BST: High-Yield Tech Fund with Discount Opportunity

Locales: UNITED STATES, UNITED KINGDOM, IRELAND

Fund Overview & Portfolio Highlights

BST is a closed-end fund, meaning it has a fixed number of shares and trades on an exchange. It boasts approximately $800 million in assets and specializes in investing in companies driving innovation across science and technology. The fund's portfolio is broadly diversified across 151 holdings, but heavily concentrated in the industry's giants. Apple (AAPL) and Microsoft (MSFT) form the cornerstones, representing 22% and 17% of the fund, respectively. Nvidia (NVDA), currently experiencing immense growth, accounts for another significant 12.4%. The sector breakdown reveals a dominant presence in software and IT services (66.5%), followed by semiconductors (15.9%), electronic equipment (10.8%), and technology hardware & equipment (6.9%). This concentrated approach reflects the fund's strategy to benefit from the large-cap growth trends within the tech sector.

Impressive Income Generation & Distribution Dynamics

One of BST's most attractive features is its high annual distribution rate, currently at 14.5%. This translates to a compelling yield for income-seeking investors. A noteworthy aspect is the fund's dividend payout ratio, which stands at 123%. This implies that the fund is distributing more than it's earning in current income, a scenario which, while seemingly unsustainable on the surface, is currently supported by realized gains on investments and the strategic use of capital gains reserves. While this reliance on capital gains reserves introduces a degree of uncertainty, the fund's recent performance suggests this approach has been effective in the short to medium term.

Performance Discrepancy & the NAV Discount

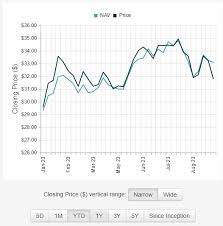

While the underlying investments within BST have been performing exceptionally well, the market's perception of the fund itself reveals a disconnect. Year-to-date (as of December 28, 2023), BST's Net Asset Value (NAV) has surged by an impressive 36%. However, the share price has only increased by 26%. This difference highlights the discount at which BST is currently trading - a current 9.7% discount to its NAV. This discount isn't unusual; historically, over the past five years, BST has typically traded at an average discount of 8.9%. The current discount of 9.7% represents a relatively high point within that historical range, suggesting potential for future narrowing and positive price appreciation if investor sentiment shifts.

The total return for BST, including dividends, currently stands at 21% year-to-date, demonstrating that despite the discount, the fund has generated significant returns for investors.

Navigating the Risks & Future Outlook

Despite the attractive yield and potential for NAV convergence, investors must be aware of the risks associated with BST. The fund's concentrated focus on technology stocks exposes it to significant market risk. A downturn in the technology sector could substantially impact its performance. Furthermore, rising interest rates, a prevalent concern in the current economic climate, could exert downward pressure on the fund's valuation. The sustainability of the high distribution rate is also a key consideration. Should income generation falter, the fund may be forced to reduce its distribution, potentially impacting investor returns and share price.

Conclusion

BlackRock Science and Technology Trust (BST) presents a unique blend of high income, exposure to innovative technologies, and a potential undervaluation opportunity. However, potential investors must carefully consider the inherent risks associated with the fund's concentrated portfolio and the reliance on capital gains to support its generous distribution. Monitoring the fund's income generation, prevailing interest rates, and overall market sentiment will be crucial in assessing its long-term viability and investment potential.

Read the Full Seeking Alpha Article at:

[ https://seekingalpha.com/article/4858357-bst-is-generating-large-amounts-of-income-and-still-trading-below-its-nav ]