Don't Buy Scotch Whisky Casks As An Investment. Here's Why.

Forbes

Forbes

Why Buying Scotch Whisky Casks Might Not Be the Smart Investment You Think

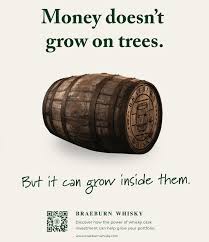

In a recent Forbes piece, Felipe Schrieberg cautions investors that the allure of owning a scotch whisky cask—promised by some blogs and niche forums as a “goldmine” of returns—may be more myth than reality. While the whisky market has indeed grown in popularity over the past decade, the article argues that the financial benefits of purchasing casks are overstated and that the risks are far greater than most buyers anticipate.

The Allure of the “Cask Investment”

For years, the idea that a single cask could be a tangible, liquid alternative to stocks, bonds or real estate has spread across social media and investor forums. The narrative is simple: a cask of single‑malt scotch ages in oak, picking up desirable flavors over time, and when finally released, can fetch a premium price at auction. A handful of high‑profile investors and whisky collectors have sold casks for more than double their purchase price, leading to a myth that “whisky is a guaranteed investment.”

Schrieberg notes that this story has been amplified by anecdotal success stories from individuals who bought casks at prices as low as $3,000–$4,000 and later sold them for $10,000–$15,000. The dramatic returns make the market seem like a quick‑rich scheme that everyone should jump into.

The Reality of Cask Valuation

The article dives into why these anecdotes don’t translate into a dependable investment model. Casks are not standardized like stocks; each one is unique, often sourced from a particular distillery and a specific barrel‑age combination. As a result:

Valuation is highly subjective – Pricing depends on the distillery’s brand, the cask’s origin (e.g., cask type, age of the wood), and the whisky’s projected flavor profile. There is no published market data or comparable sales framework, making accurate valuation difficult.

Lack of transparency – Most cask purchases happen through private deals, brokerages, or auction houses that provide limited disclosure about the contents or provenance. Even reputable auction houses, such as Christie’s or Bonhams, rely on expert appraisal rather than a standardized price chart.

Insufficient market data – While a few high‑profile auctions can provide price points, the overall volume of cask sales is small. The market does not have the depth required to generate reliable price indices, making it hard to track performance over time.

Schrieberg compares the cask market to fine‑wine investment, noting that wine has a longer history of liquidation markets and publicly available price guides. Whisky lags behind in that regard.

Liquidity Problems

Even if a cask is “worth” $20,000 after five years, there is no guarantee that a buyer will be found. The article outlines several liquidity concerns:

Limited buyer base – While there are whisky collectors, the overall pool of serious buyers who can afford large cask purchases is small.

Long transaction times – Selling a cask can take months, as buyers often need to verify authenticity, negotiate shipping, and wait for the right auction cycle.

High transaction costs – Brokers and auction houses charge fees that can eat into potential profits. For example, a 5% broker fee on a $10,000 sale would already be $500.

In contrast, a traditional stock or bond can be sold within minutes on a major exchange, providing the investor with immediate liquidity.

Storage and Preservation Costs

Owning a cask is not as simple as holding a bond certificate. Investors must:

Secure a storage location – A proper cask requires a climate‑controlled warehouse. Monthly storage fees can range from $100 to $400, depending on the location and cask size.

Handle transportation and insurance – Shipping a cask to a buyer or storage facility, plus insuring it against loss or damage, adds significant overhead.

Deal with potential spoilage – While whisky is generally resilient, improper storage can lead to oxidation, leakage, or even contamination, compromising the cask’s value.

Schrieberg points out that these ongoing costs can erode the profit margin considerably.

Regulatory and Legal Hurdles

The whisky investment space is less regulated than traditional securities markets. Consequently, investors face:

Limited consumer protections – If a broker misrepresents the cask’s provenance or quality, the investor may have little recourse.

Tax complexities – In many jurisdictions, capital gains on whisky are treated similarly to collectibles, with potentially higher tax rates and complicated reporting requirements.

Compliance with export/import rules – Shipping casks across borders can trigger customs duties, additional taxes, and regulatory approvals that further increase costs.

The Bottom Line

Schrieberg concludes that while whisky casks can be a fascinating collectible and may yield a return for a small minority of savvy buyers, the investment is fraught with hidden costs, valuation uncertainties, and liquidity constraints. He argues that for most investors, the risk‑return profile is far less attractive than more conventional assets.

His recommendation? Treat cask ownership as a hobby or personal indulgence rather than a serious investment vehicle. If you still want to explore the whisky market, start with lower‑risk alternatives—such as purchasing a limited‑edition bottling or investing in a reputable whisky-focused funds—rather than committing to a single, opaque cask.

For those who remain intrigued, a deeper understanding of the market’s nuances, storage logistics, and the legal landscape is essential before any capital is deployed. Ultimately, the whisky industry’s growth and the story of a few high‑profile sales do not translate into a guaranteed profit for the average investor.

Read the Full Forbes Article at:

[ https://www.forbes.com/sites/felipeschrieberg/2025/11/06/dont-buy-scotch-whisky-casks-as-an-investment-heres-why/ ]