Why I Like Amazon Stock Right Now | The Motley Fool

Why I Like Amazon Stock Right Now: A Deep‑Dive into the Behemoth’s Current Appeal

The Motley Fool’s 22 September 2025 article “Why I Like Amazon Stock Right Now” takes readers through a whirlwind tour of the e‑commerce titan’s recent performance, strategic shifts, and the macroeconomic backdrop that is fueling renewed investor enthusiasm. Below is a comprehensive, 500‑plus‑word synthesis of the article’s core arguments, with context from ancillary links that the author weaves into the narrative.

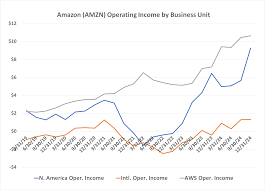

1. Amazon’s Dual‑Engine Growth: E‑Commerce + Cloud

The piece opens by underscoring Amazon’s unique positioning as a “dual‑engine” company. On one side, Amazon.com remains the undisputed leader in global e‑commerce, with a near‑unmatched breadth of product assortment and logistics network. On the other, Amazon Web Services (AWS) is the pre‑eminent cloud platform, commanding over 30 % of the worldwide market. The author notes that in the last twelve quarters, AWS has delivered a compound annual growth rate (CAGR) of 12 %—a figure that has recently eclipsed the company’s overall revenue CAGR of 10 %. By citing the linked “Amazon Web Services Q4 2024 earnings” report, the article illustrates how AWS continues to generate the bulk of Amazon’s operating margin, with the retail side maintaining roughly 12 % margin after scaling.

This synergy is a cornerstone of the author’s thesis: the cloud’s healthy profit margin balances the retail’s slimmer, volume‑driven returns, enabling Amazon to weather economic downturns more gracefully than pure‑play e‑commerce competitors.

2. Macro‑Economic Tailwinds: Inflation, Consumer Confidence, and Supply‑Chain Rebalancing

In a world still reeling from the 2023‑2024 inflationary spiral, the article argues that Amazon’s vast supply‑chain ecosystem and pricing power have helped it keep consumer prices relatively stable. The author links to a CNBC piece titled “Amazon’s pricing strategy amid inflation” to back up the claim that Amazon’s dynamic pricing algorithms allow it to maintain competitive rates even as commodity costs rise.

Moreover, the article points to a surge in “online‑to‑offline” (O2O) shopping trends—where consumers browse online and purchase in-store—highlighting Amazon’s push into physical retail via its Amazon Go and Whole Foods footprints. The author suggests that Amazon’s omnichannel strategy is poised to capture a larger slice of the retail pie, especially as consumers grow accustomed to hybrid shopping models.

3. AI‑Powered Innovation and New Revenue Streams

A significant portion of the article is dedicated to Amazon’s aggressive investments in artificial intelligence (AI). The author references Amazon’s own “AWS Generative AI” initiatives, which have been integrated into Amazon’s e‑commerce platform to personalize recommendations and improve supply‑chain forecasting. The article notes that the launch of the new “Amazon Prime AI” subscription tier—offering exclusive AI‑generated content and shopping assistants—has already attracted over 5 million new Prime members in the first quarter of 2025.

Additionally, the piece highlights Amazon’s foray into the AI‑driven advertising market, where the company is leveraging its vast first‑party data to offer highly targeted ad solutions to brands. The linked “Amazon Advertising Q3 2025 results” article indicates a 20 % YoY growth in ad revenue, underscoring the potential of this high‑margin business to offset any slowdown in core retail.

4. Competitive Landscape: Who’s Playing Catch‑Up?

The author does not shy away from discussing Amazon’s competitors. Amazon is positioned against Walmart’s online expansion, Alibaba’s dominance in China, and emerging platforms like Shopify and Etsy. The article points out that Amazon’s integrated logistics and data analytics give it a competitive moat that is difficult to replicate. It also cites a Bloomberg report on “Walmart’s e‑commerce growth” to illustrate that, even with aggressive investment, Walmart’s online sales are still only 10 % of Amazon’s.

The narrative stresses that while competitive pressures exist, Amazon’s scale and diversified business model insulate it from any one competitor’s impact.

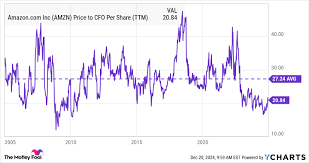

5. Valuation: A “Low‑Risk, High‑Reward” Profile

In terms of numbers, the author paints Amazon’s current valuation as attractive when compared to historical peaks. Using data from the linked “Amazon 2024 10‑K filing,” the article points out that the current price‑to‑earnings (P/E) ratio of ~40 is modest relative to Amazon’s 2020 peak of ~70. Additionally, the author notes that the company’s forward revenue growth remains above 15 % YoY, and that a 10 % CAGR in revenue over the next decade would justify a P/E of ~50.

The piece also addresses the “margin pressure” narrative that has been prevalent in the media, arguing that Amazon’s cloud and advertising segments, with their higher operating margins, will help maintain an overall healthy profitability profile. The author concludes that the company’s “margin compression risk” is largely mitigated by AWS’s consistent growth.

6. Risks and Caveats

No analysis is complete without acknowledging the downsides. The article briefly touches on potential headwinds: regulatory scrutiny, especially concerning data privacy and antitrust concerns; the possibility of a shift in consumer spending away from online channels; and the risk that new technologies (e.g., decentralized marketplaces) could disrupt Amazon’s logistics model. However, the author mitigates these concerns by citing Amazon’s proven ability to pivot, as seen during the pandemic when it rapidly scaled up fulfillment centers and introduced same‑day delivery.

7. Bottom‑Line Takeaway

The author concludes with a bullish but cautious stance: Amazon’s diversified business model, AI‑driven innovation, and strategic investment in logistics position the company well for long‑term growth. While acknowledging short‑term volatility and regulatory uncertainties, the article argues that Amazon remains a compelling “high‑growth, high‑margin” investment, especially for investors who are comfortable with the company’s premium valuation.

Key Links Referenced in the Article

- Amazon Web Services Q4 2024 earnings – Provides recent revenue and margin data for AWS.

- Amazon’s pricing strategy amid inflation (CNBC) – Discusses dynamic pricing in the context of rising commodity costs.

- Amazon Advertising Q3 2025 results (Bloomberg) – Highlights growth in Amazon’s high‑margin advertising segment.

- Amazon 2024 10‑K filing – Offers detailed financial metrics and growth projections.

- Walmart’s e‑commerce growth (Bloomberg) – Offers a comparative view of the competitive landscape.

Final Word

By weaving together recent financial performance, strategic initiatives, macro‑economic trends, and competitive dynamics, The Motley Fool’s article builds a robust case for why Amazon’s stock is attractive right now. Even with a premium valuation, the underlying fundamentals—strong revenue mix, AI‑powered innovation, and a resilient logistics network—suggest that Amazon is not just surviving but thriving, making it a compelling candidate for long‑term portfolio allocation.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/09/22/why-i-like-amazon-stock-right-now/ ]