Costco Faces Caution Despite Strong Model

Locales: New York, California, Texas, UNITED STATES

Sunday, February 15th, 2026 - Costco Wholesale Corporation (COST) has long been a darling of the retail sector, consistently outperforming competitors and delivering robust returns for investors. While the company continues to demonstrate fundamental strength, recent analysis from Wall Street, particularly Goldman Sachs, suggests a period of cautious optimism is warranted. This article delves into the factors driving Costco's success, the current market pressures it faces, and the nuanced warnings being issued by financial analysts.

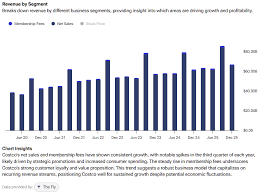

The Power of the Membership Model: Beyond Merchandise Sales

Costco's enduring appeal isn't simply about discounted televisions or bulk toilet paper. It's the business model itself that sets it apart. Unlike traditional retailers reliant on profit margins from product sales, Costco generates the lion's share of its revenue - and a remarkably stable income stream - from annual membership fees. As of early 2026, Costco boasts a staggering 68.5 million members, with an astonishing 95% renewal rate. This consistently high retention isn't accidental; it's a testament to the perceived value members receive.

This 'treasure hunt' shopping experience, combined with generally lower prices on a wide range of goods, creates a powerful incentive for consumers to maintain their memberships. The psychological effect of finding unexpected deals, coupled with the convenience of one-stop shopping, fosters a strong sense of brand loyalty. The membership model effectively shifts the focus from maximizing profit on individual items to maximizing volume of purchases, allowing Costco to offer competitive pricing while maintaining profitability. It's a virtuous cycle: more members mean more purchasing power, which allows Costco to negotiate better deals with suppliers, further enhancing the value proposition for members.

Navigating a Turbulent Economic Landscape

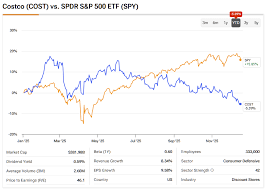

Despite its inherent strengths, Costco hasn't been immune to the broader economic headwinds impacting consumer spending. The stock has experienced a correction, falling roughly 17% from its recent peak. This dip reflects a combination of factors, including overall market volatility, persistent (though cooling) inflation, and growing concerns about a potential recession in the latter half of 2026. While many consumers still prioritize value, even budget-conscious shoppers are beginning to feel the pinch of higher prices across essential goods.

Costco's resilience is evident in the fact that the downturn hasn't been more severe. The company continues to report solid sales figures, demonstrating that its core customer base remains committed. However, analysts are closely monitoring key indicators, such as average transaction size and the frequency of shopping trips, to gauge the potential impact of economic pressures on consumer behavior. A slowdown in these metrics could signal a weakening of Costco's previously unshakeable demand.

Goldman Sachs' Cautionary Note: Valuation and Market Sensitivity

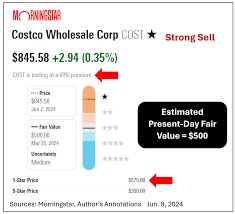

While the consensus on Wall Street remains largely bullish regarding Costco's long-term prospects, Goldman Sachs recently issued a notable warning. Their analysis highlights that Costco's valuation - the price of the stock relative to its earnings and growth potential - is becoming increasingly stretched. This means the stock price may already be factoring in a significant amount of future growth, leaving limited room for upside surprises.

Goldman Sachs argues that Costco is particularly vulnerable to a market correction. If investor sentiment turns negative - perhaps triggered by disappointing economic data or escalating geopolitical tensions - the stock could experience a more substantial decline than other, more conservatively valued retailers. They aren't suggesting the company is fundamentally flawed, but rather that the current price doesn't adequately reflect the potential risks.

The Long View: Still a Strong Buy, But With Prudence

So, what does this all mean for investors? Costco remains a fundamentally strong company with a powerful business model and a loyal customer base. Its consistent performance throughout various economic cycles speaks volumes about its resilience. However, it's crucial to acknowledge the risks highlighted by analysts like those at Goldman Sachs.

For long-term investors, Costco is still a worthy consideration. Its membership model provides a degree of stability that many retailers lack. However, potential buyers should be prepared for short-term volatility and consider whether the current valuation justifies the risk. Diversification remains a key principle for any investment strategy, and it's wise to avoid overexposure to any single stock, even one as historically reliable as Costco. Monitoring economic indicators and company performance closely will be vital in the coming months as Costco navigates a potentially challenging economic environment.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2026/02/15/one-hottest-consumer-stocks-warning-wall-street/ ]