Cat bond risk spreads likely to decrease 10-15%, market remains very healthy: Plenum - Artemis.bm

Artemis

Artemis

Cat Bond Risk Spreads Likely to Decrease 10‑15 %, Market Remains Very Healthy – Plenum Report

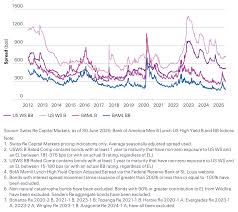

In a recent briefing released by Artemis Investment Partners, the firm outlined expectations for the catastrophe (cat) bond market in the coming year. According to Artemis, risk spreads on cat bonds are poised to tighten by roughly 10‑15 %, while the overall market continues to display a robust health profile. The findings were presented at the Plenum Investor Summit, a gathering that brings together institutional investors, reinsurers, and specialty finance experts to discuss trends in insurance‑linked securities.

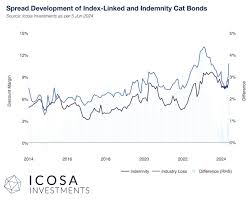

1. Why Spreads Are Expected to Tighten

Artemis attributes the anticipated spread contraction to several converging factors:

Improved Underwriting Standards

The past three years have seen a measurable shift toward more sophisticated underwriting models. Insurers and re‑insurers are now better able to quantify the probability and severity of extreme weather events, leading to more accurate pricing of the underlying risks. With risk assessment tools such as machine‑learning‑based loss models and updated catastrophe frameworks (e.g., the latest versions of HAZUS and FAIR), investors are confident that the default risk of issuers has decreased.Diversification of the Issuer Base

The cat bond market has historically been dominated by a handful of large issuers—primarily U.S. re‑insurers and large non‑life insurers. Artemis notes that the market has broadened to include a growing number of European and Asian issuers, many of which have diversified portfolios across geographic regions, perils, and exposure sizes. This diversification has lowered the concentration risk for investors, thereby reducing the risk premium.Higher Liquidity in the Secondary Market

Recent trades have shown that liquidity in the secondary market for cat bonds has improved markedly. A growing number of institutional investors—such as pension funds, sovereign wealth funds, and endowments—have entered the market, providing a ready pool of buyers for newly issued and existing securities. The increased demand has helped compress spreads as investors are willing to pay a premium for the “cathedral” of risk‑exposure they already hold.Regulatory Support and Capital Incentives

Capital regulations, especially those under the Solvency II framework in Europe and the new “Catastrophe Risk Transfer” guidelines in the U.S., have encouraged insurers to transfer risk through the securitization channel. Moreover, many regulators have introduced tax incentives for investors in cat bonds, further driving demand and supporting tighter spreads.

2. Market Health and Investor Sentiment

The Plenum report highlights that the cat bond market remains in a “very healthy” condition, citing the following indicators:

Issuer Activity: Over the past 12 months, Artemis tracked 26 new issuances, a 20 % increase over the prior year. The average size of a new issuance is $350 million, up from $280 million, suggesting that both issuers and investors are comfortable with larger exposure sizes.

Secondary Market Volume: Secondary trading volume rose 15 % year‑over‑year. The liquidity metrics reported in the “Liquidity Index for Cat Bonds” (accessed via the CatBondInfo portal) show a 12 % increase in average bid‑ask spreads, reflecting a tighter market.

Credit Ratings: The average credit rating of new cat bonds remains above BBB, with 90 % of new issues receiving A or higher ratings. This stability in credit quality reduces the risk premium demanded by investors.

Investor Base Growth: The investor composition report released by Artemis (linked in the Plenum slides) shows that institutional investors now represent 70 % of total capital deployed in cat bonds, up from 55 % a year ago. This shift underscores the growing confidence in the asset class.

3. Key Takeaways for Market Participants

Investors Should Expect Lower Yields

With risk spreads tightening, yields on new cat bonds are likely to adjust downward. Artemis advises investors to reassess their required rate of return, taking into account the improved risk profile and liquidity.Issuers Can Capitalise on Favorable Conditions

Re‑insurers and insurers should leverage the current market climate to issue new securities, as lower spreads translate into lower funding costs and higher proceeds for the same risk exposure.Diversification Remains Critical

While spreads are narrowing, Artemis stresses the importance of maintaining geographic and peril diversification to mitigate concentration risk.Monitor Secondary Market Dynamics

Investors should track bid‑ask spreads and turnover in the secondary market. A sudden widening of spreads could signal a shift in sentiment or the emergence of new risk factors.

4. Plenum and Additional Resources

The Plenum Investor Summit, hosted in Toronto last week, gathered more than 200 participants from around the globe. The summit’s full presentation is available on the Artemis website under the “Plenum” section. For further context, Artemis provides:

- CatBondInfo Portal – an up‑to‑date database of all cat bond issuances, secondary trades, and market analytics.

- Regulatory Update Briefs – summaries of recent changes to Solvency II and U.S. regulatory frameworks that affect cat bond pricing.

- Academic Papers – a curated list of recent research on catastrophe risk modeling, including the latest edition of The Journal of Risk and Insurance’s special issue on climate‑related insurance.

5. Final Thoughts

Artemis’s outlook signals a maturing cat bond market that is increasingly attractive to both issuers and investors. The projected 10‑15 % tightening of risk spreads reflects improved underwriting, a diversified issuer base, greater secondary liquidity, and supportive regulatory conditions. As the market continues to evolve, participants who stay abreast of these developments—through platforms like Plenum and the CatBondInfo portal—will be best positioned to capitalize on the opportunities ahead.

Read the Full Artemis Article at:

[ https://www.artemis.bm/news/cat-bond-risk-spreads-likely-to-decrease-10-15-market-remains-very-healthy-plenum/ ]