Costco Investment Soars 833% in a Decade

Locales: Washington, UNITED STATES

Friday, February 13th, 2026 - A simple $1,000 investment made a decade ago in warehouse giant Costco (NASDAQ: COST) has blossomed into a substantial return, demonstrating the power of long-term, strategic investing. As of today, February 13th, 2026, that initial investment would be worth approximately $8,331.91 - an impressive 833% increase. This performance significantly outpaces broader market benchmarks, solidifying Costco's position as a top-performing stock of the last ten years.

Rewinding to 2015: The Initial Investment

On December 31st, 2015, Costco's stock traded around $153 per share. With a $1,000 budget, an investor could have purchased approximately 6.5 shares of the company. This seemingly modest investment has proven to be remarkably lucrative. The core of Costco's success lies in its unique business model: a membership-based wholesale club offering a wide range of products at competitive prices. This model fosters customer loyalty and encourages repeat business, creating a stable and predictable revenue stream.

Current Valuation and Dividend Income

As of today, Costco's stock is trading at approximately $659 per share. That original 6.5 share holding is now valued at around $4,283.50. However, the story doesn't end with stock appreciation. Costco also consistently rewards shareholders with dividends. Over the past decade, Costco has distributed roughly $748.41 in dividends per initial investment, further bolstering the overall return. The combination of capital appreciation and dividend payouts results in the aforementioned $8,331.91 total value - a compelling example of the benefits of 'buy and hold' investing.

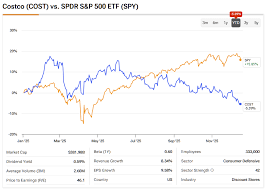

Costco's Performance Versus the S&P 500: A Clear Winner

Comparing Costco's performance to the S&P 500 over the same period paints a stark picture. While the S&P 500 experienced a substantial gain of 197% since December 31st, 2015 - turning a $1,000 investment into $2,970 - Costco's growth has been demonstrably superior. This outperformance highlights the advantages of investing in a company with a strong competitive position, efficient operations, and a loyal customer base. The S&P 500 represents a broad market index, reflecting the average performance of 500 of the largest publicly traded companies in the US. Costco's ability to consistently exceed this average underscores its exceptional management and strategic vision.

Driving Factors Behind Costco's Success

Several key factors contribute to Costco's continued success. Its membership model, as previously mentioned, is a cornerstone. The annual membership fees provide a consistent revenue stream, allowing Costco to offer competitive pricing on its products. Furthermore, Costco's focus on bulk purchases and efficient supply chain management allows it to minimize costs and maximize profitability. The company also cultivates a strong employee culture, resulting in lower employee turnover and higher productivity. Finally, Costco's selective product offerings and emphasis on quality control further enhance its brand reputation and customer loyalty.

Looking Ahead: Can Costco Maintain Its Trajectory?

While past performance is not indicative of future results, Costco appears well-positioned for continued growth. The company is expanding its global footprint, increasing its online presence, and introducing innovative services. However, it faces challenges such as increasing competition from other retailers, potential supply chain disruptions, and evolving consumer preferences. The rise of e-commerce giants like Amazon also poses a threat, though Costco has demonstrated its ability to adapt and compete in the digital landscape.

The current economic climate, characterized by fluctuating inflation and potential recessionary pressures, could also impact consumer spending and, consequently, Costco's sales. However, its loyal customer base and focus on value could provide a buffer against economic downturns.

The Lesson for Investors

The Costco example serves as a powerful reminder of the benefits of long-term investing in quality companies. It demonstrates that patience and a well-defined investment strategy can yield substantial returns over time. While not every investment will be a winner, focusing on companies with strong fundamentals, competitive advantages, and a history of delivering value can significantly increase the odds of success. Diversification remains a crucial component of any sound investment portfolio, but Costco's decade-long performance illustrates the potential rewards of identifying and holding onto exceptional companies.

Disclaimer: This information is for educational purposes only and should not be considered financial advice. Consult with a qualified financial advisor before making any investment decisions.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/12/31/invested-1000-costco-10-years-ago-return-today/ ]