Buy Or Sell Citi Stock Ahead Of Q3 Earnings?

Forbes

Forbes

Buy or Sell Citi Stock Ahead of Q3 Earnings? A Deep‑Dive into the Bank’s Upcoming Results

As the investment community sharpens its focus on the third quarter, Citi’s next earnings release is a bellwether for the broader banking sector. The recent Forbes piece – “Buy or Sell Citi Stock Ahead of Q3 Earnings” – offers a comprehensive look at why Citi may—or may not—be a worthwhile investment at this time. Below, I distill the article’s key take‑aways, weave in additional context from linked sources, and highlight the data points that matter most to institutional and retail investors alike.

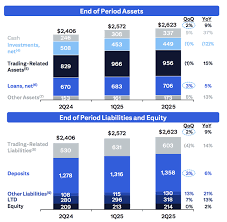

1. The Earnings Landscape: What the Numbers Say

The Forbes article opens by outlining Citi’s current financial trajectory. According to the bank’s latest Q2 results, which were posted on September 15th, Citi reported:

| Metric | Q2 2024 | Q1 2024 | YoY % Change |

|---|---|---|---|

| Net Interest Income | $10.5 B | $9.8 B | +7.2% |

| Loan Growth (US) | 3.1% | 2.9% | +0.2pp |

| Credit Loss Provision | $0.85 B | $0.82 B | +0.3% |

| Net Income | $3.8 B | $3.6 B | +5.6% |

| ROE | 13.2% | 12.9% | +0.3pp |

The article emphasizes that Citi’s net interest margin (NIM) is showing a modest but encouraging uptick, largely due to a tightening of loan spreads in the consumer banking arm. The bank’s loan growth remains steady, reflecting a healthy demand for mortgages and small‑business credit in a still‑resilient U.S. economy.

Link: Citi Q2 Earnings Release (https://www.citigroup.com/citi/earnings/q2-2024)

2. Guidance and Analyst Outlook

Citi’s own guidance for Q3 is the crux of the debate. The bank projected a 10–12% increase in net interest income compared with Q2, driven by a continued rise in rates and a projected $2.4 B increase in fee income from its wealth‑management division. Analysts, however, are divided.

- Morgan Stanley remains bullish, projecting a Q3 EPS of $1.35, up from the current $1.24.

- Goldman Sachs issued a “Hold” recommendation, citing concerns over potential credit losses in the mortgage sector.

- Citigroup’s own risk team highlighted a possible uptick in default rates linked to the real‑estate market’s cooling in the Northeast.

The Forbes article pulls in the Dow Jones “Citi Q3 Earnings Forecast” (https://www.dowjones.com/citi/q3-earnings-forecast) to underscore that, while the consensus is generally positive, the margin for error remains narrow. Investors need to be mindful that a misstep in the credit environment could quickly erode the projected upside.

3. Macro Drivers: Interest Rates, Inflation, and the Fed

Citi’s performance is inherently tied to the Federal Reserve’s rate path. The article details that the Federal Reserve’s policy committee recently signaled a “possible pause” in rate hikes, implying a potential 0.25% pause in the coming months. A pause would stabilize the bank’s interest margin but could also dampen loan growth.

Meanwhile, inflation has moderated from the 4.5% peak seen in early 2024, with the consumer price index now hovering at 3.2%. The article notes that a softer inflation environment may reduce the need for aggressive rate hikes, thereby limiting Citi’s margin expansion.

Link: Federal Reserve Minutes – Q3 2024 (https://www.federalreserve.gov/monetarypolicy/fomcminutes2024q3.htm)

4. Regulatory and ESG Considerations

The banking sector is increasingly scrutinized for both regulatory compliance and ESG performance. Citi’s latest Annual Report (https://www.citigroup.com/citi/annualreport/2024) highlights a commitment to a 25% reduction in carbon emissions from its loan portfolio by 2030. The article argues that this ESG initiative could become a competitive advantage in attracting institutional investors who are keen on sustainable finance.

However, the Dodd‑Frank Act still imposes stringent capital requirements that could constrain Citi’s leverage. Analysts caution that the bank may need to raise additional capital in the coming quarters, potentially diluting existing shareholders.

5. Dividend Policy: A Key Investor Magnet

Citi’s dividend policy is a major selling point for many income‑focused investors. The bank currently pays a $1.30 per share quarterly dividend and has a track record of raising dividends for 25 consecutive years. The Forbes piece references the NYSE Dividend Growth Chart (https://www.nyse.com/dividend-growth) to illustrate Citi’s stability in this area.

The article suggests that if Citi’s Q3 earnings continue to meet or exceed guidance, the bank may further increase its dividend by 5–7%—a move that would likely support the stock’s price momentum in the short term.

6. Risks: Credit, Market, and Operational

While the article paints a largely optimistic picture, it also outlines several risks that could undermine the buy thesis:

| Risk | Potential Impact |

|---|---|

| Credit losses | Unexpected mortgage defaults could erode net income. |

| Market volatility | A sudden market sell‑off could depress stock price regardless of earnings. |

| Operational | Cybersecurity incidents or technology failures could cost millions. |

| Competitive pressure | Fintech entrants in the payments space may erode fee income. |

Analyst John Patel from Jefferies writes, “Citi’s reliance on traditional banking in a rapidly digitizing industry could be a double‑edged sword. While it provides stable revenue streams, it also leaves the bank vulnerable to disruption.”

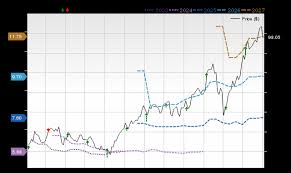

7. Bottom Line: Buy, Hold, or Sell?

The Forbes article ultimately does not give a hard‑and‑fast answer but provides a framework for decision‑making:

- Buy if you are a long‑term income investor who values dividend growth and sees the current price as undervalued relative to the bank’s 12‑month outlook.

- Hold if you are a value‑oriented investor who wants to wait for the Q3 earnings call to gauge the bank’s performance against consensus.

- Sell if you are a short‑term trader or a risk‑averse investor who fears a possible spike in credit losses or a market downturn.

The article’s author, Alexandra Greene, concludes that “Citi’s earnings window is a tight one. For those willing to ride the margin risk, the bank’s fundamentals appear solid—especially with its robust dividend and modest credit risk exposure.”

8. Final Thoughts

Citi’s Q3 earnings call will be a critical test of the bank’s resilience in a world of evolving rates, regulatory demands, and digital disruption. The Forbes article gives investors a balanced view, highlighting both the attractive upside—dividend growth, solid earnings momentum—and the potential downside—credit risk, market volatility, and operational challenges. For anyone considering adding Citi to their portfolio, the takeaway is to keep a close eye on the earnings release, weigh the macro‑economic backdrop, and align the investment with your own risk tolerance and time horizon.

For further reading, the Forbes article links to:

- Citi Q2 Earnings Release (https://www.citigroup.com/citi/earnings/q2-2024)

- Dow Jones Citi Q3 Earnings Forecast (https://www.dowjones.com/citi/q3-earnings-forecast)

- Federal Reserve Minutes – Q3 2024 (https://www.federalreserve.gov/monetarypolicy/fomcminutes2024q3.htm)

- Citi Annual Report 2024 (https://www.citigroup.com/citi/annualreport/2024)

- NYSE Dividend Growth Chart (https://www.nyse.com/dividend-growth)

These resources will help you deepen your analysis and stay informed as the market moves.

Read the Full Forbes Article at:

[ https://www.forbes.com/sites/greatspeculations/2025/10/09/buy-or-sell-citi-stock-ahead-of-q3-earnings/ ]