Robotics Boom Driven by Labor Shortage & AI Advances

MarketWatch

MarketWatchLocales: UNITED STATES, JAPAN, GERMANY, CHINA

Why the Sudden Surge? The Driving Forces Behind the Robotics Boom

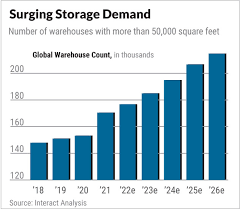

Several key factors are converging to accelerate the development and adoption of humanoid robots. The most pressing is the global labor shortage, particularly in manufacturing, logistics, and elder care. Businesses are increasingly desperate for solutions to maintain productivity in the face of dwindling workforces. Humanoid robots offer a potential solution, capable of filling labor gaps and performing tasks that are dangerous, dull, or dirty.

Beyond labor, advancements in AI, specifically generative AI and machine learning, are crucial. These technologies provide the 'brains' for robots, enabling them to perceive their environment, make decisions, and learn from experience. Furthermore, improvements in battery technology are extending robot operating times and reducing reliance on cumbersome power cables. Finally, innovations in materials science are leading to lighter, stronger, and more flexible robot bodies.

Navigating the Investment Landscape: Three Core Strategies

So, how can investors capitalize on this emerging market? Here are three primary avenues, each with its own risk-reward profile:

1. Direct Equity Investment: High Risk, High Reward

Investing directly in the companies building these robots offers the greatest potential upside, but also carries the most risk. These companies are often startups or in the early stages of commercialization, making them susceptible to volatility and potential failure.

- Tesla (TSLA): While primarily known for electric vehicles, Tesla's Optimus robot represents a significant long-term play. The company's massive financial resources, expertise in AI (through its Autopilot system), and established manufacturing capabilities give it a substantial advantage. However, Optimus has faced delays and re-evaluations of its intended purpose, shifting from general-purpose to focused factory work. Investors should closely monitor Tesla's progress and the robot's actual deployment.

- Figure AI (FGR): This company is laser-focused on humanoid robotics, aiming to create robots for commercial deployment. Their partnership with BMW to integrate robots into automotive manufacturing provides a crucial validation of their technology and a guaranteed early customer. This focused approach, while promising, also carries the risk of being overly reliant on a single industry.

- Agility Robotics (AGL): Agility Robotics' Digit robot is designed for logistics and warehouse automation, addressing a significant pain point for companies like UPS and Amazon. Current testing with these major players offers valuable real-world data and potential for future contracts. However, competition in the logistics automation space is fierce.

2. Robotics ETFs: Diversification and Reduced Risk

Exchange-Traded Funds (ETFs) offer a more diversified approach. These funds hold a basket of robotics-related companies, spreading the risk across multiple players.

- Global X Robotics & Artificial Intelligence ETF (BOTZ): This ETF provides broad exposure to the robotics and AI sectors, including companies involved in hardware, software, and enabling technologies. It's a good choice for investors seeking general exposure without focusing on humanoid robots specifically.

- ROBO Global Robotics and Automation Index ETF (ROBO): This ETF is more focused on industrial automation and robotics, offering a deeper dive into the sector. It can provide significant exposure to companies that benefit from the wider adoption of robotic solutions.

3. Robotics Mutual Funds: Professional Management, Higher Fees

Actively managed mutual funds offer another diversified option, with professional fund managers selecting investments based on their expertise. While these funds may offer potentially higher returns, they typically come with higher expense ratios.

The Road Ahead: Risks and Challenges

Despite the immense potential, investing in humanoid robotics isn't without its challenges. High development costs remain a significant hurdle. Bringing these complex machines to market requires substantial capital investment. Regulatory uncertainties also loom large. As robots become more integrated into society, governments will likely introduce regulations governing their use, potentially impacting the market's growth. Finally, societal acceptance and overcoming public concerns about job displacement are vital for widespread adoption.

The humanoid robot revolution is still in its early stages, but the trajectory is clear. The companies and technologies that successfully navigate these challenges stand to reshape industries and create substantial value for investors.

Read the Full MarketWatch Article at:

[ https://www.marketwatch.com/story/3-ways-to-invest-in-what-could-become-a-200-billion-market-for-humanoid-robots-e258d39f ]