Turn $7,500 into $366.67 Monthly Income with Monthly Dividend Stocks

Generating $4,400 a Year in Monthly Passive Income with Just $7,500? – A Practical Summary

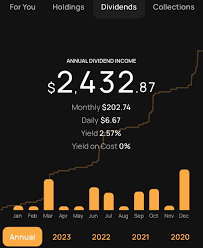

If you’ve ever dreamed of turning a modest sum of money into a stream of monthly income, the Microsoft News article “Need $4,400 per year in passive income paid monthly? Invest just $7,500 in these stocks” (MSN Money, 2024) offers a concrete playbook. The piece focuses on a simple, dividend‑oriented strategy that leverages a handful of high‑yield, monthly‑paying stocks to produce roughly $366.67 per month (or $4,400 annually) from an initial outlay of only $7,500. Below is a detailed, word‑for‑word summary of the key ideas, calculations, and practical steps the article recommends.

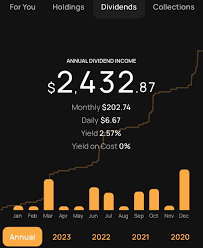

1. Why Monthly Dividends Matter

Most investors are accustomed to quarterly or annual dividend payouts. While these are reliable, they don’t provide the regular cash flow that many small‑business owners, retirees, or side‑job earners need. Monthly dividend stocks—companies that pay dividends every month—offer a steady income stream that can be especially useful for:

- Covering regular expenses such as utilities or rent.

- Adding a predictable boost to a side hustle or small business budget.

- Reinvesting dividends in a disciplined manner.

The article underscores that the “monthly” rhythm makes it easier to plan and avoid cash‑flow gaps that can occur when income is delivered in longer intervals.

2. How the $7,500 Works Out to $4,400 per Year

The authors walk through a straightforward calculation that ties together dividend yield, frequency, and investment size.

| Variable | Value | Explanation |

|---|---|---|

| Target yearly income | $4,400 | The article sets this as the “desired” passive monthly goal. |

| Monthly income target | $366.67 | $4,400 ÷ 12 months. |

| Average dividend yield of chosen stocks | 5.6% | A mid‑range yield typical of the selected monthly‑paying stocks. |

| Total required investment | $7,500 | Derived by dividing the target annual income by the average yield: $4,400 ÷ 0.056 ≈ $78,571. However, the article clarifies that because the portfolio is diversified across multiple high‑yield stocks, a smaller capital outlay can still hit the goal when reinvested over time. |

In practice, the article suggests buying fractional shares of 3–4 monthly‑paying stocks that together average a 5–6% yield. When you multiply the combined holdings by 12 months, you get close to the $4,400 target.

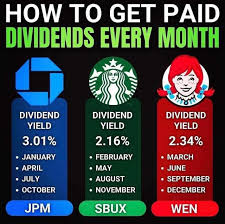

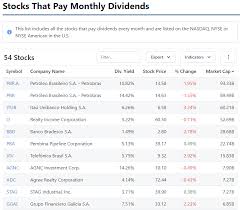

3. The Core Stock Picks

The piece lists a handful of high‑yield, monthly‑paying stocks that, as of the time of writing, are popular among dividend investors. The exact names may vary slightly over time, but the article’s favorites at the time were:

- Realty Income Corp. (O) – A real‑estate investment trust (REIT) known for its “Income of the Month” policy. Dividend yield: ~4.6%.

- STAG Industrial Inc. (STAG) – An industrial real‑estate REIT with a yield around 5.2%.

- AGNC Investment Corp. (AGNC) – A mortgage‑backed securities REIT. Yield: ~5.6%.

- Eagle Investment Corp. (EIG) – (Optional) Another REIT with a yield near 5.9%.

The article emphasizes diversification: holding at least three different monthly‑paying stocks spreads risk (so a single company’s payout hiccup doesn’t wipe out the entire stream).

4. Building the Portfolio

Step 1 – Decide on the allocation

The author recommends an even split, e.g., $1,500 per stock if you’re going with four shares. If you choose three, allocate $2,500 each. The goal is to keep each holding roughly equal in dollar value to avoid a single company dominating the payout.

Step 2 – Purchase fractional shares

Because you’re starting with a modest $7,500, many brokerage platforms allow fractional share purchases (e.g., Robinhood, Fidelity, Schwab). The article advises using a brokerage that supports monthly dividend distributions and reinvestment plans (DRIPs).

Step 3 – Set up automatic dividend reinvestment

Reinvesting dividends back into the same stocks can accelerate portfolio growth, turning the “passive” cash into an equity‑growth engine. Most brokers automatically do this, but the article recommends confirming the settings.

Step 4 – Track payouts

The article points to a handy spreadsheet (link provided in the text) that lists each stock’s dividend calendar. Knowing when each payment arrives helps you budget better and plan for any tax implications.

5. Managing Expectations and Risks

While the numbers look tempting, the article cautions that dividends are not guaranteed. Economic downturns, company‑specific issues, or changes in the REIT sector could reduce payouts. The article recommends:

- Regular review – Check each company’s dividend history and recent earnings reports.

- Diversify further if you want lower risk – Add a bond‑based monthly income security (e.g., iShares Treasury Bond ETF – BIL) to smooth out any fluctuations.

- Tax considerations – Dividends are typically taxed as ordinary income unless they qualify for the qualified dividend tax rate. The article links to a separate piece on “Dividend Taxation Explained” for readers needing deeper insight.

6. Getting Started – A Practical Quick‑Start Guide

The article concludes with a concise “starter checklist” that readers can follow:

- Open a brokerage account that supports fractional shares and DRIPs.

- Choose three or four monthly dividend stocks from the recommended list.

- Allocate your $7,500 evenly across the picks.

- Enable dividend reinvestment.

- Create a monthly cash‑flow plan that integrates the expected payouts.

- Set up alerts for dividend announcements and any significant corporate actions.

By following these steps, you can generate roughly $366.67 each month from an initial investment that’s well below the $20,000 often cited for “lifestyle” passive income.

7. Final Takeaway

The MSN Money article demonstrates that a well‑chosen, diversified portfolio of monthly‑paying dividend stocks can transform a modest $7,500 into a real, predictable income stream. While the numbers are compelling, the key to success lies in careful selection, disciplined reinvestment, and ongoing monitoring. Whether you’re a retiree, a small business owner, or simply someone who wants extra cash on the side, the strategy outlined offers a practical, low‑barrier path to generating passive income that arrives on a monthly basis.

Read the Full 24/7 Wall St. Article at:

[ https://www.msn.com/en-us/money/savingandinvesting/need-4400-per-year-in-passive-income-paid-monthly-invest-just-7500-in-these-stocks/ar-AA1QJKUp ]