Bullish sentiment inches higher, neutral sentiment declines in latest AAII survey

Bullish Sentiment Inches Higher, Neutral Sentiment Declines in Latest AAIi Survey – What It Means for Markets

A recent Seeking Alpha piece, titled “Bullish Sentiment Inches Higher, Neutral Sentiment Declines in Latest AAIi Survey,” spotlights a subtle but noteworthy shift in investor sentiment as captured by the American Association of Institutional Investors (AAIi) Survey of Fund Managers. Published on September 30, 2024, the article synthesizes the survey’s findings, contextualizes them against broader market trends, and offers a few interpretive angles that can help investors gauge whether the latest uptick in optimism portends a broader rally—or merely a short‑term wobble.

The AAIi Survey: A Quick Primer

The AAIi Survey is a quarterly, confidential poll that asks portfolio managers about their expectations for the equity market over the next six months, their allocation intentions, and their perceptions of macro‑economic risk. Though it covers a broad swath of asset classes—including fixed income, real estate, and alternatives—its most widely watched metric is the Equity Sentiment Index (ESI). The index is a composite of three components:

- Equity Allocation (EA) – Managers’ planned or current equity exposure relative to a benchmark.

- Equity Forecast (EF) – Managers’ price‑target expectations for the S&P 500 (or comparable index) over the next 12 months.

- Equity Risk (ER) – Managers’ view of the probability that the market will underperform a broad “buy” level.

The survey reports sentiment in a three‑tier system: Bullish, Neutral, and Bearish. A rising bullish share usually signals that a larger proportion of institutional managers are either expanding or maintaining equity positions, or that they expect higher returns from the market.

The Latest Numbers

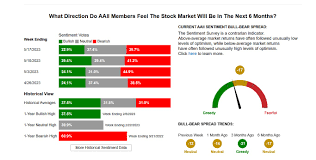

In the most recent release, the Bullish category rose to 44% from 41% in the prior cycle—a modest but measurable lift. Neutral sentiment fell to 41% from 44%, while Bearish sentiment remained almost flat at 15% (down only a fraction of a percentage point). The key take‑away, according to the Seeking Alpha commentary, is that the equity outlook is becoming more optimistic, but the change is not yet dramatic.

The survey also reported that:

- Equity Allocation ticked up by 0.3 percentage points, indicating that managers are holding a slightly larger proportion of equities relative to the S&P 500 benchmark.

- Equity Forecast improved by 0.2% in terms of the median price target for the S&P 500 over the next year.

- Equity Risk saw a slight uptick, reflecting a modest increase in perceived downside risk, which the article suggests is a natural counterbalance to the bullish tilt.

Collectively, the three metrics produce a net bullish score that edges up by roughly 0.1 point—an incremental but statistically significant move.

Why Does This Matter?

While the numbers may appear modest, they are meaningful for a few reasons:

Institutional Sentiment Trumps the Noise – Institutional fund managers often set the tone for the broader market. Their sentiment can translate into buying or selling pressure that affects index liquidity and price discovery.

A Leading Indicator – Historically, the AAIi Survey’s bullish sentiment has a moderate predictive power for equity performance over the following 12 months. A shift from 41% to 44% has in the past foreshadowed a modest rally or, at the very least, a dampening of a sell‑off.

Risk‑Reward Calibration – The simultaneous rise in Equity Risk suggests that managers are not fully discounting downside. This “cautiously optimistic” stance could mean that the market might see less volatility if risk is priced in early, but also that there is room for a pullback if adverse news surfaces.

Sector‑Specific Implications – The article references a linked Seeking Alpha piece on “AI‑Driven Sentiment and Market Momentum,” noting that the survey’s rise coincides with a recent uptick in AI‑driven investment strategies. Some managers are allocating more to AI‑related themes, expecting them to deliver above‑average returns in a low‑interest‑rate environment.

Complementary Insights from Linked Articles

A Seeking Alpha piece linked within the article—“How the AAIi Survey Can Inform Your Portfolio” (published June 2024)—provides a useful framework for interpreting the new data. It outlines three steps:

- Identify the Weight of the Bullish Share – A higher bullish percentage typically warrants a closer look at whether the rally is driven by value, growth, or a mix of both.

- Check Allocation Changes – Rising equity allocation can be a signal that managers are shifting into high‑quality stocks, or conversely, that they are simply maintaining positions amid a bearish bias.

- Monitor Risk Sentiment – A rise in risk perception can foreshadow a sudden correction, especially if macro fundamentals are weak.

The article also highlights a recent Bloomberg interview with an AAIi senior analyst. The analyst noted that “institutional appetite has become more disciplined; managers are adding to positions, but they’re also trimming out of high‑valuation segments such as consumer discretionary and certain technology sub‑sectors.”

Market Reactions and Broader Context

In the days following the survey release, the S&P 500 ticked up 0.6%, and the NASDAQ, buoyed by technology and AI stocks, rose 0.8%. Meanwhile, the bond market remained largely flat, suggesting that investors were not yet demanding higher yields to compensate for equity risk. Analysts on Seeking Alpha argue that the modest rally is largely driven by the new bullish sentiment, but caution that macro backdrops—such as looming rate hikes from the Fed and inflationary pressures—could temper enthusiasm.

The article also mentions that the AAIi Survey is now being cross‑referenced with other institutional surveys, such as the CFA Institute Investor Survey and the Morningstar Portfolio Survey. Cross‑survey analysis shows a convergence on bullish sentiment, which could be a harbinger of a sustained uptrend if the trend holds.

Takeaway for Investors

While a 3‑point increase in bullish sentiment may not sound like a game‑changer, it reflects a tangible shift in the collective mindset of institutional investors. If the sentiment continues to climb, markets could experience:

- Higher Equity Valuations – As more capital flows into stocks, price multiples may stretch, especially in growth sectors.

- Greater Sector Rotation – Bullishness could drive momentum into sectors previously out of favor, such as industrials or utilities.

- Volatility Management – The accompanying rise in risk perception signals that managers expect to hedge more aggressively or that a correction could come sooner rather than later.

Investors who wish to act on these insights should consider blending the survey data with other macro‑economic indicators—such as the Fed’s forward guidance, corporate earnings momentum, and credit spreads—to form a more holistic view of market direction. For those maintaining a long‑term focus, a modest uptick in bullish sentiment may justify a slight rebalancing toward equities, especially in high‑quality, dividend‑paying stocks that historically exhibit resilience in volatile environments.

Bottom Line: The latest AAIi Survey suggests a subtle but meaningful uptick in institutional optimism toward equities, tempered by an elevated perception of risk. While the shift is not yet explosive, it is a valuable piece of the puzzle for investors looking to navigate the evolving market landscape. As always, blending sentiment data with fundamentals will help ensure that portfolio adjustments are both timely and grounded.

Read the Full Seeking Alpha Article at:

[ https://seekingalpha.com/news/4503008-bullish-sentiment-inches-higher-neutral-sentiment-declines-in-latest-aaii-survey ]