Small-Cap Stocks: Potential for High Growth

MarketWatch

MarketWatchLocales: UNITED STATES, CHINA

1. Embrace the Growth Potential of Small-Cap Stocks

While larger, more established companies offer stability, small-cap stocks - those with market capitalizations between $300 million and $2 billion - often present greater growth opportunities. Historically, small-caps have tended to outperform their large-cap counterparts over the long term. This is due to their inherent potential for expansion; a smaller base makes substantial percentage gains more attainable. However, it's vital to acknowledge the increased volatility typically associated with smaller companies. Recent performance, illustrated by the roughly 16% rise of the Russell 2000 index since November, indicates a positive trend, but it currently lags behind the broader market gains seen in the past year. Investors should consider a strategic allocation to small-caps, recognizing both the potential rewards and inherent risks.

2. Unlock Value in Undervalued Stocks

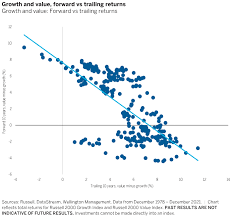

For the past decade, growth stocks have dominated the investment landscape. However, a shift may be underway. Value stocks - those trading at a lower price relative to their fundamental metrics like earnings and book value - are beginning to demonstrate signs of a resurgence. These stocks represent companies that may be overlooked or temporarily out of favor, offering a potentially attractive entry point for investors. The iShares Russell 1000 Value ETF has shown a significant 17.84% increase over the past year, signaling a potential turning point for value investing. Diversifying into value stocks can provide a counterbalance to growth-oriented holdings and potentially enhance portfolio returns as market dynamics evolve.

3. Secure Income with Dividend-Paying Companies

In an era of economic uncertainty, consistent income streams are particularly valuable. Dividend-paying companies offer a reliable source of income, even amidst market fluctuations. Beyond the immediate returns, dividends can also act as a buffer against potential losses, providing a degree of stability to a portfolio. Exchange-Traded Funds (ETFs) like the Vanguard Dividend Appreciation ETF offer a cost-effective and diversified way to access this strategy, with a low expense ratio of 0.06% and a current dividend yield of 2.17%. These funds provide exposure to a basket of companies with a history of increasing their dividend payouts, potentially offering both income and long-term growth.

4. Diversify Globally with International Stocks

The U.S. stock market has enjoyed a prolonged period of outperformance compared to international markets. However, relying solely on domestic equities can expose a portfolio to unnecessary risk. Diversifying into international stocks offers several benefits, including access to new growth opportunities and a reduction in overall portfolio volatility. Different economies and industries will perform differently, and international exposure can help offset potential downturns in the U.S. market. The Vanguard Total International Stock ETF provides broad exposure to international equities with a low expense ratio of 0.07%, making it a convenient and cost-effective way to achieve global diversification.

5. Shield Against Inflation with TIPS

Inflation remains a persistent concern for investors. Protecting purchasing power is critical, and Treasury Inflation-Protected Securities (TIPS) offer a unique solution. TIPS are government bonds indexed to inflation, meaning their principal value increases as the Consumer Price Index (CPI) rises. This feature helps safeguard the real value of the investment and provides a hedge against the erosion of returns caused by rising prices. The iShares TIPS Bond ETF has demonstrated a 7.69% increase over the past year, indicating investor interest in inflation protection. Including TIPS in a portfolio can provide a valuable layer of defense against unforeseen inflationary pressures.

By carefully considering these five portfolio adjustments, investors can position themselves for potential success in the year ahead. Remember to consult with a financial advisor to determine the strategies best suited to your individual risk tolerance and financial goals.

Read the Full MarketWatch Article at:

[ https://www.marketwatch.com/story/5-portfolio-moves-to-make-now-that-could-pay-off-this-year-7651a87d ]