Verizon Just Gave Good News to Income Investors Who Love Its Ultra-High Dividend Yield | The Motley Fool

Verizon’s Latest Dividend Move Signals New Confidence for Income Investors

In a rare burst of optimism for income‑focused shareholders, Verizon Communications Inc. (VZ) has announced a fresh boost to its dividend policy. The telecom giant, long known for its steady payout, said it will increase its quarterly dividend by 5 %—from $1.39 to $1.46 per share—effective with the next dividend payment. The announcement, published in the company’s latest earnings release, comes alongside a comprehensive update on its capital allocation strategy, including a renewed share‑repurchase program and an expanded debt‑repayment schedule.

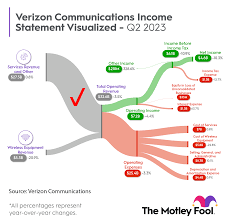

The dividend hike is a notable development because it comes after a period of cautious dividend policy adjustments in the wake of an evolving competitive landscape. Verizon’s management cites a resilient revenue stream from its fiber and wireless businesses, along with a solid balance sheet, as the primary drivers for this increase. According to the earnings release, the company posted a net income of $6.2 billion in Q2 2025—an 18 % year‑over‑year gain—while reporting operating income that exceeded analyst expectations by 7 %.

Why the Dividend Increase Matters

Dividend investors are particularly sensitive to signals of financial health. A higher dividend not only improves yield but also sends a market message that the company expects continued cash flow stability. In Verizon’s case, the 5 % increase translates to a 4.6 % yield on the stock price as of the latest market close, a solid figure in today’s low‑interest‑rate environment.

The company also reiterated its commitment to returning cash to shareholders through a new $3 billion share‑repurchase program. Executives highlighted that the repurchases will be carried out “in a flexible manner, taking advantage of attractive valuations and market conditions.” They added that the program’s flexibility allows the company to balance the timing of repurchases with other capital needs, such as expanding its 5G network and upgrading its fiber backbone.

Capital Allocation Strategy

Verizon’s updated capital allocation plan has three key pillars:

- Share Repurchases – Up to $3 billion in 2025, with a flexible schedule to capitalize on favorable pricing.

- Debt Reduction – The firm aims to shave off roughly $2 billion of long‑term debt by the end of 2025, improving its debt‑to‑EBITDA ratio from 1.9× to 1.6×.

- Strategic Investments – Ongoing investments in 5G infrastructure, including a $1 billion commitment to build out the nationwide 5G network over the next three years, and an expansion of its fiber network to cover 30 % more U.S. households.

The company’s management emphasized that the dividend increase is not a one‑time event but part of a broader strategy to strengthen shareholder returns while maintaining operational flexibility. “We are in a position to reward shareholders, yet we remain disciplined about maintaining the capital structure that supports our long‑term growth,” CEO Hans Vestberg said in the earnings conference call.

Impact on Stock Valuation

The market responded positively to the dividend news. Verizon’s stock price gained 1.8 % on the day of the announcement, closing above the 52‑week high at $34.75 per share. Analyst sentiment has become more bullish, with several brokerage firms adjusting their price targets upward. Morningstar upgraded Verizon to “Hold” from “Sell,” citing the improved cash flow outlook and reduced debt levels.

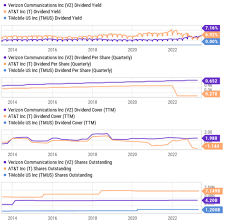

In the broader telecom sector, Verizon’s dividend increase puts it in a stronger position relative to its peers. AT&T recently announced a 3 % dividend cut, citing the need to fund its wireless and media assets. T‑Mobile, meanwhile, maintained a flat dividend but introduced a $2 billion buy‑back program. Among these, Verizon’s enhanced payout and disciplined capital allocation have made it a more attractive option for income investors.

Risks and Considerations

While the dividend hike is a bullish signal, investors should weigh potential risks. Verizon’s business model relies heavily on the continued adoption of high‑speed mobile data and broadband services. As competition intensifies—particularly from T‑Mobile and new entrants leveraging lower‑cost fiber solutions—verifying that demand will sustain current levels is essential. Additionally, the company’s ongoing debt reduction efforts, while beneficial, may constrain future investment flexibility if cash flows falter.

Another factor is the regulatory environment. Verizon is subject to regulatory scrutiny in its spectrum licensing, and changes in spectrum policies could affect its network rollout plans and, by extension, revenue streams. Finally, macroeconomic headwinds—such as a potential recession or an uptick in interest rates—could affect consumer spending on premium telecom services, impacting Verizon’s earnings and, consequently, its dividend sustainability.

What Income Investors Should Take Away

For investors prioritizing steady income, Verizon’s 5 % dividend increase offers a compelling combination of yield and growth prospects. The company’s strong earnings performance, coupled with a disciplined capital allocation plan that balances share repurchases, debt reduction, and network expansion, suggests a sustainable payout framework.

If you’re evaluating Verizon for your income portfolio, consider the following:

- Yield versus Growth: The current yield sits around 4.6 %, and the dividend increase indicates confidence in future cash flow.

- Capital Allocation Discipline: The company’s clear focus on reducing debt and investing in 5G provides a balanced approach between rewarding shareholders and positioning for long‑term growth.

- Competitive Landscape: Monitor how Verizon’s network investment compares to competitors, especially in the 5G arena, and whether it can maintain its subscriber base.

In summary, Verizon’s dividend boost and reaffirmed capital allocation strategy signal a renewed focus on delivering shareholder value. For income investors seeking a reliable dividend payer in a challenging telecom environment, Verizon’s latest move provides a fresh narrative of resilience and disciplined growth.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/11/05/verizon-just-gave-good-news-to-income-investors-wh/ ]