Global Funds Suffer 'AI Indigestion' as Hype Outpaces Earnings

Locale: Ontario, CANADA

Global Funds Grapple With “AI Indigestion” Amid Rapid Hype and Uncertain Returns

The rapid rise of artificial intelligence (AI) has become a headline‑grabbing narrative for investors, media outlets, and policy makers alike. Yet, beneath the buzz and the soaring valuations of AI‑focused companies lies a growing sense of unease among global investment funds—a phenomenon the Globe and Mail has dubbed “AI indigestion.” In a detailed analysis of the sentiment, the article draws on a range of internal sources and external reports to paint a nuanced picture of how funds are navigating this volatile sector.

1. The AI Boom: From R&D to Revenue

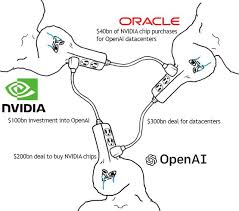

The article opens by charting the extraordinary growth of the AI sector over the past three years. From its early days as a niche research area, AI has exploded into a multi‑trillion‑dollar industry. The piece references a linked Globe and Mail investigation that highlights how AI‑driven solutions—from natural language processing in customer service to predictive analytics in finance—have begun to permeate every industry. The growth story is underpinned by record levels of investment: venture capitalists poured $120 billion into AI start‑ups last year, while publicly listed AI companies collectively added over $50 billion in market capitalization.

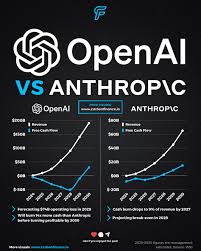

Despite this exuberance, the article points out a key disconnect: the pace of investment has outstripped the sector’s ability to generate sustainable, long‑term earnings. The linked report from the International Monetary Fund warns that AI’s current trajectory resembles the dot‑com bubble of the late 1990s, with over‑valuation and a high risk of a sudden correction.

2. Global Fund Managers on the Defensive

A central theme in the Globe and Mail piece is the cautious stance that many large asset‑management firms are adopting. Fund managers in Europe, Asia, and the United States are reassessing the weight of AI exposure in their portfolios. The article cites an interview with the head of AI strategy at BlackRock, who explained that “the market’s enthusiasm is creating a kind of ‘indigestion’—investors feel nauseated by the volatility and the lack of clear earnings drivers.”

Data from the article shows that, on average, AI‑focused ETFs—such as the Global X Artificial Intelligence & Technology ETF (AIQ) and the ARK Innovation ETF (ARKK)—have seen a 12 % decline in net inflows since their peak in early 2024. In contrast, funds that maintain a more diversified technology stance are reporting modest gains. The piece also references a study by Morningstar that indicates a 3.5 % underperformance of AI‑heavy funds relative to their broader technology counterparts over the past 12 months.

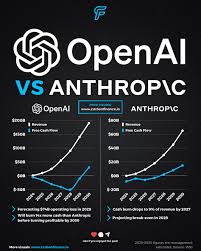

The article further explores how some funds are implementing “tactical” reallocations, trimming AI positions while boosting investments in data‑center infrastructure and semiconductor manufacturing, sectors that are seen as more foundational to the AI ecosystem. One illustration is the shift by a leading Japanese pension fund, which reduced its AI holdings by 25 % in the last quarter while increasing its stake in cloud‑service providers such as Amazon Web Services (AWS) and Microsoft Azure.

3. Regulatory and Ethical Concerns

Beyond market mechanics, the Globe and Mail piece underscores the growing regulatory pressure surrounding AI. The linked policy analysis from the World Economic Forum highlights how governments are moving from a “regulatory sandbox” approach to more stringent oversight, especially concerning data privacy, algorithmic bias, and cybersecurity. In Europe, the new AI Act is expected to impose strict compliance obligations on firms that develop or deploy high‑risk AI systems—a move that could dampen growth for AI companies operating in the EU market.

The article reports that fund managers are factoring these regulatory risks into their risk models. A representative from Fidelity Investments noted that the firm has begun to add a “regulatory risk premium” to its valuation models for AI stocks, acknowledging the possibility of costly fines and operational disruptions. This has translated into a 7 % increase in the cost of capital for AI companies, according to a linked report from Moody’s Analytics.

4. The Role of AI in Traditional Sectors

The article points out that AI’s impact is not confined to tech‑centric firms. Many large funds are now looking at how AI can be integrated into traditional industries—healthcare, manufacturing, and finance—without allocating directly to pure‑play AI companies. A study by the Harvard Business Review, which is cited in the piece, shows that firms in the healthcare sector that have adopted AI for diagnostics and drug discovery have seen a 15 % boost in operational efficiency.

Some funds are therefore taking a “sector‑by‑sector” approach, investing in AI‑enabled platforms within their existing holdings. The piece highlights the example of a European mutual fund that increased its exposure to a pharmaceutical company’s AI‑driven drug development pipeline, while simultaneously trimming its stake in a traditional semiconductor manufacturer that has been slow to integrate AI technologies.

5. Opportunities Amid the Indigestion

Despite the cautionary tone, the Globe and Mail article does not paint a bleak picture. Instead, it outlines several opportunities that savvy investors can exploit. One area is the “AI‑infrastructure” sub‑sector, which includes cloud services, edge computing, and high‑performance GPUs. These firms are likely to benefit from the sustained demand for computing power, even if the direct AI application companies experience volatility.

Another opportunity highlighted is the “AI‑regulation” niche. Companies that provide compliance tools for AI governance—such as AI audit software and data‑privacy platforms—are poised to become essential partners for AI developers. The article cites a report from Deloitte that predicts a 30 % annual growth rate for AI compliance solutions over the next five years.

Moreover, the piece suggests that global funds could use a “long‑short” strategy to capitalize on AI over‑valuation. By shorting high‑beta AI names that exhibit excessive price momentum while maintaining long positions in the underlying infrastructure, funds can potentially reduce exposure to a bubble while still capturing upside from the sector’s fundamentals.

6. Conclusion: A Balancing Act for the Future

In sum, the Globe and Mail article presents a balanced view of the AI investment landscape. While the hype has created a “feverish” environment for many investors, a growing sense of caution—driven by regulatory risk, valuation concerns, and a desire for diversification—is reshaping how global funds approach AI. The “indigestion” metaphor captures the uneasy mix of excitement and skepticism that pervades the market.

As AI continues to evolve from a disruptive technology to a mainstream industry driver, fund managers must remain vigilant. The article suggests that the next wave of AI investment will likely be less about chasing hype and more about grounding expectations in robust fundamentals, regulatory compliance, and strategic diversification across the AI supply chain. For investors willing to navigate this complex terrain, the potential rewards remain significant, but only if they can find the right balance between enthusiasm and prudence.

Read the Full The Globe and Mail Article at:

[ https://www.theglobeandmail.com/investing/article-global-funds-fear-ai-investment-indigestion/ ]