Research Reports Evolving in the Age of Algorithms

Investopedia

InvestopediaLocales: New York, UNITED STATES

Friday, January 9th, 2026 - For decades, research reports have been a cornerstone of the investment world, guiding institutional and individual investors alike. But the nature of these reports, and their influence, is undergoing a significant transformation. Traditionally, these documents - meticulously crafted by analysts at brokerage firms and investment banks - provided in-depth assessments of companies, industries, and macroeconomic conditions, culminating in actionable investment recommendations like 'buy,' 'sell,' or 'hold' along with projected price targets. However, with the rise of algorithmic trading, alternative data, and a democratization of information, the role of the classic research report is being redefined.

Historically, research reports followed a standardized structure. They began with an executive summary distilling key findings, followed by a detailed company background, a rigorous financial analysis dissecting balance sheets and income statements, and a contextual industry analysis. Crucially, the report would then offer an investment recommendation, supported by a clearly articulated price target and a frank discussion of potential risk factors. These reports weren't just about the numbers; they provided narrative - an explanation of why an analyst believed a stock would perform a certain way. This narrative was often invaluable, providing context that pure quantitative analysis lacked.

While equity research - focusing on individual stock analysis - remains prominent, the scope of research has broadened. Fixed income research, examining bonds and other fixed-income securities, continues to be critical, especially in a fluctuating interest rate environment. Macroeconomic research, analyzing broad economic trends, is arguably more important than ever, given the interconnectedness of global markets and the rapid shifts in policy. And industry research provides vital context for understanding the competitive landscape and potential disruptors.

The Shift in Access & Influence

The traditional model of research distribution is shifting. For years, access to high-quality research was largely limited to institutional investors and clients of full-service brokerage firms. Regulation changes in the past decade, specifically MiFID II, aimed to unbundle research costs from trading commissions, impacting the profitability of research departments. This led to a reduction in the number of analysts covering specific companies, particularly smaller-cap stocks.

Today, several avenues exist for accessing research. Brokerage firms still provide reports to their clients, but increasingly, independent research providers are gaining traction. These firms specialize in specific sectors or methodologies, offering a more focused and potentially unbiased perspective. Furthermore, the proliferation of financial data platforms and online investment communities means that information, while abundant, also requires increased scrutiny.

The Impact of Technology

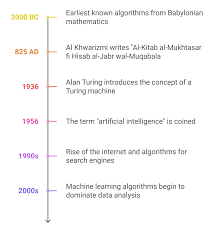

The most profound change, however, is the influence of technology. Algorithmic trading, powered by artificial intelligence, now executes a significant portion of trades. These algorithms often react to news and data before analysts can even publish their reports. Alternative data - information derived from sources beyond traditional financial statements (like satellite imagery, social media sentiment, and credit card transactions) - is also being incorporated into investment strategies, sometimes bypassing the need for traditional research altogether.

The future of research isn't the elimination of reports, but rather their evolution. We are seeing a move towards shorter, more focused reports addressing specific catalysts or events. Analysts are increasingly using data visualization and interactive tools to communicate complex information more effectively. The emphasis is shifting from simply providing a 'buy' or 'sell' recommendation to offering nuanced insights and identifying emerging trends. The true value now lies in providing context and interpretation of the vast amounts of data available, something algorithms still struggle to replicate. The ability to connect the dots, understand the 'why' behind the numbers, and anticipate future disruptions will be the defining characteristics of successful analysts in the years to come.

Read the Full Investopedia Article at:

[ https://www.investopedia.com/terms/r/research-report.asp ]