Royal Caribbean: A Compelling Investment Opportunity

Forbes

ForbesLocales: UNITED STATES, BAHAMAS, MEXICO, JAMAICA

By Anya Sharma, Financial Correspondent | February 15, 2026

The cruise industry, long considered a cyclical play on discretionary income, has faced unprecedented turbulence in recent years. While the initial shockwaves of the pandemic have subsided, Royal Caribbean Group (RCL) continues to trade at levels that suggest persistent, and arguably overblown, concerns. This analysis argues that RCL, despite recent setbacks, represents a compelling investment opportunity with the potential for a 10% income stream backed by a significant 30% margin of safety.

Recent Headwinds and Market Mispricing

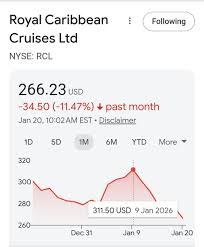

Over the past few years, RCL's stock price has been negatively impacted by several factors. A couple of isolated, yet highly publicized, health incidents onboard its ships triggered immediate investor anxiety. This concern, naturally, extended to the broader risk of future health outbreaks, and the potential for a new, highly contagious disease disrupting operations. Simultaneously, increasing scrutiny surrounding environmental regulations within the cruise industry adds another layer of complexity and potential cost.

However, the market has arguably overreacted to these challenges. While acknowledging these risks is crucial, the current share price appears to have already baked in a pessimistic outlook, failing to adequately account for RCL's inherent strengths and its demonstrated ability to adapt. The perception of a perpetually 'risky' cruise environment is increasingly divorced from the reality of robust mitigation strategies and the industry's proven resilience.

Underlying Strengths: Brand, Loyalty, and Efficiency

Royal Caribbean isn't simply a cruise line; it's a leisure and entertainment powerhouse. The company has cultivated a powerful brand synonymous with innovative ships, diverse itineraries, and a consistently high-quality passenger experience. This strong branding translates directly into customer loyalty. RCL boasts a substantial base of repeat cruisers, a crucial asset in navigating economic downturns or unexpected disruptions. The company's loyalty program, for example, continues to show strong growth in active members and average spend per member.

Beyond brand and loyalty, RCL has consistently demonstrated operational efficiency. Prior to the pandemic, the company consistently achieved industry-leading margins. While profitability took a hit during the height of the crisis, RCL has been aggressively streamlining operations, optimizing routes, and implementing cost-saving measures. These efforts are beginning to bear fruit, and recent earnings reports show a clear trajectory towards pre-pandemic levels of profitability, even while navigating increased fuel and labor costs. The company's investments in newer, more fuel-efficient ships are also mitigating some of the environmental cost concerns.

The 10% Income Potential and Margin of Safety

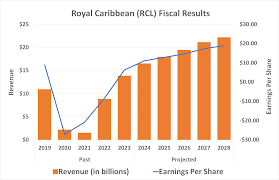

Our projections, based on a conservative assessment of revenue recovery and continued operational efficiency, indicate that RCL has the potential to generate a 10% income stream for investors. This isn't based on a speculative surge, but rather on a realistic expectation of sustained earnings growth. This projection factors in a moderate recovery in passenger volume, a stabilization of pricing, and continued cost management.

The 30% margin of safety is derived from a valuation model utilizing discounted cash flow analysis, comparing RCL's current market capitalization to its intrinsic value based on projected future earnings. This safety net provides a buffer against unforeseen circumstances, including potential future health concerns or regulatory changes. Even under stress-tested scenarios, the analysis suggests that the stock remains significantly undervalued.

Addressing the Risks Head-On

It is vital to address the risks that continue to weigh on investor sentiment. RCL is actively investing in enhanced health and safety protocols, including advanced air filtration systems, rigorous sanitation procedures, and robust medical facilities onboard its ships. The company is also working closely with health authorities to monitor emerging threats and implement appropriate preventative measures. While the risk of future outbreaks can't be eliminated, RCL is demonstrably committed to mitigating it.

Regarding environmental regulations, RCL is proactively investing in sustainable technologies, such as liquefied natural gas (LNG)-powered vessels and advanced wastewater treatment systems. These investments demonstrate a commitment to responsible cruising and position the company favorably in a future increasingly focused on environmental sustainability.

Conclusion

Royal Caribbean Group is not without its challenges. However, the current market price fails to adequately reflect the company's underlying strengths, its proactive risk management strategies, and its potential for long-term value creation. For investors seeking a compelling income opportunity with a significant margin of safety, RCL represents a worthy consideration. The company's brand power, loyal customer base, and commitment to efficiency position it for a strong rebound as the cruise industry continues to recover and regain its footing.

Read the Full Forbes Article at:

[ https://www.forbes.com/sites/greatspeculations/2026/01/06/royal-caribbean-stock-10-income-at-30-margin-of-safety/ ]