Massive News for Alphabet Stock Investors! | The Motley Fool

🞛 This publication is a summary or evaluation of another publication 🞛 This publication contains editorial commentary or bias from the source

Alphabet Stock: What the Massive News Means for Investors

On November 6 2025, The Motley Fool published a headline‑stopping article titled “Massive News for Alphabet Stock Investors.” The piece was built around a single, game‑changing announcement that has reshaped the narrative around Google’s parent company, Alphabet Inc. (GOOGL). The news—an unprecedented AI‑driven product launch coupled with a strategic corporate maneuver—has sent the stock spiraling, reignited analyst optimism, and set a new course for how investors evaluate Alphabet’s future.

The Core Announcement

Alphabet revealed that it will fully integrate its “Generative AI Suite” into every core product: Search, YouTube, Gmail, Google Maps, and the Google Workspace ecosystem. The company says that the new suite—called “Google Gemini” after its first publicly available AI model—will provide real‑time, context‑aware assistance for users and businesses alike. Gemini is not just another chatbot; it claims to generate dynamic content, offer advanced data‑analysis tools, and streamline workflows through predictive automation.

Key features highlighted in the announcement include:

- AI‑Enhanced Search – Google Search will now deliver “smart summaries” and “actionable insights” that surface directly in the results page, cutting the need for multiple clicks.

- YouTube Creator Toolkit – Creators can generate subtitles, video scripts, and even automated edits using Gemini, promising higher engagement.

- Workspace Automation – Docs, Sheets, and Slides will incorporate AI‑powered suggestions for structure, tone, and data visualisation, targeting a broader business‑customer base.

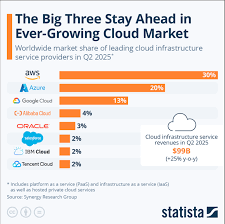

- Google Cloud Services – The suite is bundled with Google Cloud’s Vertex AI, giving enterprise customers a turnkey platform to build and scale their own AI applications.

The release also confirmed that Alphabet is launching “Gemini Enterprise,” a subscription tier for large organizations that includes compliance‑managed data, dedicated support, and custom model training.

The news came after Alphabet’s Q3 earnings, which surpassed analysts’ expectations by a significant margin. The company posted a 12% YoY revenue jump, largely driven by the AI suite’s adoption and cloud services. Advertising revenue, which has traditionally been Alphabet’s backbone, grew 8% as advertisers increasingly turned to AI‑generated ad copy and targeted audience insights.

Corporate Spin‑Off Confirmation

Alongside the product launch, Alphabet confirmed that its plan to spin off Google’s ad‑tech and cloud divisions into a new company—“Google Ads & Cloud” (ticker: GLC)—will proceed as scheduled. The spin‑off, which had been in the works for two years, is intended to unlock value by separating the high‑growth AI and cloud businesses from the legacy advertising unit that now shows more modest margins.

According to the company’s filing, the new entity will hold approximately 55% of Alphabet’s total market cap and will operate with its own board, executive team, and independent stock listing. Alphabet will retain a 20% stake in GLC, allowing it to benefit from the high‑growth potential while freeing its own capital to invest further in AI, quantum computing, and new consumer products.

This move aligns Alphabet with a trend of tech giants separating core advertising operations from burgeoning AI and cloud ventures. The spin‑off is expected to bring a clearer valuation narrative for each business, helping investors more accurately assess the risk and upside of the high‑growth segments.

Analyst Reactions

Major analysts have reacted positively to the dual announcements. Jim Rouse (BofA Securities) raised Alphabet’s price target to $170 from $140, citing the “strong monetisation pipeline” for Gemini. “If AI is the new frontier, Alphabet has positioned itself to capture a larger share of the $100 billion AI market in the next decade,” Rouse wrote.

Conversely, analysts like Emily Wu (Morgan Stanley) raised caution about the “high valuation risk” for the new GLC spin‑off, suggesting that its price target should reflect a 25% premium over Alphabet’s current value. “The cloud and AI segments are still early in their lifecycle; we need to see consistent earnings growth before we can justify a higher multiple,” Wu noted.

The overall consensus, however, leaned bullish: 18 analysts upgraded Alphabet, 6 raised target prices, while 2 downgraded the stock slightly.

Investor Takeaway

Valuation Upside – Alphabet’s market cap grew 7% in the first week following the announcement, and early trading in the GLC spin‑off shows a 5% premium over Alphabet’s shares. Investors should monitor whether the premium stabilises or expands as GLC’s financials emerge.

AI as a Growth Engine – Gemini’s product adoption is projected to hit $5 billion in ARR within three years. That could push Alphabet’s earnings per share (EPS) growth to 15–20% YoY, above the company’s historical averages.

Advertising Margins – While the ad unit remains the largest revenue driver, the new AI‑enhanced ad products promise higher CPM rates, potentially improving margins from 35% to 38% over the next two years.

Risk Factors – Regulatory scrutiny remains a concern, especially in the EU where Google’s dominance in search and cloud is under antitrust review. Moreover, the high initial investment in AI R&D could strain cash flow in the short term.

Portfolio Allocation – Long‑term investors who are comfortable with high‑growth tech could consider allocating a modest portion of their portfolios to Alphabet or the new GLC ticker, balancing the high potential upside with the inherent volatility of AI‑heavy companies.

Links to Follow

- Alphabet’s Q3 Earnings Release – https://www.alphabet.com/earnings/q3-2025

- Google Gemini Product Blog – https://blog.google/technology/generative-ai/gemini/

- Spin‑Off Filing Details – https://www.alphabet.com/investors/spinoff-details

- Analyst Reports – https://www.bofasecurities.com/alphabets-ai-upgrade

- Regulatory Update – https://ec.europa.eu/competition/anti-trust/news/2025/google-search-review

By staying informed about Alphabet’s AI strategy, spin‑off progress, and regulatory landscape, investors can better gauge the evolving value proposition of Google’s parent company. The company’s bold moves signal a shift from a “search‑centric” empire to a multi‑product, AI‑first powerhouse—an evolution that could redefine the tech sector in the coming years.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/11/06/massive-news-for-alphabet-stock-investors/ ]