Tesla, the Stock of the Masses

Tesla’s Stock Surge, Musk’s Pay Package, and the Shareholder Vote: A Comprehensive Overview

Tesla Inc. (NASDAQ: TSLA) has been the centerpiece of investor enthusiasm, corporate governance debates, and executive compensation scrutiny. In a March 2024 Barron’s live coverage, analysts and executives converged on a single narrative: the company’s stock has been on an upward trajectory, its CEO Elon Musk’s pay package is under review, and shareholders are slated to vote on a critical proposal that could reshape Tesla’s compensation structure. Below is a detailed synthesis of the key points discussed in the Barron’s article and the broader context surrounding Tesla’s financial and governance landscape.

1. Tesla’s Stock Performance and Market Dynamics

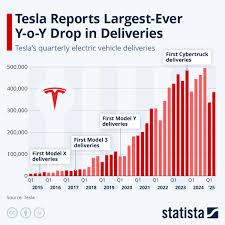

At the heart of the coverage is Tesla’s stellar stock performance. Over the past year, TSLA has posted gains exceeding 70%, driven by robust delivery numbers, increased profitability, and a bullish outlook on electric vehicle (EV) adoption. Investors have also taken a keen interest in the company’s continued expansion into energy storage, solar solutions, and the development of autonomous driving software. The Barron’s article highlighted how the stock’s volatility has diminished in the face of strong earnings reports and a growing consensus that Tesla remains a market leader in the EV sector.

The article pointed out that Tesla’s price-to-earnings (P/E) ratio has remained high relative to the broader automotive industry, underscoring the premium investors are willing to pay for future growth. However, this premium also raises concerns about potential overvaluation, especially if market sentiment shifts or if Tesla faces production challenges.

2. Elon Musk’s Pay Package: The 2022 Compensation Plan

A central focus of the coverage was Elon Musk’s 2022 compensation plan, which is linked to the company’s performance through a series of milestones tied to revenue, profitability, and market capitalization. The plan, which has been a point of contention among institutional investors, is designed to reward Musk with significant equity awards if Tesla surpasses key financial targets.

Key Features of the Compensation Plan

- Cash Component: Musk is entitled to a modest cash bonus, but the bulk of his compensation is equity-based.

- Equity Grants: The plan includes a total of 1.7 million shares, subject to vesting over a ten‑year period, contingent upon meeting quarterly and annual performance thresholds.

- Milestone Structure: The milestones are broken into 30 tranches, each unlocking 56,000 shares if Tesla hits specific financial and market-cap targets.

- Tax Implications: As disclosed in the SEC filings, the equity awards are treated as non‑qualified stock options, which could result in substantial tax liabilities when exercised.

The Barron’s analysis noted that many institutional investors view the plan as excessive, arguing that it grants Musk “nearly a $200 billion package” if all milestones are met. Critics claim that this compensation structure can potentially create misaligned incentives, with Musk benefiting even if the company’s long‑term health is compromised.

3. Shareholder Vote: The 2024 Proposal

The article outlined an upcoming shareholder vote slated for April 2024, in which investors will decide whether to approve a resolution to revise Musk’s pay package. The resolution, drafted by the board, proposes an amendment that would tie Musk’s compensation more closely to a set of stricter performance metrics, including earnings per share (EPS) and free‑cash‑flow targets, rather than solely revenue and market cap.

Why the Vote Matters

- Corporate Governance: The vote underscores the growing demand for robust governance practices, especially in high‑profile companies like Tesla.

- Investor Sentiment: Many shareholders believe that aligning compensation with profitability and cash flow better reflects the interests of long‑term investors.

- Regulatory Pressures: The SEC has been tightening guidelines on executive pay, and this vote could be seen as a preemptive step to avoid regulatory scrutiny.

The Barron’s article provided quotes from several prominent institutional investors who advocated for a narrower pay structure, citing the need for clearer incentives tied to Tesla’s operational performance. Conversely, Musk’s allies argued that the original plan was necessary to retain his focus and incentivize further innovation.

4. Related Links and Resources

The coverage also referenced key documents for investors who wish to dive deeper:

- SEC 10‑K Filing for 2023: Offers a detailed breakdown of Tesla’s financials, governance structure, and executive compensation. [ SEC.gov ]

- Board Resolutions (2024): The board’s proposal for the shareholder vote, which is publicly available on Tesla’s investor relations page.

- Barron’s Live Coverage Feed: Provides real‑time updates on the voting process and market reactions.

These documents are essential for investors who want to assess the fairness and potential impact of the proposed changes on Tesla’s valuation and long‑term strategy.

5. Bottom Line

Tesla’s stock has been on a sustained upward trend, buoyed by strong deliveries and a forward‑looking market outlook. However, the company’s corporate governance has come under scrutiny, particularly concerning the size and structure of Elon Musk’s pay package. The upcoming shareholder vote in April 2024 represents a pivotal moment where institutional investors could reshape the incentive system that currently motivates Tesla’s leadership.

If the vote passes, Tesla could see a shift toward a more conservative compensation framework that emphasizes profitability and cash flow. This move could potentially satisfy institutional investors and align the company’s executive incentives with shareholder value. Conversely, if the vote fails, the existing compensation structure will remain, perpetuating the debate around executive pay at one of the world’s most valuable and closely watched companies.

For investors, the stakes are high: a change in compensation structure could influence Tesla’s stock performance, investor sentiment, and even regulatory oversight. As the vote approaches, both the market and the broader corporate governance community will be watching closely to see whether Tesla’s leadership decides to adapt its approach or maintain the status quo.

Read the Full Barron's Article at:

[ https://www.barrons.com/livecoverage/tesla-stock-price-musk-pay-package-vote-today/card/tesla-the-stock-of-the-masses-sdzavACvSqTqlHEzY5ih ]