Is 2025 the Year of a Market Bubble? Experts Weigh in on Equity Valuations

Locale: New York, UNITED STATES

Navigating the 2025 Market Landscape: AI, Credit, Commodities, and Bonds in the Era of a Potential Bubble

Business Insider’s November 2025 feature takes a deep dive into the complex forces that are shaping today’s financial markets, warning that investors may be on the cusp of a significant bubble while offering practical guidance for those who want to protect and grow their portfolios. The piece is organized around five key pillars—stock‑market valuation, artificial‑intelligence‑powered investing, credit markets, precious metals, and bonds—each paired with a set of actionable tips for both seasoned professionals and novice savers.

1. The Stock‑Market Bubble: When Growth Outpaces Reality

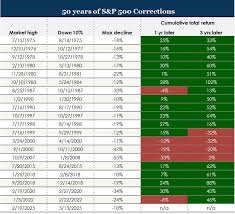

The article opens with a stark assessment of current equity valuations. According to the report, several major indices are trading on price‑to‑earnings multiples that comfortably exceed the historical average, even after adjusting for inflation. Analysts cited in the piece argue that this surge is fueled not only by continued corporate profitability but also by a wave of speculative enthusiasm that has been amplified by low interest rates and the ease of borrowing on margin.

Business Insider highlights a 2023 study from the University of Chicago that suggests that when market multiples surpass 30‑year averages by more than 25%, the probability of a corrective pullback jumps dramatically. The article stresses that while a correction is not imminent, the market is showing “early signs of over‑extension,” a sentiment echoed by several prominent economists on the panel.

Take‑away for investors: Keep a closer eye on valuation ratios, and consider trimming positions in high‑growth, high‑multiple stocks if earnings growth fails to keep pace.

2. AI‑Powered Investing: Tool or Trick?

A sizable portion of the feature focuses on the rapid adoption of artificial‑intelligence platforms for trading and portfolio management. The article distinguishes between “model‑based” AI that relies on historical data and “real‑time” AI that processes streaming news, social‑media sentiment, and macro‑economic indicators.

Business Insider points out that while AI can identify patterns humans might miss, it also introduces new risks. Automated systems can amplify market movements by executing large trades based on the same signals, potentially creating a feedback loop that pushes prices away from fundamentals. Moreover, the opacity of many AI models raises concerns about “black‑box” risk—investors may not fully understand how an algorithm arrived at a recommendation.

The piece offers a balanced view: AI can be an effective tool for diversification, risk management, and even for identifying undervalued assets, but it should not replace human judgment.

Take‑away for investors: Use AI‑driven insights as a supplement to traditional research, not a substitute. Regularly audit your algorithmic strategies for performance and alignment with your risk tolerance.

3. Credit Markets: Rising Risk, Potential Payoffs

In a section devoted to debt, Business Insider explores the tightening of credit spreads across both corporate and municipal bonds. The article notes that many companies that previously enjoyed “easy credit” are now facing higher borrowing costs as the Federal Reserve has begun to raise short‑term rates. The credit quality of high‑yield issuers has also deteriorated, with default rates climbing from 3% in 2024 to 4.5% in early 2025.

The report highlights two key strategies for navigating this environment:

- Sector‑rotation: Invest in industries with robust cash flows, such as utilities or healthcare, which tend to weather rising rates better.

- Credit‑spread ladders: Build a laddered portfolio of bonds that matures at staggered intervals, allowing reinvestment at higher rates without locking in long‑term credit risk.

Take‑away for investors: Pay close attention to the yield‑to‑worst metric and maintain liquidity to capture opportunities in distressed debt, but only if you have the capacity to monitor these positions closely.

4. Gold and Other Metals: Safe Havens or Overvalued Assets?

The article turns to the commodities market, underscoring that gold and other precious metals have traditionally served as a hedge against inflation and geopolitical uncertainty. However, the Business Insider piece points out that the current price trajectory for gold has not been supported by a proportional rise in inflation expectations or supply constraints.

In contrast, the narrative for industrial metals like copper and nickel has shifted. Rising demand from the renewable‑energy sector—particularly for battery production—has spurred higher prices, but the article warns that these are not “purely speculative” assets. The piece suggests that investors view metals as a mix of hedge and growth opportunity, rather than a safe haven.

Take‑away for investors: Diversify within the metals space by balancing precious metals (gold, silver) with industrial metals (copper, nickel) that are tied to tangible growth drivers.

5. Bonds in a Rising‑Rate World

Finally, Business Insider rounds out the story by focusing on the bond market. The Federal Reserve’s gradual rate hikes have pushed yields up, squeezing the market value of existing fixed‑income securities. The article examines several strategies to mitigate duration risk:

- Short‑to‑medium duration ladders: Reduce exposure to rate‑sensitive bonds while still benefiting from current yields.

- Floating‑rate instruments: These securities adjust with benchmark rates, thereby maintaining relative purchasing power.

- Inflation‑protected bonds (TIPS): While TIPS have seen lower demand recently, the article suggests they can still provide a buffer against core inflation.

The report also highlights a subtle shift in investor sentiment: many institutional funds are now favoring “liquid alternatives” that include a blend of fixed‑income and hedge‑fund strategies to navigate the higher‑rate environment.

Take‑away for investors: Regularly re‑assess the duration of your bond holdings and consider adding floating‑rate or inflation‑linked instruments to protect against further rate increases.

Final Thoughts: A Multi‑Faceted Approach to Uncertain Times

Business Insider’s 2025 feature ultimately emphasizes that there is no one‑size‑fits‑all solution to the current market landscape. The convergence of a potential stock‑market bubble, AI‑driven investment tools, tightening credit conditions, evolving commodity dynamics, and rising rates creates a complex environment that demands a layered strategy.

For individual investors, the article advises:

- Diversification across asset classes – equity, credit, commodities, and bonds.

- Active risk management – employing tools like stop‑loss orders, hedges, and position sizing.

- Continuous learning – staying informed through reputable sources, academic research, and expert panels.

By weaving together these elements, the piece suggests that investors can better position themselves to weather volatility while still pursuing growth opportunities in a market that is, at times, overvalued and, at others, underappreciated.

Read the Full Business Insider Article at:

[ https://www.businessinsider.com/stock-market-bubble-ai-investing-tips-credit-gold-metals-bonds-2025-11 ]