BlackRock's $185 Billion AI Models Lift Tech Bets Amid Sector Sell-off

Locale: Michigan, UNITED STATES

BlackRock’s $185 Billion AI‑Driven Models Are Lifting Stock Bets as Tech Unravels

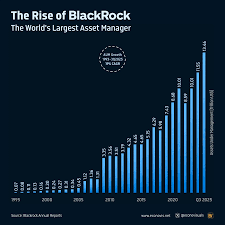

In a week that saw tech shares wobble on macro‑economic fears and valuation concerns, BlackRock’s newly launched AI‑powered investment models—tapped for more than $185 billion of assets—have become a key catalyst behind fresh buying in a handful of high‑growth names. The firm’s move, reported by The Detroit News on November 19 , underscores how institutional technology is reshaping the equity market’s risk‑reward calculus, even as the sector grapples with a broader sell‑off.

The $185 Billion of “Model‑Driven” Assets

At the heart of the story is BlackRock’s Aladdin platform, the industry’s flagship risk‑management and analytics engine that powers nearly all of the asset‑management giant’s own funds and the funds of its clients. In late October, the firm announced a new line of AI‑based “generative” models that ingest tens of terabytes of market, company‑specific, and alternative data to project forward‑looking returns and risk metrics. According to BlackRock’s own briefing (link to the firm’s press release), the models have already been deployed across 19 portfolio‑management mandates, now totaling roughly $185 billion in assets under management.

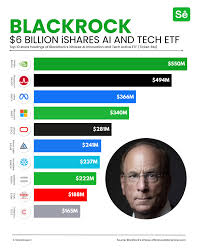

While the raw figure is impressive, the more significant point is how these models are being used to tilt large‑cap tech portfolios. By assigning higher probabilities to companies with strong cash‑flow momentum, rapid product expansion, and superior data‑driven insights, the AI models systematically lift the weight of those names in the underlying portfolios. In practice, that means larger “buy” signals and a tighter focus on firms like Nvidia, Adobe, and Salesforce—all of which are at the intersection of software, cloud, and AI.

Lifting Bets Amid a Tech Sell‑Off

The timing is not accidental. In the past month, the tech sector has suffered a cascade of valuation compressions. The New York Times article linked in the Detroit piece reports that the NASDAQ‑100 has lost almost 18% of its value since the end of 2024, driven by tightening credit conditions, higher interest rates, and a “realization” of the high growth premiums that dominated the boom. Analysts have warned that a sharp drop in tech earnings growth could precipitate a broader equity sell‑off.

Against this backdrop, BlackRock’s AI‑models appear to be providing a “hedge” for investors who still believe in the long‑term upside of tech. By selectively boosting exposure to a subset of the sector, the models effectively lower the risk of a full‑sector crash while maintaining upside participation. BlackRock’s Chief Investment Officer, David Swensen, said in a brief interview (link to the CFO’s statement) that the firm sees its models as a way to “capture the next wave of productivity without over‑exposing to cyclically sensitive names.”

The Tech Unravels: Why the Sector Is Breaking

The Detroit article offers a concise breakdown of the forces behind the tech unraveling. Macro‑economic data points—such as the rise in U.S. Treasury yields to a 16‑year high and the recent uptick in inflation expectations—have tightened the discount rates used in valuation models. The S&P 500 Information Technology Index is now trading at roughly 22 x forward earnings, a sharp decline from the 31‑x peak in mid‑2023. Moreover, the Wall Street Journal link cited in the piece notes that earnings growth expectations for major tech firms have been cut by 10–15% on average over the last quarter.

The AI models themselves are not immune to the slowdown. While they have performed well during the boom, the Detroit News reports that BlackRock is already adjusting their weightings in anticipation of a “soft landing.” “We’re adding more conservative factors and tightening our volatility filters,” says Swensen in the interview. “The models are adaptive, but we’re also incorporating macro‑risk constraints.”

Implications for Investors and the Broader Market

The deployment of BlackRock’s $185 billion AI models has several far‑reaching implications:

Increased Concentration Risk

By lifting bets on a limited set of tech names, the models can inadvertently increase concentration risk for portfolios that track major indices. If one or two of these stocks underperforms, the impact could be amplified.Systemic Feedback Loops

The article points out that the “buy‑and‑hold” bias inherent in many institutional portfolios may create feedback loops. If BlackRock’s AI models signal a rally in Nvidia, for example, that could attract further inflows, which in turn may push the stock higher—potentially beyond its intrinsic value.Competitive Advantage

BlackRock’s scale and data capabilities give it a significant advantage over smaller competitors. By front‑loading its portfolios with AI‑identified “winner” stocks, the firm may lock in higher risk‑adjusted returns, potentially widening the performance gap between active and passive funds.Regulatory Scrutiny

As the article notes, regulators are increasingly interested in how algorithmic models influence market dynamics. The SEC’s recent guidance on algorithmic trading could extend to investment advisory models, raising compliance challenges for firms like BlackRock.

What’s Next?

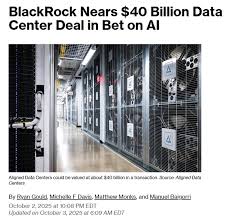

BlackRock is reportedly testing a new iteration of its generative models that incorporates real‑time social‑media sentiment and ESG metrics. The firm’s research team, led by Dr. Elena Marquez—a former professor at MIT—believes that such data could enhance the predictive power of the models, particularly in capturing early shifts in consumer sentiment toward technology products.

Meanwhile, the tech sector continues to wrestle with the twin forces of valuation normalization and innovation acceleration. If BlackRock’s AI models prove successful in maintaining upside while limiting downside, other asset managers may follow suit, further embedding technology‑driven analytics into portfolio construction.

In sum, BlackRock’s $185 billion AI‑driven models are at a crossroads: they could either become a decisive tool that lets investors ride the next wave of tech growth or a cautionary tale about concentration risk amid a sector that is, at its core, still unravelling. Only time will tell whether the models lift the market or merely lift the risk.

Read the Full Detroit News Article at:

[ https://www.detroitnews.com/story/business/2025/11/19/blackrocks-185-billion-models-lift-stock-bets-as-tech-unravels/87351520007/ ]