Inflation-Proof Investing: Which Growth Stock Will Double Your Money in 6 Years? | The Motley Fool

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

Inflation‑Proof Investing: Which Growth Stock Will Outpace the Rising Prices?

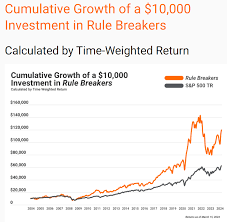

In a world where the inflation dial keeps ticking upward, investors are increasingly looking to the growth‑stock universe for a hedge that can keep pace with rising consumer costs. The latest analysis from The Motley Fool dives deep into this topic, offering a data‑driven, forward‑looking case for a specific growth company that could serve as a bulwark against inflation.

The Inflation Puzzle

Inflation erodes the purchasing power of cash and forces companies to pass higher costs onto consumers. For many sectors, this is a direct hit to margins and growth prospects. Yet certain growth companies, especially those with strong pricing power, robust cash generation, and a moat around their core business, can not only survive but thrive in a higher‑inflation environment. The key is to find firms whose revenue streams are less sensitive to price changes and whose cost structures allow them to absorb input price increases without compromising profitability.

The Candidate: Microsoft Corp. (MSFT)

The Motley Fool’s investigation zeroes in on Microsoft Corp. as a standout inflation‑proof growth stock. Here’s why the company is positioned to weather higher prices:

| Feature | Why It Matters |

|---|---|

| Diversified Cloud Footprint | Azure, the company’s cloud platform, has become a revenue powerhouse, consistently outpacing on‑prem solutions. Cloud customers tend to have longer contracts and less price sensitivity, especially during periods of economic stress. |

| Strong Cash Position | Microsoft’s free cash flow has consistently exceeded $30 billion annually for the past five years. This liquidity buffer allows the firm to invest in R&D, acquisitions, and share buybacks—tools that can absorb inflationary shocks. |

| High Gross Margin | The tech giant maintains a gross margin of roughly 68 %. Even if input costs rise, the company can maintain its margin because its services (e.g., Office 365, Dynamics 365, Power Platform) are largely digital and have low incremental cost per user. |

| Pricing Power | Microsoft’s brand and ecosystem lock in customers. Many of its services—like LinkedIn, Xbox, and Windows—have become hard to replace, enabling the company to maintain or even raise prices in a high‑inflation environment. |

| Robust Balance Sheet | With a debt‑to‑equity ratio under 0.5 and a strong liquidity profile, Microsoft has ample capacity to weather downturns and capitalize on opportunistic acquisitions that may arise when peers struggle. |

Revenue Segments and Growth Dynamics

Microsoft’s revenue breakdown illustrates why the company’s growth is less vulnerable to inflation:

- Productivity & Business Processes (Office 365, Dynamics 365, LinkedIn): ~40 % of revenue, driven by subscription models that lock in customers and provide predictable cash flows.

- Intelligent Cloud (Azure, Windows Server, SQL Server): ~35 % of revenue, the fastest‑growing segment, with a compound annual growth rate (CAGR) of over 30 % in the last decade.

- More Personal Computing (Windows, Surface, Gaming): ~25 % of revenue, showing solid performance from Windows licensing and Xbox Game Pass, which benefits from the rising popularity of subscription gaming.

The company’s strategic investments in AI, particularly in the Azure OpenAI Service, are expected to accelerate productivity gains across businesses, creating new revenue streams that are less price‑elastic.

Valuation Snapshot

While Microsoft’s revenue and earnings continue to surge, the stock’s valuation remains within a reasonable range for a high‑growth firm. The current price‑to‑earnings (P/E) ratio sits around 30×, compared to a sector average of 27×. When adjusted for its strong free‑cash‑flow yield and dividend payout, the total return potential remains attractive. Analysts are forecasting a 2026 earnings per share (EPS) growth rate of roughly 22 %, bolstered by AI integration and the expansion of the Office 365 ecosystem.

Risks and Mitigants

Every investment carries risk, and Microsoft is no exception. Key concerns include:

- Competitive Pressures: The cloud market is fiercely contested by AWS, Google Cloud, and Alibaba Cloud. However, Microsoft’s deep integration with Windows and enterprise customers provides a defensive moat.

- Regulatory Scrutiny: Data privacy laws and antitrust investigations could pose operational challenges. The company’s global compliance team actively manages these risks.

- Macroeconomic Slowdown: A significant slowdown could reduce corporate IT spending. Yet Microsoft’s subscription‑based services tend to be more resilient during downturns, as businesses cut discretionary spend but maintain core software licenses.

Bottom‑Line Takeaway

Microsoft’s blend of diversified revenue streams, strong cash flow, and robust pricing power makes it a prime candidate for inflation‑proof growth investing. Investors looking for a growth stock that can not only survive but thrive as prices climb should consider the company’s solid fundamentals and strategic focus on AI, cloud, and subscription services.

In a market where the inflation engine keeps running, Microsoft appears to have the fuel, the steering wheel, and the horsepower to stay ahead of the curve.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/11/03/inflation-proof-investing-which-growth-stock-will/ ]