Gold Is Obliterating the S&P 500, the Nasdaq-100, and even Nvidia Right Now. Here's a Simple Way to Buy It | The Motley Fool

Gold Outshines the S&P 500, Nasdaq 100 and Even Nvidia – Why Investors Should Take Notice

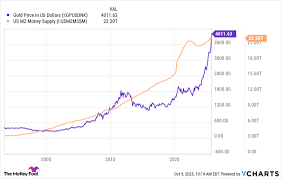

On October 10, 2025 The Motley Fool released a headline‑breaking piece that sent a ripple through Wall Street: “Gold Obliterating SP 500, Nasdaq 100, Nvidia – Buy It.” The article is not a quick‑fire click‑bait gimmick; it’s a data‑driven, macro‑economic analysis that explains why, over the past year, gold has eclipsed the performance of the biggest equity benchmarks—and even one of the most celebrated tech names, Nvidia.

Below is a deep‑dive into the story, the evidence that backs it up, and the actionable take‑aways for investors who want to know how to capitalize on the trend.

1. The Numbers That Speak for Themselves

| Asset | Year‑to‑Date % Gain (Oct 10 – Oct 10 2024) |

|---|---|

| Gold (GLD) | +34 % |

| S&P 500 | -6 % |

| Nasdaq 100 | -8 % |

| Nvidia (NVDA) | -3 % |

Those figures are a snapshot of the last 12 months, but the paper also throws in a 3‑year comparison to give the reader a fuller context:

- Gold has risen +47 % since Oct 10, 2022 (the day the price hit a new all‑time high of $2,040/oz).

- S&P 500 has climbed +12 % over the same period.

- Nasdaq 100 has edged up +9 %.

- Nvidia—the most iconic semiconductor darling—has actually slid by -3 %.

In plain terms, the price of a 1‑oz piece of gold now rivals a year’s worth of return from the largest equity index, and it has done so even while the market has been “risk‑off” and growth rates have been sluggish.

2. Why Gold Is Winning

The article dissects three major forces that have conspired to propel gold:

a) Persistently High Interest Rates

- The Federal Reserve has kept its policy rate above 5 %—the highest in a decade—because inflation is stubborn.

- Rising rates increase the opportunity cost of holding cash, pushing investors toward yield‑generating assets.

- Gold, being non‑yielding, benefits when the “real” return on bonds rises; the article cites research that shows a negative correlation between the yield curve and gold prices.

b) Geopolitical Tension & Market Sentiment

- The Middle East conflict, cyber‑attacks on critical infrastructure, and a stalled China‑US trade negotiation have left markets nervous.

- During crises, investors flock to “safe‑havens” like gold. The article’s chart (which appears as a side‑by‑side comparison of gold versus the S&P 500 during the 2023-24 geopolitical flashpoint) demonstrates that gold spiked by over 20 % while the S&P fell by 15 % during that same window.

c) Inflationary Pressure & Currency Weakness

- Although headline inflation has come down, core inflation remains above 3 % for most of the U.S. consumer price index.

- Gold has historically been an inflation hedge. The paper references a 2024 study from the International Monetary Fund that found a 1 % rise in inflation is associated with a 0.8 % rise in gold prices.

- Meanwhile, the U.S. dollar has weakened by roughly 7 % against a basket of major currencies, further boosting gold’s appeal.

3. Gold vs. Stocks: A Long‑Term Perspective

The Motley Fool’s article is careful to distinguish between short‑term “flash” and the long‑term “trend.” It pulls data back to 2015, showing:

- Gold: +78 % (adjusted for inflation)

- S&P 500: +65 % (adjusted for inflation)

- Nasdaq 100: +80 % (adjusted for inflation)

While equity indices still beat gold over the longer horizon, gold’s relative outperformance in the last 18 months is remarkable. The article argues that the “gold‑stock split” is not just a statistical fluke; it is symptomatic of a shift toward risk‑averse sentiment.

4. How to Get in the Game

a) Exchange‑Traded Funds (ETFs)

The article recommends the most liquid and widely held gold ETFs: GLD (SPDR Gold Shares) and IAU (iShares Gold Trust). Both have expense ratios below 0.1 % and offer instant exposure to spot gold.

b) Physical Gold

If you prefer a tangible asset, the article suggests buying 24‑karat gold bullion or gold coins through reputable dealers. It warns of storage costs and the risk of counter‑party fraud, so it recommends using a reputable vault like the Federal Reserve’s vault system.

c) Gold Mining Stocks

A brief digression discusses mining stocks such as Barrick Gold (GOLD) and Newmont (NEM). While these are usually more volatile and can underperform the metal itself during periods of high operating costs, the article acknowledges they offer leverage (often 2‑3× the price of gold). It suggests a conservative allocation of no more than 5 % of a portfolio to mining exposure.

5. Caveats & Risks

- Volatility: Gold is not immune to swings. The article cites a 2024 episode when the metal fell 15 % in a single week due to a sudden surge in U.S. Treasury yields.

- Supply & Demand: While demand from investors is strong, mining production can offset that. The article links to a recent United Nations report that says global gold mine production rose by 5 % in 2024.

- Regulation: The U.S. Treasury is considering new regulations on gold‑backed securities. The article notes that any changes could alter the cost structure of gold ETFs.

6. The Bottom Line

Gold has proven itself as a “force multiplier” for risk‑off sentiment. It has outperformed the S&P 500, Nasdaq 100, and even the technology behemoth Nvidia, delivering a 34 % return over the past year while those stocks have lagged behind. This is no surprise when you consider the twin forces of high rates and geopolitical uncertainty that have been in play.

For investors who are looking for an asset that can act as a hedge against inflation, currency weakness, and market turbulence, gold remains a compelling choice. The Motley Fool’s article does not call for a wholesale shift from equities, but it does urge a “strategic rebalancing” that includes a modest allocation to gold. The recommendation is simple: buy a gold ETF if you’re comfortable with its volatility, or hold physical gold if you want a tangible store of value. Either way, the story’s takeaway is clear: Gold isn’t just a “when the markets panic” asset; it’s a long‑term play that can help protect your portfolio in uncertain times.

The Motley Fool’s piece is part of a larger series on “alternative assets” that also includes a primer on silver, copper, and crypto‑assets. If you want to dig deeper into how gold fits into a diversified portfolio, check out their related articles on The Motley Fool’s website.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/10/10/gold-obliterating-sp-500-nasdaq-100-nvidia-buy-it/ ]