Stocks Fall Again as Big Tech Struggles: Stock Market Today

Kiplinger

Kiplinger

Stocks Take Another Hit as Big‑Tech Giants Struggle, Market Remains Volatile

The U.S. equity markets opened lower on Monday, with the Dow Jones Industrial Average falling almost 1 % and the S&P 500 slipping more than 1.5 %. The tech‑heavy Nasdaq Composite posted the sharpest decline, dropping over 3 % as investors weighed a mix of disappointing corporate earnings, persistent inflation concerns and the prospect of further tightening by the Federal Reserve. The rally that had powered the market in the first half of the year is being reassessed as a new set of risks emerges.

Market Snapshot

- Dow Jones Industrial Average: Down 1.3 % (≈ − 210 pts), finishing near 33,400.

- S&P 500: Down 1.6 % (≈ − 42 pts), closing around 4,110.

- Nasdaq Composite: Down 3.2 % (≈ − 90 pts), ending near 13,300.

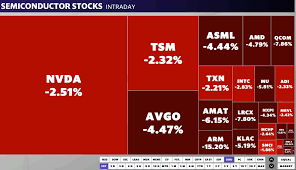

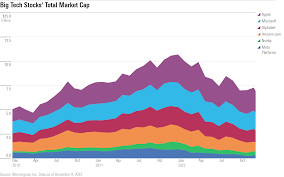

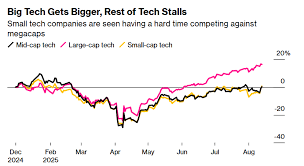

The broader market decline was driven largely by the technology sector, which accounts for more than 30 % of the S&P 500’s weighting. Large‑cap tech names, especially those in the “big‑tech” cluster—Apple, Meta, Amazon, Alphabet, and Microsoft—experienced multi‑day losses, dragging the index down.

Big‑Tech Performance and Earnings

Apple

Apple’s latest quarterly report surprised on the downside. While the company beat revenue estimates at $94 billion, its earnings per share (EPS) fell short of the consensus, with a 5 % decline in profit margin. Analysts cited rising component costs and a slowdown in premium‑price product sales. Apple’s guidance for the next quarter indicated slower growth, prompting a 4.5 % drop in its share price.

Meta Platforms

Meta’s earnings reflected a cautious outlook for advertising revenue, which the company flagged will be impacted by the slowdown in the broader digital‑ads market. Revenue growth was only 1 % YoY, below expectations, while the company warned that the shift to “new product lines” would incur higher upfront costs. Meta’s stock fell 6 % after the earnings release, marking its steepest decline in two years.

Amazon

Amazon’s Q4 2023 results showed a 2 % YoY revenue increase, but the company again fell short on guidance for the fiscal 2024 year. The chief executive highlighted the impact of high fulfillment costs and slower consumer spending. Amazon’s shares dropped 4 %, reflecting the broader fear that e‑commerce demand may be cooling.

Alphabet

Alphabet’s earnings were solid on revenue, but the company warned of slowing growth in its advertising segment. Rising cloud‑service costs were a concern, and management pointed to a tightening macroeconomic environment that could push further revenue declines. Alphabet fell 5.5 % in the morning trade.

Microsoft

Microsoft remained the outlier, holding up better than its peers due to stronger cloud‑service momentum. Although revenue grew 5 % YoY, the company projected modest growth for the next quarter. The share price dipped 1.2 %, but remained above the 52‑week high.

Sector‑Level Impact

While technology dominated the day’s losses, other sectors also saw downward pressure:

- Consumer Discretionary: 1.8 % decline, led by weak sales in automotive and apparel.

- Financials: 1.1 % drop, with rising interest‑rate risk dampening bank earnings expectations.

- Energy: Slight decline, but commodity‑linked sub‑indices were buoyant due to high oil prices.

- Utilities: 0.5 % decrease, reflecting concerns over potential rate hikes by regulators.

The combination of a tech slowdown and weaker earnings in several consumer‑focused sectors has contributed to the overall market slide.

Economic Backdrop

Inflation remains a central concern. Despite recent price declines in some categories, core inflation has stubbornly stayed above the Federal Reserve’s 2 % target. Interest rates are expected to stay elevated, with the Fed hinting that it may maintain the policy rate at the 5.25 %–5.50 % range for the remainder of 2024. The risk of further tightening weighs heavily on growth‑sensitive sectors like technology and consumer discretionary.

Supply Chain & Geopolitics: Ongoing supply‑chain disruptions, especially in semiconductor production, continue to affect manufacturing costs across tech firms. Meanwhile, geopolitical tensions, particularly in the Asia‑Pacific region, have added uncertainty to commodity prices and corporate risk assessments.

Corporate Earnings Outlook: Many large firms have indicated cautious guidance for the next 12 months, citing higher operating expenses and a slowing consumer market. This earnings softness is being absorbed by the market, particularly in tech, which carries a large weight in major indices.

Investor Implications and Strategies

The market’s current volatility may present both risks and opportunities:

Rebalance Focus: With tech shares under pressure, investors may consider reallocating capital to sectors that are less sensitive to rate hikes, such as utilities or consumer staples, to preserve downside protection.

Value & Dividend Play: The dip in large‑cap growth stocks may create buying opportunities for value investors looking for stable dividend yields and lower valuations.

Diversification across Geography: Emerging markets and developed markets outside the U.S. may provide alternative growth avenues, especially in regions where the impact of rate hikes is less pronounced.

Watch for AI‑Driven Gains: Even with current setbacks, firms that are early adopters of artificial intelligence, especially in cloud and cybersecurity, might outpace the broader tech slowdown as AI adoption accelerates.

Active Risk Management: Investors should pay close attention to earnings updates, Fed announcements, and inflation data, as any significant shifts can further tilt market sentiment.

Outlook

The market is navigating a complex mix of corporate earnings, macroeconomic uncertainty, and policy decisions. While the decline in big‑tech stocks has dragged indices down today, the long‑term trajectory will hinge on how quickly inflation normalizes, the pace of interest‑rate policy, and the resilience of the corporate earnings landscape. Market participants who remain vigilant about risk and adaptable to changing fundamentals may find favorable positioning amid the current turbulence.

Read the Full Kiplinger Article at:

[ https://www.kiplinger.com/investing/stocks/stocks-fall-again-as-big-tech-struggles-stock-market-today ]