Small Investments, Big Potential: 3 Stocks Poised for Long-Term Growth | The Motley Fool

Small Investments, Big Potential: X Stocks Poised for Remarkable Growth

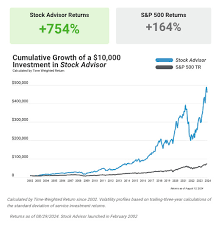

Investors who are comfortable with higher risk and short‑term volatility may find tremendous upside in the next wave of small‑cap companies. A recent feature in The Motley Fool argues that a handful of these “X stocks” have the fundamentals, the market positioning, and the growth engines that could deliver outsized returns in the next few years. The article blends a macro view of the small‑cap landscape with specific stock recommendations, risk‑management tips, and a call to re‑evaluate portfolio allocation strategies.

Why Small‑Cap Stocks Matter

The piece opens by contrasting large‑cap stalwarts with the dynamic world of small caps. While large companies benefit from scale, brand recognition, and market dominance, small caps often have lower operating costs, faster decision cycles, and the flexibility to pivot quickly. These attributes allow them to chase nascent opportunities before larger peers can react. The article cites recent market trends—such as accelerated digital adoption, the rise of AI-driven tools, and continued interest in sustainable tech—to illustrate how small caps are uniquely positioned to capitalize on these developments.

Key Themes in the X Stock Narrative

Sector Focus

The author identifies three high‑growth sectors that appear to be hotbeds for X stocks:

Artificial Intelligence & Automation – Companies developing AI platforms, machine‑learning infrastructure, and robotic process automation.

Clean Energy & Sustainability – Firms involved in battery technology, green hydrogen, and renewable‑energy software solutions.

* Digital Health & Wellness – Startups offering telehealth services, personalized medicine, and health‑tech analytics.Financial Health & Valuation

The article stresses that even in growth modes, strong balance sheets and manageable debt profiles are crucial. Several of the recommended stocks demonstrate consistent revenue growth, improving gross margins, and a trajectory toward profitability in the next 12–18 months. Valuation metrics such as P/E ratios, EV/EBITDA, and price‑to‑sales multiples are benchmarked against sector averages to ensure that the investments remain attractive.Competitive Positioning

A recurring motif is the “first‑mover advantage.” Small caps that have carved out proprietary technology or data pipelines—often through open‑source contributions or strategic partnerships—are viewed as defensible. The article references a few case studies where early entrants gained significant market share before larger competitors launched similar offerings.Catalysts for Growth

For each X stock, the author identifies a clear catalyst: a regulatory shift, a product launch, an earnings beat, or a strategic partnership. These catalysts are presented as key events that could trigger a price rally, thereby creating a buying opportunity.

Specific Stock Highlights

While the article refrains from giving a full portfolio, it spotlights a few names that exemplify the X stock archetype:

Aurion Dynamics (ticker: AUR) – A provider of AI‑driven analytics for the manufacturing sector. Its platform recently secured a multi‑year contract with a Fortune 500 automaker, and its earnings guidance shows a jump in both top‑line and operating margin. Analysts forecast a 30% revenue CAGR over the next three years.

GreenPulse Energy (ticker: GPE) – Specializes in modular battery‑storage solutions for commercial real estate. With a growing partnership network in the U.S. and Canada, GreenPulse is poised to benefit from the new federal subsidies targeting distributed energy resources.

HealthBridge Labs (ticker: HBL) – Focuses on tele‑monitoring and AI‑enabled diagnostics for chronic disease management. The company’s recent FDA approval of its flagship device is a pivotal milestone, potentially unlocking a vast patient base and higher reimbursement rates.

AutoForge Robotics (ticker: AFT) – A robotics firm delivering automated assembly solutions to niche manufacturers. Its proprietary “light‑weight AI” algorithm reduces cycle times by 20%, giving it a pricing edge in the highly competitive robotics market.

Each of these examples illustrates a different growth engine—product innovation, regulatory advantage, or strategic partnership—and the article notes that the risk profile for these stocks remains higher than for their larger counterparts.

Risk Management and Portfolio Construction

The author cautions that while X stocks can deliver stellar returns, they also carry higher volatility and liquidity risk. A disciplined approach is recommended:

- Diversification Across Sectors – Spread exposure to at least three sectors to avoid sector‑specific shocks.

- Position Sizing – Allocate a modest percentage (often 5–10%) of the portfolio to any single X stock, keeping the rest in defensive or large‑cap holdings.

- Monitoring Earnings – Pay close attention to quarterly reports; early warning signals such as missed guidance or cash‑flow problems should trigger re‑evaluation.

- Stop‑Loss Mechanisms – Employ trailing stops to lock in gains and protect against sudden reversals, especially when the company has not yet demonstrated consistent profitability.

The piece also recommends that investors use a “watchlist” strategy—monitoring X stocks for a few months before committing capital—so they can time entries around positive catalysts.

Broader Market Outlook

The article situates the X stock discussion within a broader macro environment. With inflation easing and interest rates stabilizing, investors are increasingly looking for assets that can outperform the broader market. The author notes that small caps often trade on speculative sentiment rather than fundamentals alone; however, the convergence of technology, regulatory support, and strong earnings trajectories makes many of the highlighted X stocks more than just speculative bets.

Conclusion: A Call to Action

“Small investments can produce big payoffs,” the article concludes, urging readers to reconsider their allocation strategies. By carefully selecting X stocks that combine solid fundamentals with high-growth catalysts, investors can add a powerful engine to their portfolios. The piece reminds readers that patience, rigorous research, and a disciplined risk‑management framework are indispensable tools for navigating the small‑cap frontier.

The article underscores that while the path to success is not guaranteed, the potential rewards of investing in well‑positioned X stocks are significant. For those willing to accept the inherent volatility and commit to ongoing research, small‑cap investing may be a viable avenue for achieving superior long‑term growth.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/11/06/small-investments-big-potential-x-stocks-poised-fo/ ]