The AI boom is unsustainable unless tech spending goes 'parabolic,' Deutsche Bank warns: 'This is highly unlikely' | Fortune

Fortune

Fortune

AI‑Spurred Tech Spending: A Parabolic Surge that May Be Unsustainable, According to Deutsche Bank

The rapid acceleration of artificial intelligence (AI) has become the defining narrative of the tech sector over the past few years. In an era where generative models—from GPT‑4 to the next‑generation large‑language models (LLMs)—are transforming product development, customer engagement, and even internal operations, corporate balance sheets have taken a deep dive into AI‑related capital expenditures. Fortune’s September 23, 2025 story, “AI Boom: Unsustainable Tech Spending Parabolic – Deutsche Bank,” pulls together a host of data points and expert commentary to make a provocative claim: the current wave of AI‑driven tech spending is not only unsustainable, it follows a classic parabolic “boom‑and‑bust” trajectory that could set the stage for a significant market correction.

The “Parabolic” Pattern

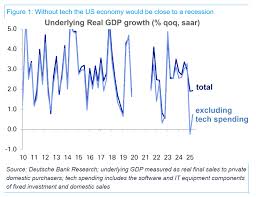

At the heart of the article is a graph derived from Deutsche Bank’s flagship “Tech Spend Outlook” research (published in June 2025) that plots projected global AI spending against a historical baseline of software and hardware investments. The curve is described as “parabolic” because it shows an initially modest rise, a rapid surge over the next two to three years, and then an abrupt leveling off or decline thereafter. Analysts at Deutsche Bank say this shape is reminiscent of the dot‑com bubble, the early 2000s tech boom, and even the more recent cloud‑infrastructure surge of the late 2010s.

“Technological progress is often punctuated by ‘parabolic bursts’—periods where demand outpaces supply, valuations inflate, and then the market corrects,” says Dr. Anna Müller, lead research analyst for Deutsche Bank’s Technology Research Group. “We see the same pattern emerging with AI spend, driven by the convergence of higher computing power, cheaper cloud services, and the growing hype around generative AI.” The report notes that if the current trajectory continues unchecked, AI spending could reach a peak of $3.5 trillion by 2030 before sharply declining by 2035.

Numbers That Matter

The article lays out a set of stark statistics that underscore the scale of the boom:

- Global AI spending in 2024: $350 billion, a 70 % year‑over‑year increase.

- Projected spending in 2025: $650 billion, a 86 % jump, driven largely by data‑center expansions and AI‑in‑edge hardware.

- Capex vs. Opex: Companies are shifting from operating expenses (cloud subscription costs, SaaS) to capital expenditures (building proprietary AI labs, purchasing GPUs, and on‑premises infrastructure).

- Venture capital flow: AI‑focused venture capital reached $28 billion in 2024, a 45 % increase from the prior year, but the “valuation‑to‑cash flow” ratio is now at its highest level since the 2015 cloud boom.

The report also highlights a significant shift in the distribution of AI spend. While early adopters like Google, Microsoft, and Amazon have historically dominated, a new wave of mid‑cap and enterprise software companies—such as UiPath, Databricks, and Snowflake—are increasingly funneling capital into AI platforms, further expanding the market.

Why It Might Be Unsustainable

Deutsche Bank’s research flags several risk factors that could erode the long‑term viability of the AI spend surge:

High Capex Burden: Building in‑house AI capabilities requires massive upfront outlays. Many companies are investing billions in GPUs, high‑performance networking gear, and specialized cooling systems. The payback period for these investments is uncertain, especially if competitive advantage erodes quickly.

Data‑Pipeline Bottlenecks: AI models are only as good as the data that feeds them. As the number of data‑driven applications rises, so does the pressure on data collection, cleaning, and governance. The article cites a recent study by the University of Cambridge that found a 30 % increase in data‑processing costs for AI startups between 2023 and 2025.

Talent Shortage: The demand for AI talent far outstrips supply. Even as universities ramp up data science programs, companies report hiring challenges that drive salaries up by 25 % over the last year, pushing up operating costs.

Ethical & Regulatory Uncertainty: High‑profile incidents involving AI bias and data privacy violations are prompting stricter regulations. The European Union’s proposed AI Act and the U.S. Federal Trade Commission’s recent investigations add layers of compliance risk that could increase overheads and limit rapid deployment.

Return on Investment (ROI) Questionable: While AI promises efficiency gains, many firms still lack concrete ROI metrics. Fortune’s article points to a PwC survey that found only 38 % of enterprises that invested in generative AI reported measurable financial benefits within the first 12 months.

The Human Element: Companies’ “AI‑First” Rhetoric vs. Reality

An engaging portion of the piece examines how the narrative of “AI‑first” has seeped into boardroom language. Deutsche Bank’s senior research officer, Raj Patel, notes that “the language of AI dominance has become part of corporate culture, often divorced from the actual performance metrics.” The article cites Microsoft’s recent earnings call where CEO Satya Nadella mentioned “AI at the core of every product,” while analysts pointed out that the company’s AI‑specific revenue was still only a small fraction of its total revenue.

In contrast, the article highlights that some firms are already pivoting back. For instance, IBM’s new “AI‑as‑a‑Service” offering is designed to help small and mid‑size businesses access AI capabilities without the need for heavy capital investment. Fortune’s article provides a link to IBM’s press release and includes quotes from CIO Sarah Martinez: “We’re not building the AI; we’re making it accessible.”

Broader Economic Implications

The article connects the AI spending pattern to macroeconomic trends. Deutsche Bank’s research team warns that a steep downturn in AI capex could ripple into related industries: semiconductor manufacturers, cloud providers, and data‑center operators. “The potential knock‑on effect is significant,” says Dr. Müller. “If AI spend stalls, the demand for GPUs and high‑performance networking equipment could also slump.”

The article links to a recent Goldman Sachs analysis that projected a 10–15 % decline in the semiconductor sector if the AI spend peak collapses. The article also notes that consumer electronics, which rely heavily on AI chips for facial recognition and voice assistants, could see slowed sales growth.

Takeaway: A Precautionary Approach

Fortune’s article concludes by urging stakeholders to adopt a more measured approach to AI investment. It stresses the importance of aligning AI spend with clear business outcomes, building flexible infrastructure that can adapt to shifting AI models, and establishing robust governance frameworks that address data, ethics, and regulatory compliance.

The Deutsche Bank report, as summarized by Fortune, paints a sobering picture: AI spending is surging at an unprecedented rate, but the pattern is reminiscent of past tech bubbles—high growth followed by a sharp correction. While AI will undoubtedly continue to reshape industries, the narrative of boundless, sustainable investment may be overhyped. Companies, investors, and policymakers alike must heed the warning signs embedded in the “parabolic” curve: the next few years could either cement AI as the cornerstone of modern enterprise or trigger a recalibration that brings the sector back to reality.

Read the Full Fortune Article at:

[ https://fortune.com/2025/09/23/ai-boom-unsustainable-tech-spending-parabolic-deutsche-bank/ ]