5 Simple Rules from Warren Buffett to Avoid Costly Investment Mistakes and Grow Wealth

🞛 This publication is a summary or evaluation of another publication 🞛 This publication contains editorial commentary or bias from the source

5 Simple Rules from Warren Buffett to Avoid Costly Investment Mistakes and Grow Wealth

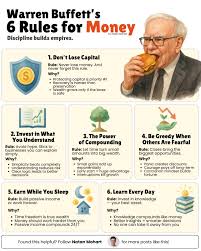

Warren Buffett, the long‑term investor who turned Berkshire Hathaway into a $800 billion juggernaut, has long preached a disciplined, rational approach to investing. A recent article on MSN Money distills his philosophy into five clear rules that can help anyone steer clear of common pitfalls and steadily build wealth. The piece pulls from Buffett’s own words, his interview notes, and a handful of secondary sources that expand on the principles.

1. Invest in Companies You Understand

Buffett’s first rule is perhaps the most straightforward: don’t invest in businesses you can’t comprehend. He famously says that the “most important rule of investing is to stay away from businesses that you cannot understand.” The article cites Buffett’s 2017 annual letter, in which he describes how he only buys companies with a “clear, durable competitive advantage” that he can explain to a five‑year‑old.

The rule’s practical implication is simple: before buying a stock, research the company’s products, market dynamics, and financials. Avoid flashy tech startups or niche firms with opaque business models. The article links to a Bloomberg interview where Buffett explains that this focus keeps investors from chasing fads and reduces the likelihood of costly mistakes.

2. Buy Businesses, Not Shares

Buffett’s second rule flips the common view of “share‑buying” into “business‑buying.” He urges investors to think of themselves as owners of the entire company, not merely as holders of a piece of paper. In the MSN piece, a side note quotes Buffett’s 1983 interview in Fortune: “If you buy a company, you’re buying an enterprise that you can run, no matter how long it takes.” This perspective leads to buying companies with solid fundamentals—consistent cash flow, strong management, and a margin of safety.

The article includes a short profile of Berkshire Hathaway’s acquisition strategy, illustrating how Buffett historically prefers companies that can be run in a few hours and still perform. It references a CNBC segment that further explains the difference between buying a stock and owning a business.

3. Keep a Margin of Safety

The margin of safety—purchasing a stock at a price below its intrinsic value—is a cornerstone of Buffett’s risk‑management playbook. The article explains how this rule protects investors from volatility and bad decisions. Buffett himself writes in his 2006 Wall Street Journal column: “The margin of safety is like a life jacket.” By buying well below intrinsic value, investors create a cushion against unforeseen events and valuation errors.

To calculate a margin of safety, the article suggests using the discounted cash flow method or simply comparing current prices to historical averages. It also notes that Buffett often uses a 25‑30 % discount on intrinsic value to determine a good entry point, citing a Financial Times interview where he explains that “you should never be afraid to wait for a better price.”

4. Avoid Excessive Trading and Leverage

Buffett is famously averse to frequent trading and especially to using leverage. The MSN article summarizes that Buffett’s 2008 Investor’s Business Daily interview made clear that “the best trades are the ones you don’t have to do.” The rule discourages short‑term speculation, transaction costs, and the psychological traps of “hot” markets.

The article points to a Bloomberg piece that shows how Buffett’s Berkshire shares have outperformed the S&P 500 by staying invested for decades. Buffett’s refusal to use margin in his personal portfolio is highlighted as an example of how leverage can amplify losses and erode returns. The article also quotes a Harvard Business Review article that details the psychological benefits of a buy‑and‑hold approach.

5. Keep Costs Low and Stay Patient

Finally, Buffett’s fifth rule emphasizes the importance of minimizing costs and maintaining patience. The MSN article explains that fees—whether brokerage commissions, fund management fees, or taxes—can erode compound growth over time. Buffett recommends low‑expense index funds or a hands‑off approach that reduces transaction costs.

The article references a Forbes study linked within the piece, which demonstrates that an investor who pays just 0.1 % per year in fees can outperform one who pays 2 % after ten years, purely due to compounding. Buffett’s own “rule of thumb” is that if a fund charges more than 1 % and has a history of underperforming its benchmark, it’s a red flag.

In addition, patience is framed as a virtue. The article quotes Buffett’s 2010 interview with The New York Times where he says, “The best time to invest is when you are afraid.” The key takeaway is that long‑term thinking reduces the temptation to react to short‑term market swings.

How These Rules Work Together

The article illustrates how the five rules complement one another. For instance, understanding a business (Rule 1) naturally leads to buying it (Rule 2). Knowing the intrinsic value and applying a margin of safety (Rule 3) ensures that you’re buying at a reasonable price, which then encourages you to hold (Rule 4). Finally, keeping costs low (Rule 5) preserves the gains from the disciplined strategy.

A sidebar in the MSN piece cites an interview with Benjamin Graham, Buffett’s mentor, who once said, “Investing is not a game of numbers; it’s a game of psychology.” The article uses this as a bridge to discuss how each rule helps an investor avoid the cognitive biases that often lead to mistakes.

Takeaway for Everyday Investors

While Buffett’s track record is extraordinary, the article argues that his rules are applicable to anyone who wants to build wealth without chasing quick gains. The key points are:

- Know what you’re buying – research thoroughly.

- Treat it as a business – think long term, not share value.

- Buy low relative to worth – use a margin of safety.

- Don’t overtrade or overleverage – stick to a steady plan.

- Control costs and be patient – let compound interest do its work.

For those who find the idea of a “life jacket” reassuring, the article offers a clear framework: a disciplined, thoughtful, and patient approach that echoes Buffett’s own philosophy. By following these simple rules, investors can sidestep common pitfalls, protect themselves from volatility, and position themselves for sustained wealth growth.

Read the Full Investopedia Article at:

[ https://www.msn.com/en-us/money/savingandinvesting/5-simple-rules-from-warren-buffett-to-avoid-costly-investment-mistakes-and-grow-wealth/ar-AA1PnPmf ]