Netflix Rebounds: Password Sharing Crackdown Boosts Subscribers

Forbes

ForbesLocales: California, UNITED STATES

A Review of Recent Gains and Crucial Metrics

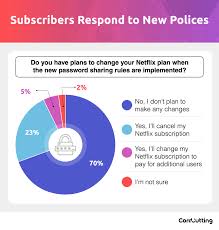

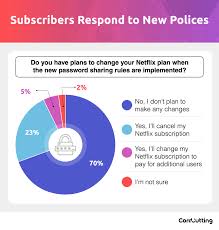

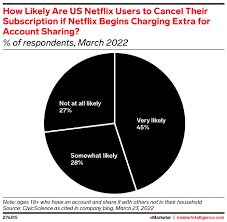

The past year saw a significant rebound in Netflix's stock price, fueled by positive Q3 2025 earnings. The crackdown on password sharing, despite initial user backlash, proved remarkably effective in converting freeloaders into paying subscribers. This demonstrates Netflix's ability to adapt and monetize its user base, but sustaining this momentum is critical.

Several key metrics will define Netflix's success in 2026. These include:

- Subscriber Growth: While the low-hanging fruit of password-sharing conversions may be dwindling, consistent subscriber growth - particularly internationally - remains paramount. Growth in mature markets like North America will be harder won.

- Average Revenue Per User (ARPU): The ad-supported tier presents a significant opportunity to boost ARPU. However, a delicate balance must be struck. Overly aggressive advertising could degrade the user experience, driving subscribers to competitors.

- Content Investment & ROI: Netflix continues to invest billions in original content. The efficacy of these investments is crucial. Simply producing more content isn't enough; Netflix must demonstrate a clear return on investment, measured by viewership, retention, and new subscriber acquisition.

- Operating Margin: Wall Street will be closely watching Netflix's ability to improve operating margins. This requires both revenue growth and efficient cost management, a challenging combination in a content-heavy industry.

Strategic Plays for Continued Growth

Netflix isn't resting on its laurels. The company is pursuing several growth strategies in 2026:

- Global Expansion - Focusing on High-Potential Regions: Expanding its footprint in Asia (particularly India and Southeast Asia) and Latin America remains a key priority. These markets offer significant growth potential but require localized content and pricing strategies.

- Content Diversification - Beyond Scripted Drama: Netflix is diversifying its content library, investing in documentaries, reality TV, live events, and - crucially - local-language programming to appeal to wider audiences.

- Gaming - A Long-Term Play: The venture into mobile gaming is still in its early stages. Success in this arena could unlock a new revenue stream and enhance subscriber engagement, but it requires significant investment and a distinct competitive advantage.

- Refining the Ad-Supported Tier: Optimizing the ad experience and expanding the tier's availability are essential for attracting price-sensitive customers without alienating existing subscribers.

Navigating the Headwinds

Despite its strengths, Netflix faces significant headwinds in 2026:

- Intensified Competition: The streaming wars are escalating. Disney+, Max, and Amazon are investing heavily in content and subscriber acquisition, squeezing Netflix's market share.

- Escalating Content Costs: The price of producing high-quality original content continues to rise, fueled by competition for talent and production resources.

- Economic Uncertainty: A potential economic slowdown could force consumers to cut discretionary spending, including streaming subscriptions.

- Maintaining User Experience: Balancing ad revenue with a positive user experience is a tightrope walk. Aggressive ad placement or irrelevant ads could drive subscribers away.

Stock Performance Outlook

Predicting stock performance is inherently speculative. However, based on current trends and Netflix's strategic positioning, continued, albeit slower, growth seems plausible. Analyst consensus currently projects a price target of around $650, representing approximately a 15% upside. More optimistic projections place the potential high around $750, contingent on successful execution of its growth strategies and favorable macroeconomic conditions.

Conclusion

Netflix remains a dominant force in the streaming landscape, but its path forward is no longer guaranteed. Successfully navigating the increased competition, managing content costs, and maintaining user engagement will be crucial for sustaining its growth trajectory. Investors should carefully weigh the potential rewards against the inherent risks in this evolving market.

Read the Full Forbes Article at:

[ https://www.forbes.com/sites/greatspeculations/2026/01/09/what-to-expect-from-netflix-stock-in-2026/ ]