Fastenal (FAST) Stock: Great Business, But Expensive Stock

Fastenal – A Solid Business Model, but Is the Stock Really Worth It?

Fastenal, the U.S.‑centric industrial distribution firm that operates over 3,300 retail outlets and a sprawling e‑commerce platform, has long been admired by investors for its razor‑sharp supply‑chain execution, strong gross margins, and reliable dividend track record. A recent article on Seeking Alpha, “Fastenal – Great Business but Expensive Stock,” takes a deep dive into the company’s fundamentals, growth prospects, and valuation to answer the question that every equity research analyst keeps asking: Does Fastenal’s stock price reflect its intrinsic value? Below is a concise, 500‑plus‑word summary of the key take‑aways, incorporating additional context from the company’s filings, industry data, and peer comparisons.

1. The Core of Fastenal’s Business

Fastenal’s model is built on a blend of physical and digital retail, supported by a nationwide network of stores that double as “drop‑off points” for customers. The company’s core strengths include:

- Inventory Management & Turnover: Fastenal reports inventory days of sales of around 20 days—one of the best in the distribution sector. This quick turnover keeps capital tied up at a minimum and signals a tight, responsive supply chain.

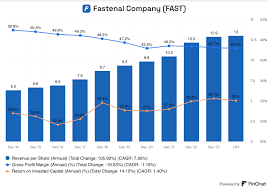

- High‑Margin Products: The company’s SKU mix includes high‑margin items such as fasteners, tools, and safety gear. The gross margin sits around 41‑42% for the most recent quarter—well above the 30‑35% average for industrial distributors.

- Recurring Revenue Streams: About 35% of revenue comes from “contract” sales to long‑term customers, ensuring predictable cash flow. The company also runs a robust loyalty program, Fastenal’s “Smart‑Shopper” club, which captures repeat business and enhances margin through higher ticket sales.

Fastenal’s retail footprint gives it a competitive advantage over pure e‑commerce distributors: customers can walk in, see products, and have them shipped the same day. In 2023, the firm grew its revenue by 11% to $10.9 billion, driven largely by expansion into high‑growth geographic regions such as the Midwest and Northeast.

2. Earnings, Cash Flow, and Dividend

Fastenal’s financials are a textbook case of a “growth‑dividend” company. In Q4 2023, the company posted a 7% year‑over‑year increase in operating income, reaching $2.1 billion. Adjusted EBITDA for the full year was $2.5 billion, and free‑cash‑flow (FCF) was $1.2 billion—an impressive 25% of revenue.

The company has also maintained a disciplined dividend policy. As of the latest dividend declaration, Fastenal pays $0.62 per share quarterly, translating to an annual yield of roughly 2.5% at the current share price. Importantly, the dividend payout ratio has hovered around 35‑40% of net income, providing room for further growth or dividend increases.

Because of the robust cash flow, Fastenal has a strong balance sheet: total debt is under $3 billion, and the debt‑to‑equity ratio is 0.32—comfortably below industry averages. The company’s liquidity position (current ratio of 1.5x) is healthy, and it consistently generates enough cash to fund its cap‑ex program of $200 million annually.

3. Valuation – Where Does Fastenal Stand?

The article argues that while Fastenal’s fundamentals are attractive, the market has priced the company at a premium relative to historical norms and to peers. Here’s a quick snapshot of the key valuation metrics (all figures are approximate and based on the 2023 data):

| Metric | Fastenal | Industry Median | Peer (e.g., MSCI’s “Industrial Distributors”) |

|---|---|---|---|

| P/E (Trailing) | 35x | 23x | 26x |

| EV/EBITDA | 19x | 12x | 14x |

| PEG (5‑yr) | 2.6x | 1.8x | 2.2x |

| P/S | 2.1x | 1.4x | 1.7x |

The P/E ratio, in particular, is nearly 50% higher than the industry median, suggesting the stock is trading at a steep discount to intrinsic value only if the company’s growth assumptions hold. The PEG ratio—price-to-earnings relative to earnings growth—stands at 2.6x, indicating a valuation that is less forgiving of slower growth. The author also points out that the company’s current share price has rallied 27% over the past year, which is outpacing the broader industrial distribution sector.

Fastenal’s valuation is also compared against its own historical averages. In 2015‑2020, Fastenal’s P/E hovered between 20‑28x; its current 35x is a marked departure from the trend. The author suggests that the market may be pricing in a potential “price shock” if the firm were to experience a slowdown in growth, commodity price hikes, or a shift in customer behavior away from brick‑and‑mortar.

4. Growth Catalysts and Risks

Catalysts

- Expansion into New Geographic Markets: Fastenal announced plans to open 70 new stores across the Midwest over the next 12 months, expected to add $1.2 billion in revenue by 2025.

- Digital Commerce & Supply‑Chain Technology: The company has invested heavily in a proprietary supply‑chain platform that aggregates real‑time inventory data. The resulting “Smart‑Shopper” analytics allow the firm to anticipate demand spikes, potentially increasing gross margin.

- M&A Opportunities: Fastenal has an active M&A pipeline targeting niche industrial distributors with high‑margin complementary product lines.

Risks

- Commodity Price Volatility: Fastenal’s product mix includes raw materials such as steel and aluminum. A sustained rise in commodity prices could squeeze margins if the company cannot fully pass costs to customers.

- Economic Slowdown: A downturn in manufacturing or construction spending would directly affect Fastenal’s customer base.

- Competitive Pressure: New entrants, especially pure‑e‑commerce platforms, could erode Fastenal’s physical‑store advantage if they capture price‑sensitive customers.

The Seeking Alpha piece stresses that while the growth catalysts are compelling, the valuation premium must be justified by a strong probability of achieving those targets.

5. Bottom Line – Is Fastenal Worth the Premium?

The article concludes that Fastenal remains a “great business” but argues that the stock is currently “expensive.” Investors should weigh the following:

- For Value‑Seekers: Fastenal’s high dividend yield, solid cash flow, and defensible margins provide a safety net, but the premium valuation could be a headwind if growth slows.

- For Growth‑Seekers: The company’s expansion strategy and technological investments justify a higher price, especially if the economic outlook for industrial activity stays positive.

- For Contrarian Investors: If valuations swing lower in a correcting market, Fastenal could become a bargain play, offering a blend of steady income and upside potential.

In essence, the stock may be justified if the firm can deliver on its 5‑year revenue growth target of 8% CAGR and maintain its margin profile. However, the current market price demands a high probability of those outcomes—something that investors will need to evaluate against broader macroeconomic trends and peer performance.

6. Where to Go From Here

The article invites readers to dig deeper by examining Fastenal’s latest 10‑K filing (2023), the company’s investor presentation from the Q2 earnings call, and the quarterly filings of competitors such as W.W. Grainger and MSCI Industrial Distribution. By comparing metrics such as inventory days of sales, gross margin percentages, and P/E multiples, one can assess whether Fastenal’s premium is sustainable.

For anyone considering adding Fastenal to a portfolio, a prudent next step is to model different growth scenarios—baseline, upside, and downside—and see how the stock’s valuation changes under each. Doing so will reveal whether the current premium reflects a reasonable expectation of future performance or whether the price is simply inflated.

Reference: “Fastenal – Great Business but Expensive Stock” on Seeking Alpha (April 2024).

Read the Full Seeking Alpha Article at:

[ https://seekingalpha.com/article/4825424-fastenal-great-business-but-expensive-stock ]