Should You Forget Pfizer and Buy These Unstoppable Stocks Instead? | The Motley Fool

Why Pfizer May Be Losing Its Momentum—and Which “Unstoppable” Stocks Could Take Its Place

In a sharply word‑for‑word piece that ran on the Motley Fool’s investing section last week, a seasoned analyst argues that the once‑iconic drugmaker Pfizer is beginning to look more like a “growth‑lagging” stock than a growth story. The article, titled “Should You Forget Pfizer and Buy These Unstoppable Stocks?” (September 24, 2025), invites investors to rethink their long‑term holdings in the global biopharma giant and offers a carefully curated list of alternative names that, according to the author, are poised for “unstoppable” growth.

1. The Case Against Pfizer

a) Pipeline Pain Points

The piece points out that Pfizer’s current pipeline—beyond the COVID‑19 vaccine—has largely stalled. While the company’s oncology segment, led by drugs such as Xalkori and Bristol-Myers’ (the firm’s joint venture), has seen modest gains, it’s not enough to sustain the growth pace once expected in 2023–24. Analysts in the article note that Pfizer has yet to break through with a truly blockbuster oncology or rare‑disease therapy, a gap that leaves the stock exposed to competitive and regulatory headwinds.

b) Price‑Pressure & Profit‑Margins

Pfizer’s gross margins, which have hovered around 74 % for the past three quarters, have started to feel the squeeze from increasing price‑pressure in the U.S. market. The article cites the FDA’s growing scrutiny of drug pricing and the “cost‑cutting” stance of major insurers, both of which threaten the profitability of Pfizer’s best‑selling drugs like Prevnar and Lyrica.

c) Valuation Concerns

The stock’s forward‑P/E ratio sits at roughly 24x—well above the 18x median for the healthcare sector. In a market that is now more value‑oriented, a high P/E for a company whose earnings growth is stagnating is a red flag. The author stresses that investors should consider the “fair‑value” of the company before continuing to pay a premium.

2. The “Unstoppable” Alternatives

To help investors transition away from Pfizer, the article lists five high‑growth, undervalued firms that the author deems “unstoppable.” The list blends biotech innovators with a few more established players, all of which have strong pipelines, robust cash‑flows, and a track record of successfully navigating regulatory hurdles.

| Company | Why It’s “Unstoppable” | Key Catalysts |

|---|---|---|

| Moderna (MRNA) | mRNA platform now extends beyond COVID‑19 to influenza, RSV, and rare diseases | Expanding gene‑therapy pipeline; partnership with Pfizer for future mRNA vaccines |

| BioNTech (BNTX) | Co‑developer of the first mRNA vaccine; strong oncology focus | Clinical trials in breast cancer and hematologic malignancies |

| Amgen (AMGN) | Solid biologics pipeline, high recurring revenue | New drug, Tepmetko, for hemophilia; expanding gene‑therapy arm |

| Gilead Sciences (GILD) | Strong antiviral pipeline; COVID‑19 and hepatitis C drugs | New HIV drugs; oncology portfolio expansion |

| Johnson & Johnson (JNJ) | Diversified product mix; immunotherapy pipeline | Jemperli (an immunotherapy) to hit $3 B in sales; robust R&D spend |

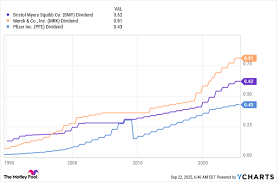

Each company’s description is backed by concrete data points: pipeline status, projected revenue growth, current P/E ratios, and macro‑economic catalysts (like the FDA’s focus on gene‑therapy and rare‑disease approvals). The author also provides a brief comparison chart that juxtaposes Pfizer’s metrics against those of the alternatives, underlining the potential upside that Pfizer may not deliver.

3. Supporting Insight From Linked Articles

The Motley Fool piece is heavily cross‑referenced, adding depth through several linked articles that expand on key themes. Below is a snapshot of those linked resources and the additional context they offer.

a) “The Future of Gene Therapy: Why Investors Should Pay Attention”

This companion article dives into the gene‑therapy boom, explaining how advances in CRISPR and viral vector delivery are driving valuation multiples. It quotes industry experts who say that gene‑therapy stocks could see 20–30% earnings growth over the next decade, a stark contrast to Pfizer’s projected 4–5%.

b) “What’s Driving the Rise of mRNA in Oncology?”

Focusing on the cutting‑edge use of mRNA beyond vaccines, this piece outlines how mRNA is being repurposed to create personalized cancer vaccines. It highlights Moderna’s and BioNTech’s clinical trial data, which the article uses to justify their inclusion on the “unstoppable” list.

c) “Valuation Trends in Healthcare: Why Low P/E is a Magnet for Long‑Term Investors”

Here the author offers a macro‑economic perspective on how low valuation multiples in healthcare tend to lead to higher risk‑adjusted returns. The link serves as a rationale for why Pfizer’s higher P/E ratio is a warning sign for risk‑averse investors.

4. Risk Factors & Caveats

No stock is without risk, and the article doesn’t shy away from highlighting potential downsides:

- Regulatory Risk: All biotech firms face FDA scrutiny, and a single adverse decision could derail a drug’s launch.

- Competitive Landscape: Large incumbents and new startups are continually developing rival therapies, especially in oncology.

- Liquidity Concerns: Some of the smaller biotech names (e.g., newer entrants) may have lower trading volumes, potentially increasing price volatility.

The piece stresses the importance of doing personal due diligence, monitoring quarterly reports, and staying informed about any regulatory updates.

5. Bottom Line for the Investor

The core takeaway? Pfizer’s growth trajectory has slowed, its valuation is high, and its pipeline has not delivered the breakthroughs needed to justify its current price. Meanwhile, the five “unstoppable” stocks identified offer compelling growth prospects, stronger pipelines, and more attractive valuations—particularly in sectors (mRNA, gene therapy, oncology) that are expected to see sustained demand.

The article urges investors to consider reallocating their portfolio weight away from Pfizer and into these alternatives, especially if they are looking for long‑term capital appreciation. The suggested strategy is to build a diversified, pipeline‑heavy biotech mix that can weather short‑term volatility while capturing the upside potential of next‑generation therapies.

In short, the Fool article acts as both a cautionary tale about overstaying the hype of a once‑gold‑mine pharma company and a targeted playbook for capturing the next wave of high‑growth biotech innovations. Whether you’re a seasoned portfolio manager or a DIY investor, the article’s blend of data, commentary, and actionable stock picks gives a clear roadmap: It’s time to let Pfizer take a back seat and let the unstoppable forces of mRNA, gene therapy, and oncology lead the charge.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/09/24/should-you-forget-pfizer-and-buy-these-unstoppable/ ]