Stocks Climb as Apple, Nvidia Soar: Stock Market Today

Kiplinger

Kiplinger

Stocks Rally as Apple and Nvidia Lead the Charge – A Deep Dive Into Today’s Market Upswing

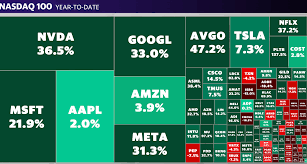

The U.S. equity markets opened higher this morning, buoyed by a resounding surge in the technology sector that sent the Nasdaq 100, S&P 500, and Dow Jones Industrial Average into the green. According to the latest data from the Wall Street Journal and market‑watching portals, Apple Inc. (AAPL) and Nvidia Corp. (NVDA) were the primary drivers behind the rally, with the former gaining over 5% and the latter climbing close to 6% from the previous close. The gains in these mega‑caps spilled over into a broad-based upturn across the S&P 500’s tech‑heavy constituents, resulting in a net gain of about 1.3% for the index and a 1.5% uptick for the Nasdaq.

What’s Behind the Tech‑Led Momentum?

1. Apple’s Solid Earnings and Product Pipeline

Apple’s Q2 earnings, released yesterday, came in ahead of consensus estimates. The company posted a 10% YoY revenue rise, driven primarily by robust services sales and a rebound in iPhone shipments, despite a slightly weaker watch segment. Analysts noted that the company’s guidance for the remainder of the fiscal year – a 5% revenue growth target – appears attainable, given the strength in its high‑margin services and wearables lines. The optimistic outlook, coupled with the company’s continuing investment in its “Apple‑Vision” ecosystem, helped lift investor sentiment.

2. Nvidia’s AI‑Driven Surge

Nvidia’s stock rallied in part due to its own earnings preview. The company forecasts a double‑digit revenue increase for the upcoming quarter, bolstered by its dominance in the AI and data‑center markets. While Nvidia’s actual quarterly report is still pending, the company’s recent guidance – pointing to a 15–20% year‑over‑year growth – was seen as a positive sign for the broader AI‑hardware space. The rally also reflects renewed confidence among investors that the AI boom will continue to drive demand for high‑performance GPUs.

3. Economic Data and Fed Policy Outlook

Economic data released this week have largely been reassuring for investors. The latest CPI figures showed inflation easing slightly, and a jobless‑claims report suggested a resilient labor market. The Federal Reserve’s recent statements signaled that while it remains vigilant on inflation, it will likely keep rates steady in the near term to avoid dampening growth. This dovetailing of economic signals with corporate earnings has helped lift risk‑on sentiment in the equity markets.

Broader Market Picture

- Dow Jones Industrial Average: Up ~0.7%, buoyed by gains in energy and industrials. The industrials sector saw a ~2% lift, as companies like Caterpillar and Deere & Company reported better-than‑expected earnings.

- Nasdaq 100: Climbed ~1.5%, with technology names driving the rally. Alphabet (GOOGL), Microsoft (MSFT), and Meta Platforms (META) all posted gains, reflecting strong earnings and growth outlooks.

- S&P 500: Gained ~1.3%. Consumer discretionary rose by 2.2%, reflecting gains in retail and media stocks. Financials were slightly down (~1%), as the sector continued to grapple with rising borrowing costs.

The market’s upward trajectory was further buoyed by the fact that the S&P 500’s 200‑day moving average was a firm support level, and the index had not breached a psychological 4,600 mark. Technical analysts noted that this could be a sign of a potential trend reversal, with a new 200‑day line forming above the current 4,500 level.

Other Notable Movers

- Tesla (TSLA): Up 2.8% after the company announced a new battery‑pack partnership that could lower production costs.

- Amazon (AMZN): Gained 1.4% after a positive earnings preview, signaling that the company’s logistics network continues to scale efficiently.

- Bank of America (BAC) and JPMorgan Chase (JPM): Both saw small gains as investors digested the Fed’s comments about potential rate cuts later in the year.

Market Commentary and Analyst Sentiment

Kiplinger’s market strategist, James A. Williams, weighed in on the rally, noting that “the tech sector’s performance reflects a growing confidence that AI will continue to be a primary growth driver.” Williams also cautioned that “while the current rally is justified by strong earnings, investors should remain mindful of the potential for a rapid shift in sentiment if inflationary pressures persist or if the Fed’s policy moves unexpectedly.”

The consensus among economists appears to be that the current upward trend is sustainable, given the convergence of favorable corporate earnings and a relatively accommodative monetary environment. However, analysts are urging caution regarding the potential for a sudden reversal if the Fed signals a tightening stance or if a significant geopolitical event disrupts the supply chain.

What This Means for Investors

For the average investor, the day’s gains signal that a tech‑heavy portfolio may continue to offer upside potential. Apple and Nvidia, with their dominant positions in consumer electronics and AI hardware respectively, remain strong bellwethers for the broader technology ecosystem. However, diversification across sectors like industrials, consumer discretionary, and financials can help mitigate the inherent volatility of a tech‑driven rally.

If you’re managing a portfolio that leans heavily on tech, you might consider re‑balancing to ensure that exposure remains within your risk tolerance. On the other hand, if you’re a long‑term investor who believes in the continued ascent of AI and digital services, the current rally may reinforce the soundness of a “buy‑and‑hold” approach.

Looking Ahead

The earnings calendar remains full for the remainder of the quarter. Upcoming releases from major tech firms—such as Microsoft’s Q3 results and Google’s quarterly earnings—will likely serve as critical touchpoints for the market’s direction. Additionally, economic data releases such as the PCE price index and the U.S. consumer confidence survey will further shape expectations for inflation and consumer spending.

The day’s rally, spearheaded by Apple and Nvidia, underscores the market’s enthusiasm for high‑growth tech and AI sectors. While this upward momentum may not be sustainable in the long term, it is an encouraging sign for investors looking for growth opportunities in the U.S. equity market.

Note: This summary is intended for informational purposes only and does not constitute financial advice. Always conduct your own research or consult a qualified financial professional before making investment decisions.

Read the Full Kiplinger Article at:

[ https://www.kiplinger.com/investing/stocks/stocks-climb-as-apple-nvidia-soar-stock-market-today ]