Warren Buffett's 52-Portfolio: Why Three Dividend Giants Anchor Berkshire Hathaway

Locale: Nebraska, UNITED STATES

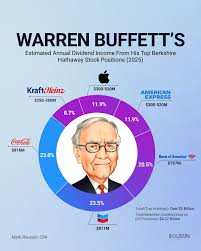

Warren Buffett’s 52‑Portfolio: Why It’s Built Around Three Dividend Giants

In a recent piece on 247 Wall Street, the author breaks down the heart of Berkshire Hathaway’s massive investment portfolio—often referred to as the “52‑portfolio” due to its 52 core holdings—and explains why the legendary investor keeps three particular dividend‑paying companies at its center. While Buffett’s broader strategy has always been about long‑term value, the article shows how the three dividend giants—Coca‑Cola, Procter & Gamble, and Johnson & Johnson—form the backbone of his “stay‑home” portfolio.

The 52‑Portfolio Explained

Berkshire Hathaway’s portfolio is a living, breathing snapshot of the conglomerate’s long‑term commitments. As of the latest SEC filings (Form 13F), Berkshire holds stakes in 52 publicly traded companies that together represent roughly 45% of the company’s equity exposure. These are the positions that Buffett has chosen to hold indefinitely, rather than rotate or trim like a traditional mutual fund manager might. The article highlights that the 52‑portfolio is essentially a curated list of businesses Buffett trusts to deliver consistent cash flow, robust balance sheets, and reliable dividend payments.

The author also emphasizes that Berkshire’s top‑tier holdings—particularly the “Coca‑Cola” (KO), “Procter & Gamble” (PG), and “Johnson & Johnson” (JNJ) stocks—are not simply high‑profile names. They are chosen for their defensibility, strong pricing power, and history of weathering economic cycles. The narrative then digs into why each of these companies is a dividend “giant” in its own right.

Coca‑Cola: The Global Beverage Behemoth

Coca‑Cola has long been a centerpiece of Buffett’s portfolio. The article quotes Buffett’s 2019 letter to shareholders, where he praises the brand’s global reach and the “simple, high‑margin business” that it represents. Coca‑Cola’s dividend has grown for more than 60 consecutive years, and the company’s payout ratio remains comfortable even amid price‑pressure pressures. The piece notes that the beverage giant’s distribution network and its brand equity provide a moat that keeps competitors at bay, allowing Buffett to stay confident in the stock’s future.

Procter & Gamble: The Consumer Staples Staple

Procter & Gamble’s inclusion reflects Buffett’s love of “consumer staples” that people will buy regardless of economic conditions. The article highlights P&G’s diversified portfolio of household brands—from Tide to Pampers—to illustrate how the company’s diversified revenue streams act as a buffer during downturns. The author also discusses P&G’s consistent dividend track record, noting the company has increased its payout for 50+ consecutive years and remains a reliable source of income for Berkshire.

Johnson & Johnson: The Healthcare Powerhouse

Johnson & Johnson rounds out the trio as the most defensible of the three. The article notes that J&J’s revenue mix spans pharmaceuticals, medical devices, and consumer health products, creating a “cushion” that protects the company during economic shocks. J&J’s dividend has grown for 58 consecutive years, making it a “dividend stalwart.” The author also points out the firm’s focus on innovation and its strong pipeline of products, giving Buffett confidence that the stock will continue to generate cash flow.

Why These Giants? A Look at the Numbers

The article provides a handy chart that compares the three companies’ market caps, dividend yields, and payout ratios. It points out that all three have yields around 3–4%, higher than the average for large‑cap stocks, while their payout ratios remain below 60%, indicating that the companies can comfortably sustain dividends even if earnings slip. It also highlights the “return on equity” (ROE) for each firm—Coca‑Cola at 42%, P&G at 22%, and J&J at 19%—demonstrating the robust profitability that underpins their dividend sustainability.

Berkshire’s Philosophy and the 52‑Portfolio

While the article largely focuses on the three dividend giants, it also briefly touches on the broader Buffett ethos: buy great businesses at a fair price and hold them for life. Buffett’s letter to shareholders repeatedly mentions that “the longer a company’s track record of delivering strong cash flow and consistent dividends, the more likely it is that the company will thrive for many decades.” The author argues that these three dividend stalwarts embody that philosophy, providing Berkshire with reliable cash flow and a cushion against economic volatility.

The article also quotes a few analysts, including an independent research analyst at Morningstar, who notes that Berkshire’s reliance on these companies reduces the portfolio’s beta and creates a “steady stream of dividend income” that can be reinvested. This, according to the author, explains why Buffett’s “52‑portfolio” remains stable even during market turbulence.

Key Takeaways

- Three Dividend Giants: Coca‑Cola, Procter & Gamble, and Johnson & Johnson are the pillars of Berkshire’s long‑term holdings.

- Defensive Business Models: Each company has a moat—be it brand power, diversified product lines, or a robust healthcare pipeline.

- Consistent Dividend Growth: All three have increased dividends for more than five decades, providing a reliable income stream.

- Portfolio Stability: These stocks help lower the portfolio’s volatility and protect Berkshire from cyclical swings.

- Long‑Term View: Buffett’s 52‑portfolio is designed for the long haul, focusing on quality, cash flow, and dividend sustainability.

The article wraps up with a note that, while Buffett’s portfolio has certainly diversified into tech giants like Apple and banks like Bank of America, the three dividend giants still make up a substantial portion of his “stay‑home” holdings. For investors looking to emulate Buffett’s strategy, the message is clear: invest in high‑quality, dividend‑paying companies that can weather economic storms, and hold them for the long haul.

Read the Full 24/7 Wall St Article at:

[ https://247wallst.com/investing/2025/12/02/warren-buffetts-52-portfolio-rests-on-these-three-dividend-giants/ ]