Marvell Technology stock is jumping. An M&A report is the trigger.

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

The catalyst: a speculative M&A report

The report—published in the firm’s weekly “Deal Insights” bulletin—identified “a large semiconductor and cloud infrastructure company” as the prospective acquirer. While the report withheld the company’s identity for confidentiality reasons, it suggested that the buyer could offer a premium of 25 % to 30 % above Marvell’s last closing price, a level that would translate into a valuation increase of roughly $8 per share. Analysts note that the report was based on preliminary contact with executives from the interested party, and no formal offer had been made.

The news arrived at a time when the semiconductor sector is in the throes of a wave of consolidation. In recent months, industry giants such as Intel, Broadcom, and Qualcomm have either acquired or announced deals with smaller chipmakers to broaden their product portfolios and expand into emerging markets like AI and edge computing. The Mergermarket report added another layer of speculation to this environment, placing Marvell in the same conversation as its peers.

Marvell’s response and market sentiment

Marvell’s executive team was quick to address the speculation. In a brief statement, CEO Chris White emphasized the company’s “commitment to organic growth” and reiterated that the firm is not actively pursuing a sale. “Our focus remains on delivering high‑performance networking and storage solutions to our customers and on strengthening our position in data‑center, automotive, and wireless markets,” White said. The statement also highlighted recent milestones, including the launch of its next‑generation 5G modem platform and a partnership with Google Cloud to accelerate data‑center networking.

Despite the company’s reassurances, the market reacted strongly. The stock’s intraday gains were largely driven by retail and institutional traders who interpreted the M&A rumor as a signal that Marvell’s valuation could be significantly higher than its current market price. Trading volume surged, with more than 12 million shares changing hands by midday, compared to an average of 5 million on a typical day.

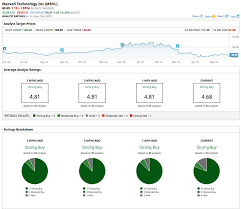

Analysts from RBC Capital Markets and Barclays Capital weighed in on the situation. RBC’s Mike Bowers estimated that if an acquisition were to materialize at the implied premium, Marvell’s price would rise to around $35‑$38 per share. “It’s not uncommon for a rumor of this magnitude to create a temporary buying rally,” Bowers noted. Barclays’ analyst, Laura Chen, was more cautious, stating that while the M&A interest could elevate investor sentiment, “the deal’s feasibility will ultimately hinge on regulatory scrutiny and the buyer’s strategic fit.”

Context: Marvell’s recent performance and strategic moves

Marvell has been posting robust growth, with a 22 % year‑over‑year increase in revenue during its most recent quarter. The company has been aggressively expanding its product portfolio, particularly in high‑performance networking, data‑center storage, and automotive electronics. In late February, Marvell announced a strategic partnership with NVIDIA to integrate its networking chips with NVIDIA’s AI platform—a move that has already begun to pay dividends in terms of customer adoption.

The company’s latest earnings call revealed a strong outlook for 2024, with guidance indicating continued revenue growth driven by data‑center demand and automotive connectivity. “We see continued momentum in both our high‑performance networking and automotive segments,” said CFO Mark McKinnon. “Our strategic investments in R&D are positioning us to capture additional market share.”

Broader industry trends

Marvell’s potential acquisition fits into a broader pattern of consolidation in the semiconductor industry. A quick look at other M&A activity over the past year shows several high‑profile deals:

- Broadcom’s $23 billion acquisition of CA Technologies (October 2023)

- NVIDIA’s $40 billion purchase of ARM Holdings (pending regulatory approval, 2023)

- Intel’s $15 billion acquisition of Habana Labs (AI chip developer, 2022)

These deals illustrate the drive among leading tech companies to secure complementary technologies and scale their market reach. For smaller players like Marvell, a strategic sale could provide a significant return to shareholders and allow the company to capitalize on its technological strengths in a rapidly evolving market.

What this means for investors

For investors, the Marvell story underscores the importance of staying attuned to early signals of M&A interest. Even a speculative report can trigger a sharp market reaction, creating both opportunities and risks. The key variables in Marvell’s case include:

- Confirmation of an official offer – until a formal bid is announced, the rally remains speculative.

- Regulatory approval – any large acquisition in the semiconductor space faces scrutiny from competition authorities in the U.S., EU, and China.

- Strategic fit – the acquirer’s product roadmap and business model must align with Marvell’s capabilities.

- Shareholder approval – the deal would need to be vetted by Marvell’s board and a majority of its shareholders.

Conclusion

Marvell Technology’s recent stock jump, sparked by a speculative M&A report, highlights how quickly market sentiment can shift in the semiconductor sector. While the company has no official plans for a sale, the rumor has generated significant investor interest and added to the growing list of consolidation stories in the industry. Whether the buzz translates into a definitive acquisition remains to be seen, but the episode has provided a timely reminder of how intertwined valuations, strategic partnerships, and market perception are in the world of high‑technology investing.

Read the Full MarketWatch Article at:

[ https://www.marketwatch.com/story/marvell-technology-stock-is-jumping-an-m-a-report-is-the-trigger-b4fafec4 ]