly important, especially given the current global economic climate. But curbing foreign stock investments inevitably comes with a trade-off. The fund needs to carefully assess the potential impact on long-term returns and ensure it can still meet its obligations to pensioners."

Broader Implications for Global Pension Funds

The NPS's decision reflects a broader trend among large national pension funds globally. Facing increasing pressure to address domestic economic challenges, these funds are reconsidering their traditional investment mandates. We've seen similar, albeit smaller-scale, interventions in Japan and other Asian economies where currency stability is paramount.

This trend could have significant implications for global capital flows. If more pension funds prioritize domestic stability over maximizing returns, it could lead to a reduction in cross-border investment and a fragmentation of global financial markets. This shift raises questions about the future of globalization and the interconnectedness of the world economy.

Furthermore, the increased focus on currency stabilization highlights the growing importance of exchange rate risk management for pension funds and other institutional investors. They are increasingly employing sophisticated hedging strategies to protect their portfolios from currency fluctuations. The NPS's move could encourage other funds to adopt similar approaches.

Looking Ahead

The effectiveness of the NPS's strategy will depend on a number of factors, including the evolution of global economic conditions, the trajectory of US interest rates, and the overall health of the South Korean economy. The fund will likely monitor the situation closely and adjust its strategy as needed. The next few months will be critical in determining whether this intervention can successfully stabilize the won without significantly impacting the long-term returns of the NPS and its beneficiaries. Observers will be watching closely to see if this move signals a more permanent shift towards a domestically focused investment strategy for one of the world's largest pension funds.

Read the Full Channel NewsAsia Singapore Article at:

[ https://www.channelnewsasia.com/business/south-korea-pension-fund-lowers-foreign-stock-target-support-won-5882981 ]